Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

On Friday, crude oil moved sharply higher and erased the last Tuesday decline, but did this increase change much in the short-term picture of black gold?

Crude Oil’s Technical Picture

Let’s examine the technical picture of the commodity (charts courtesy of http://stockcharts.com).

On Friday, we wrote the following:

(…) taking into account the fact that oil bears had some problems with the successful breakdown under the January peak, it seems that their opponents could try to push crude oil higher in the coming day(s).

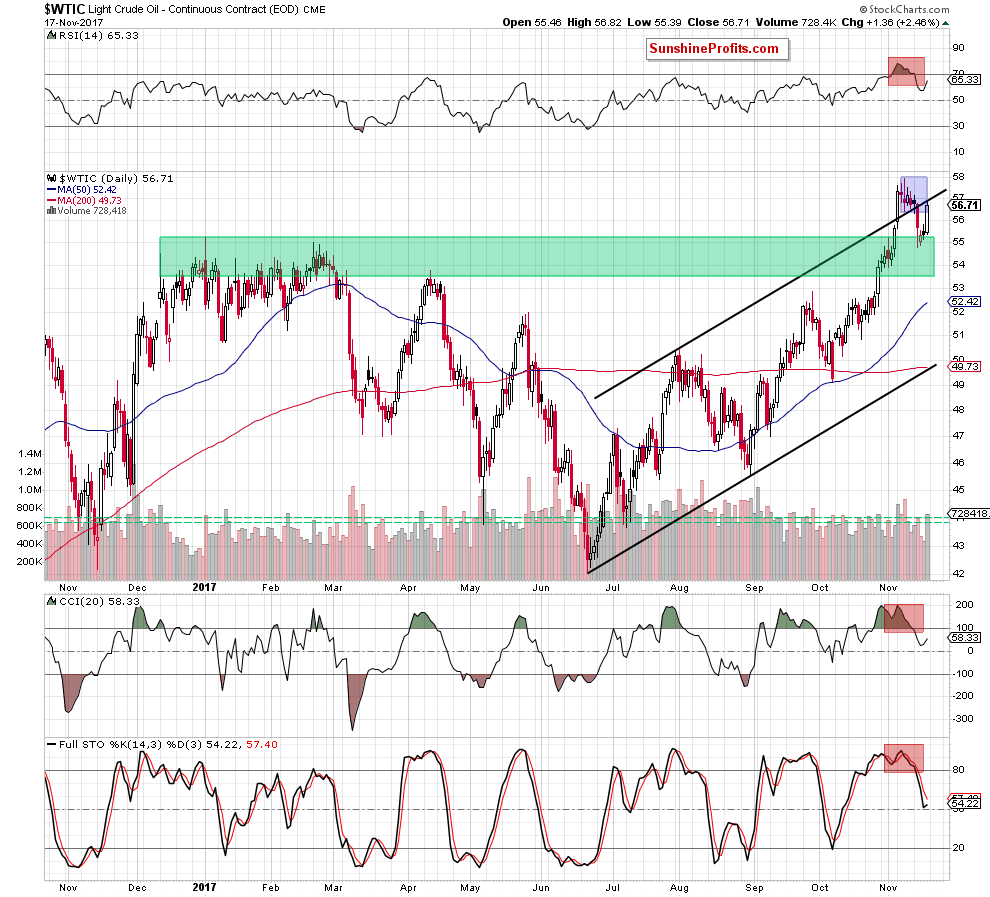

If they manage to do it, we may see an increase even to $56.41 (the lower border of the blue consolidation) or $56.85, where the previously-broken upper border of the black rising trend channel currently is.

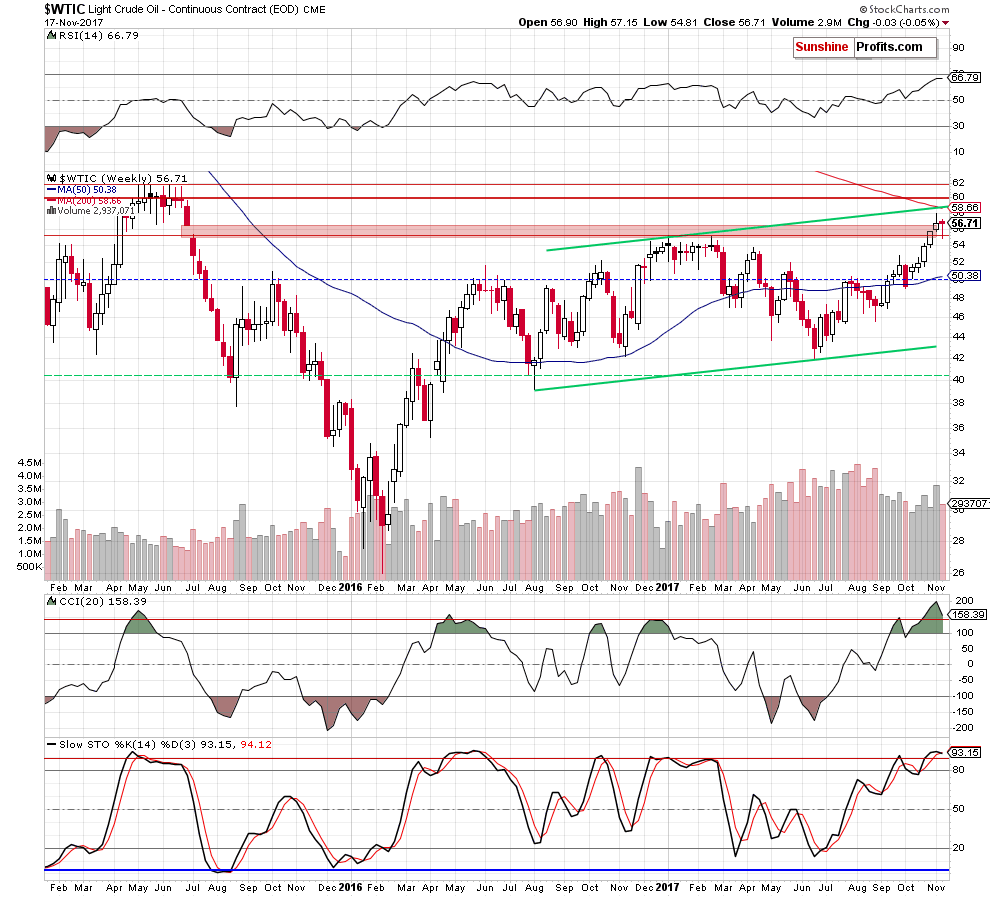

From today’s point of view, we see that the situation developed in tune with our assumptions and crude oil increased to our upside targets on Friday. Despite this improvement, oil bulls didn’t manage to break above the back resistance line, which suggests that what we wrote in our last commentary remain up-to-date also today:

(…) Will such increase change anything in the short term? Not really, because we saw similar rebounds in the past, which usually were nothing more than verifications of the earlier breakdowns.

Therefore, in our opinion, as long as there is no invalidation of the breakdown under the black resistance line, lower prices of light crude are more likely than not – especially when we factor in the Tuesday price action (an invalidation of the earlier breakout), the sell signals generated by the indicators and what we wrote on Wednesday about the current situation in the oil-to-gold ratio (…).

(…) Today, we decided to (…) examine the connection between light crude and the general stock market.

Crude Oil – General Stock Market Link

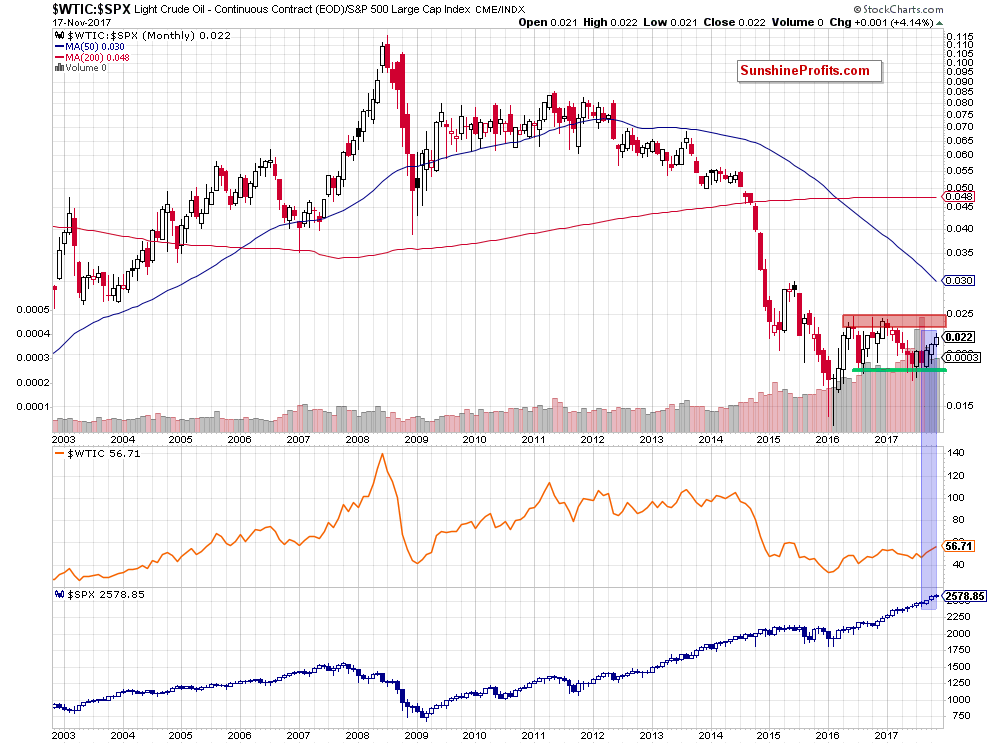

The long-term picture does not give us too many clues about future movements as the ratio remains between the red resistance zone (created by the 2016 and 2017 highs) and the green support area. Nevertheless, the size of the recent candlesticks can be disappointing for many bulls as they are getting smaller. Although this month candlestick is not finished yet, we have to unanimously admit that October candlestick was smaller than the previous one, which raises some doubts about the strength of the upward move.

Will the medium-chart be more useful and abundant in the tips on future moves? Let’s check.

From this perspective, we see that although the ratio rebounded in the previous week, the upper border of the green rising trend channel continues to keep gains in check. Additionally, the current position of the CCI and the Stochastic Oscillator (they remain in their overbought areas) suggests that lower values of the ratio may be just around the corner.

What does it mean for crude oil? We believe that the best answer to this question will be the quotes from our last Oil Trading Alert:

(…) Similarly to wrote (…) in the case of the oil-to-gold ratio, we see on the above charts that there is a positive correlation between the oil-to-stocks ratio and black gold, which means that if it reverses and declines, it will likely translate into lower prices of crude oil in the coming week(s) – similarly to what we saw in the previous months.

(…) Before we summarize today’s alert, we would like to point out that if you would like to know more about the general stock market, we invite you to check ours Stock Trading Alerts (...)

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil verified the earlier breakdown under the upper border of the black rising trend channel.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts