Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday, it was the bears who scored big against the bulls. The momentum looks to be on their side but black gold is trading higher today. Will the bulls close the week on a strong note? See for yourself what kind of action is advised to take now.

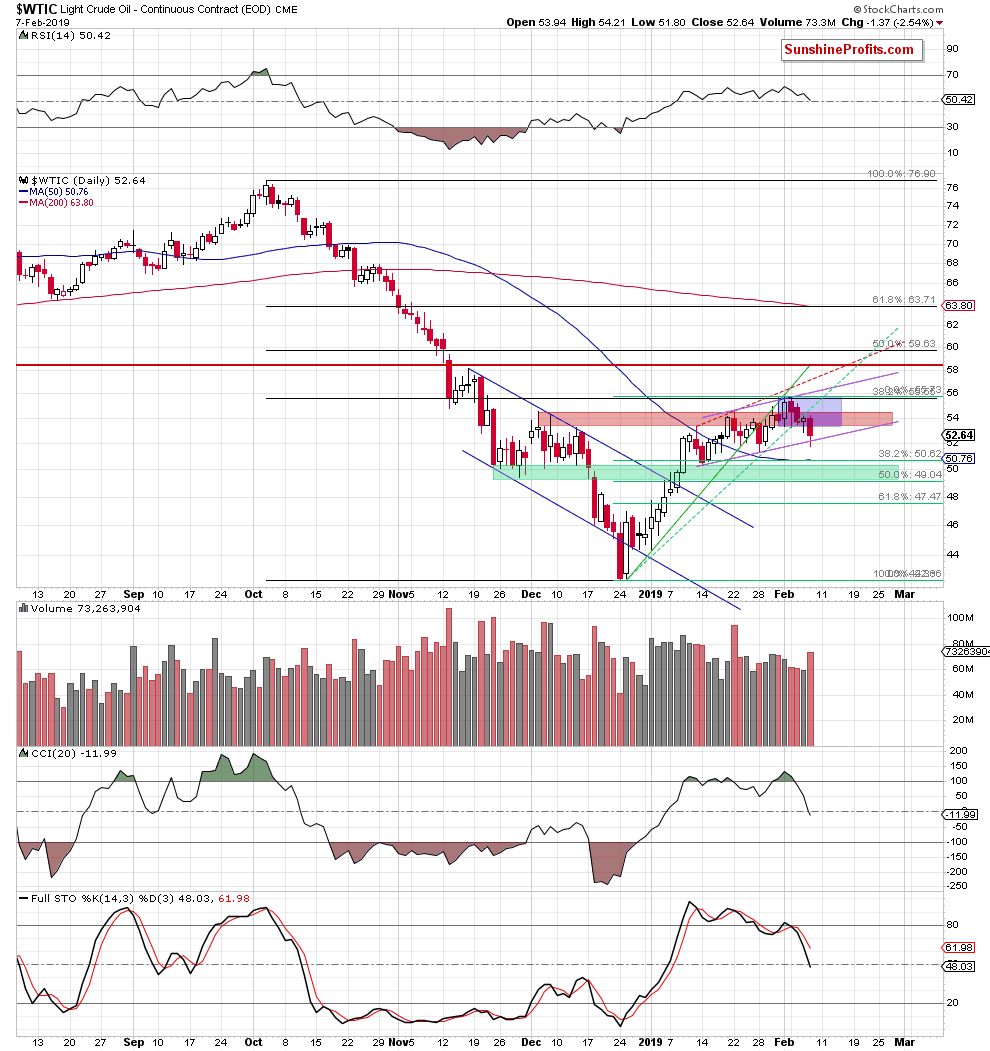

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

On Wednesday, we wrote the following:

(…) we believe that if oil extends losses from here and breaks below this week’s lows, we’ll see at least a test of the lower border of the purple rising trend channel (currently at around $52.04). If this support is broken, the next downside target will be the 50-day moving average (at $50.73) or even the green support area around the barrier of $50.

Just like on Thursday, the above remains up-to-date. Yesterday, crude oil broke below the lower border of the blue consolidation, inviting further deterioration and a test of our first downside target. Today’s trading has so far been characterized by a weak recovery attempt that looks like an inside candle so far, thus implying no change in the outlook for the downside move to continue in the coming days.

Although the pair rebounded slightly before yesterday's session close, the commodity finished the day below the lower border of the consolidation and the red resistance zone. Looking at the sell signals generated by the daily indicators, all of these support the case for lower prices of black gold in the coming day(s).

Additionally, the volume accompanying yesterday’s decline was bigger than in many recent days. This is an important sign - it signals increasing participation of the bears, which is likely to translate into further deterioration down the road. Remember that an increase in volume on any decline in general is an important omen never to ignore.

Nevertheless, before we see such price action and a test of our next downside target, a verification of yesterday’s breakdown below the lower border of the blue consolidation can’t be ruled out.

Summing up, our already profitable short position continues to be justified from the risk/reward perspective as crude oil extended losses and closed the day below the blue consolidation and the red resistance zone. On top of that, Thursday’s volume was visibly higher than during earlier times, which in combination with the sell signals generated by the indicators increases the probability of another downswing in the coming days. Possible retest of yesterday’s breakdown can’t be ruled out and doesn’t change the outlook.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.