Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Crude oil scored a nice week of price gains. The $64,000 question is whether it can be trusted. How likely is the possibility of any continuing gains actually? Please join us in reading the tea leaves the market gave us.

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

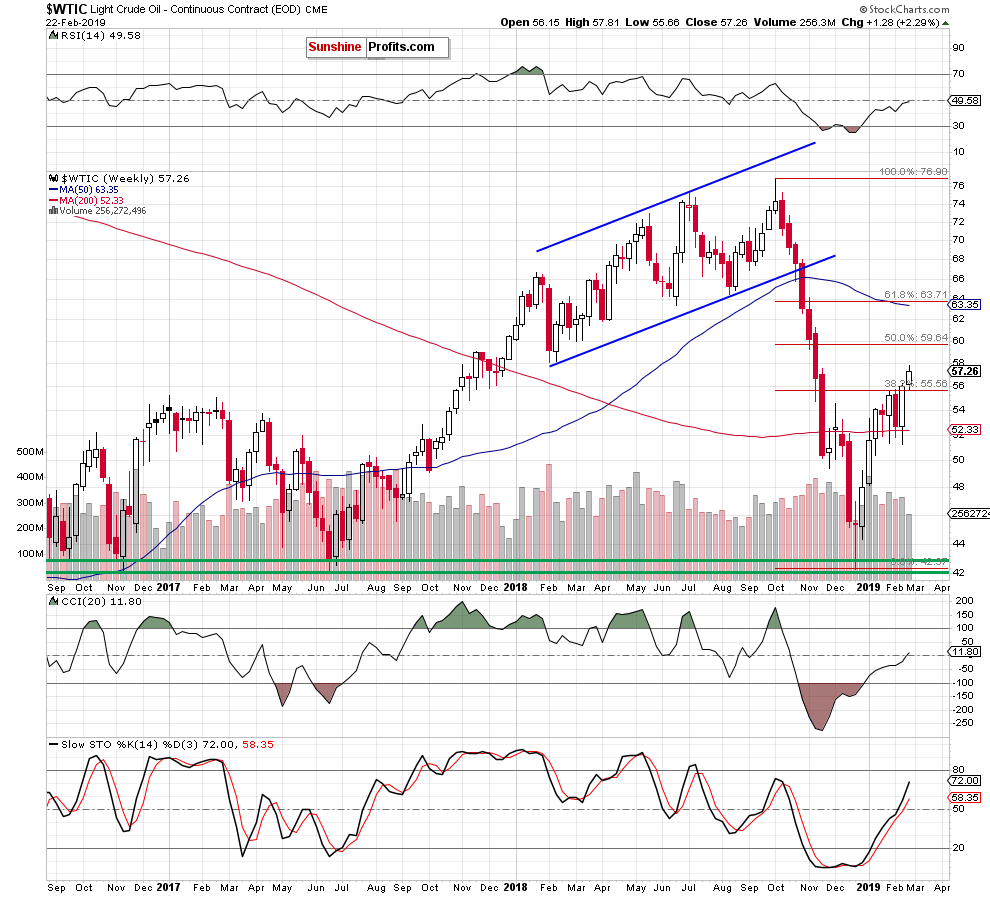

Crude oil moved higher in the previous week, but the size of the volume the increase was made on, was much smaller than the week before. It raises doubts about the strength of the buyers as upside moves are expected to attract new buying power into the market.

How did this move affect the daily chart?

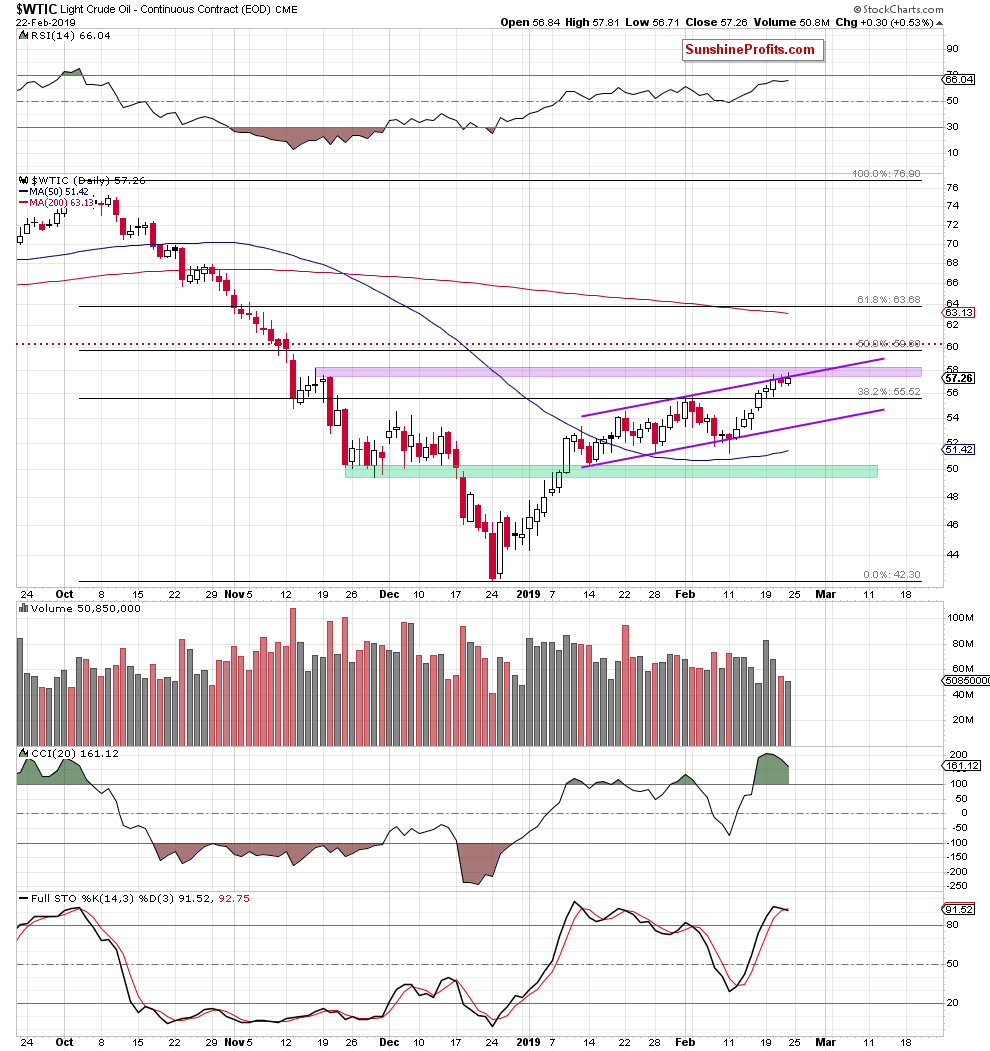

Oil bulls still have problems with the major short-term resistances. Just look at the upper border of the purple rising trend channel and the purple resistance zone that is based on the mid-November peaks. There was no breakout above either of them and any attempts to do so fizzled out quickly, just like in previous days.

It’s the third time in a row that such a tiny breakout was invalidated, which raises even more doubts about the power of the bulls. See for yourself that Friday’s volume was even lower than Thursday’s one.

On top of that, there is a visibly bearish disconnect building between the oil price and the CCI leaving its strongly trending readings, which reinforces the probability of the former moving lower in the very near future. Stochastic Oscillator concurs and generated its own sell signal on Friday. RSI’s ascent has also slowed down lately and looks ready to roll over.

Taking all the above into account, we believe that we’ll see a realization of the bearish scenario (as a reminder, we posted it in our Thursday’s alert) still this week:

(...) If that’s the case, the first downside target would be the lower border of the purple rising trend channel (currently at around $53.20).

Summing up, short positions continue to be justified from the risk/reward perspective as oil bulls apparently have serious problems breaking above the nearest short-term resistances. Additionally, the volume and the current position of the daily indicators favor the sellers and another move to the downside this week.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist