Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, black gold hit a fresh 2018 high after the EIA released an inventory report, which showed another weekly decline in crude oil stockpiles. Additionally, U.S. crude oil production decreased, encouraging oil bulls to act. How high could the commodity go in the coming days?

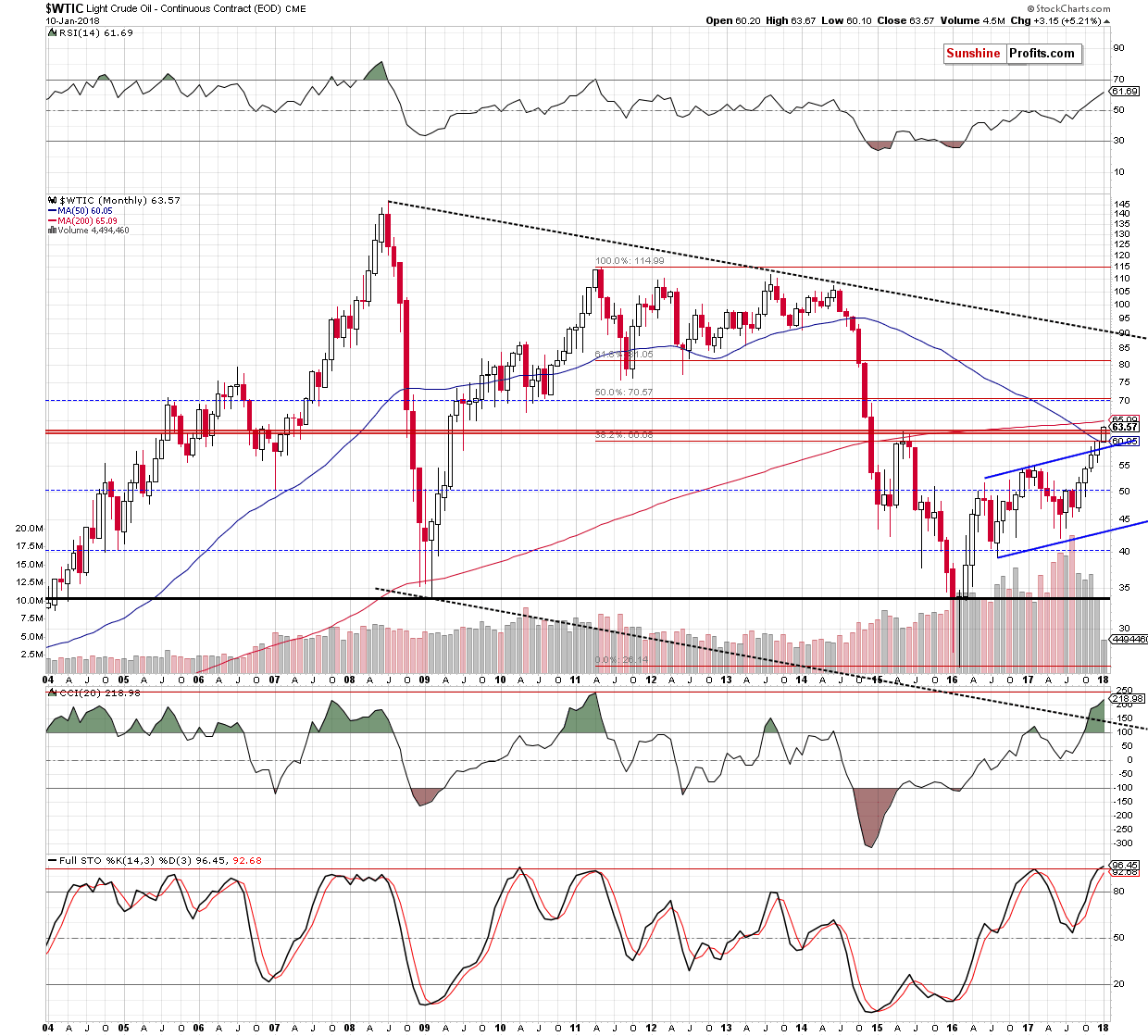

Let’s take a look at the long-term chart below (charts courtesy of http://stockcharts.com).

Looking at the monthly chart, we see that crude oil extended gains above the May 2015 high, hitting a fresh 2018 peak. On one hand, it’s a positive sign, which suggests a test of the 200-month moving average $65 in the coming week.

Nevertheless, the very short-term picture of the commodity raises some doubts about further rally. Why?

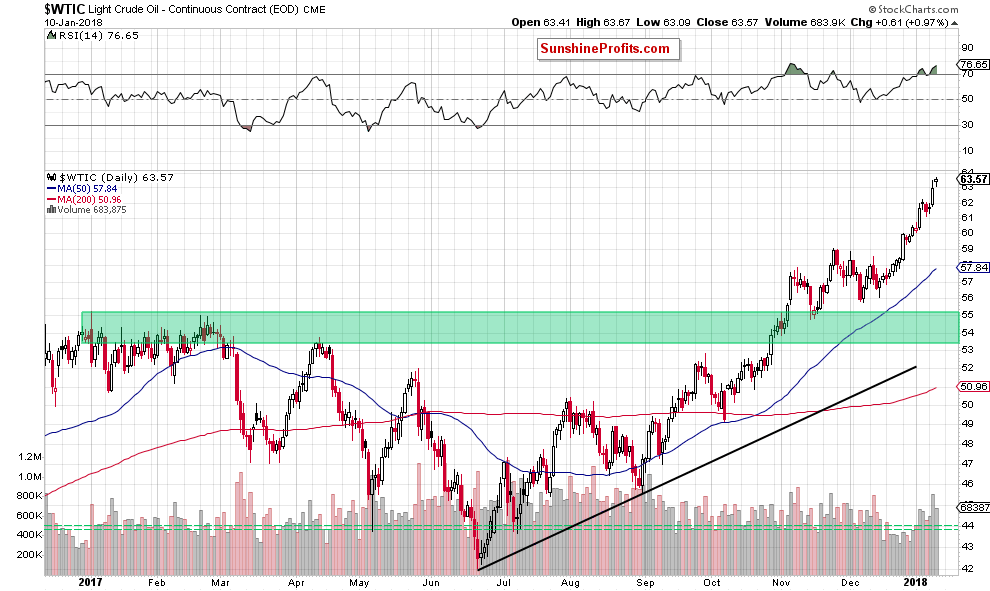

The size of yesterday’s candlestick and volume (smaller than day earlier) do not confirm oil bulls’ strength. Additionally, the current position of the RSI indicates that reversal and lower prices should not surprise us next week.

Nevertheless, until we see more reliable developments (bullish or bearish) waiting on the sidelines seems justified from the risk/reward perspective.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts