Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Although oil bulls tried to take control yesterday, their enthusiasm was quickly cooled, and black gold approached the major support levels once again. Third time lucky?

Technical Analysis of Crude Oil

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com).

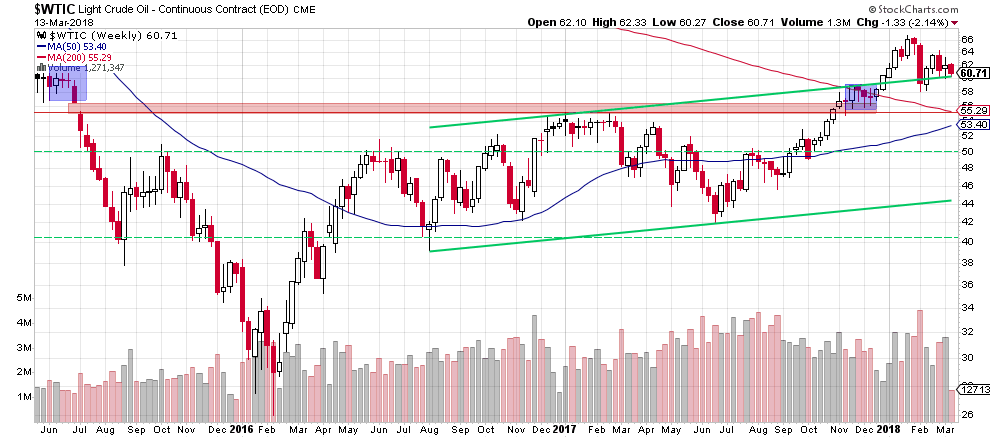

Looking at the weekly chart, we see that the upper border of the green rising trend channel stopped oil bears two times in the previous weeks. Thanks to yesterday’s drop the commodity slipped to this major support one again.

Third time lucky or another rebound? Let's try look for answers on the daily chart.

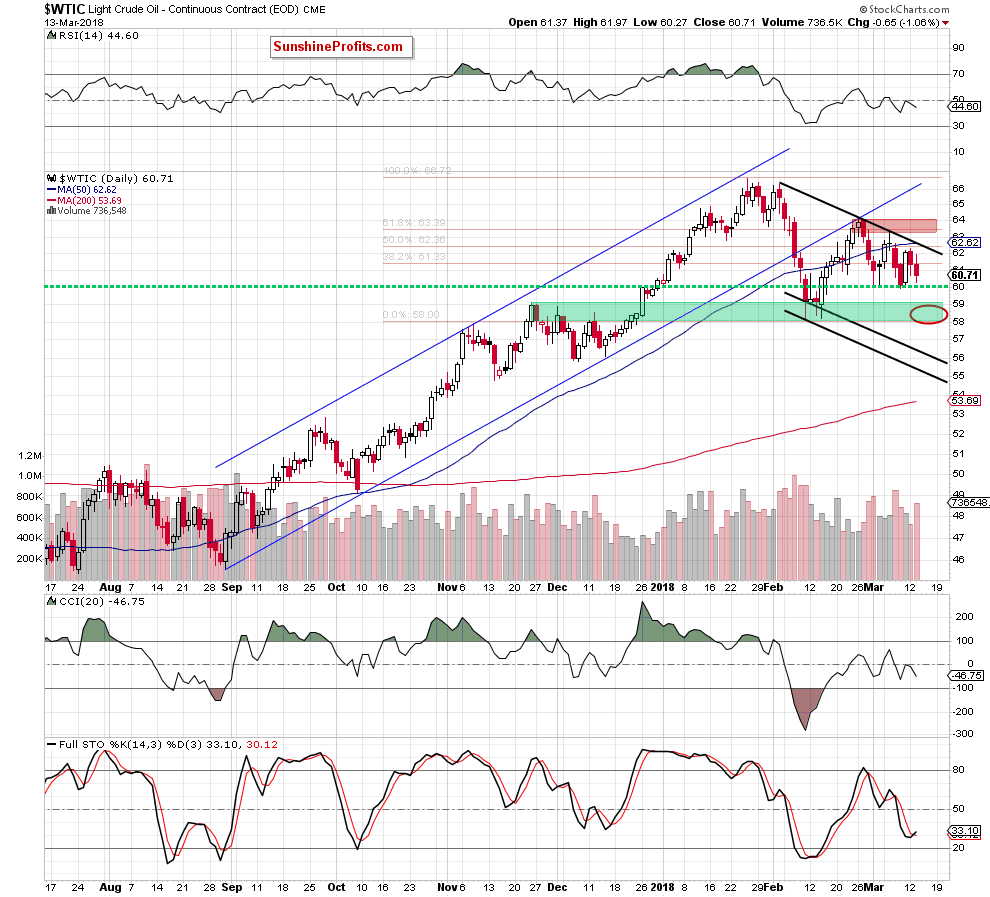

From this perspective, we see that crude oil extended losses and approached the barrier of $60 one more time. Although the commodity rebounded before the session closure, size of volume was much bigger than day earlier, which suggest that oil bears didn’t say the last word and another attempt to move lower is just around the corner.

On the other hand, the Stochastic Oscillator generated the buy signal – similarly to what we saw on March 5, which together with the proximity to the upper border of the green rising trend channel (seen on the weekly chart) and the barrier of $60 may encourage oil bulls to act once again.

However, even if black gold rebounds from current levels, the space for gains seems limited as the first resistance zone created by the black declining resistance line (a potential upper border of declining trend channel) and the previously-broken 50-day moving average is quite close (around $62.40).

Therefore, in our opinion, as long as there is no breakout above these resistances and the red resistance zone (created by the late February and early March peaks and reinforced by the 61.8% Fibonacci retracement) a bigger move to the upside is not likely to be seen and short positions continue to be justified from the risk/reward perspective – especially when we factor in the long-term perspective and the current situation in our interesting ratios about which you can read more in our latest Oil Investment Update.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts