Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Tuesday, crude oil increased on news about the gradual restart of refineries, which were shut by Hurricane Harvey. In this environment, light crude climbed above $48 and reached important resistance levels. Will they stop oil bulls in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

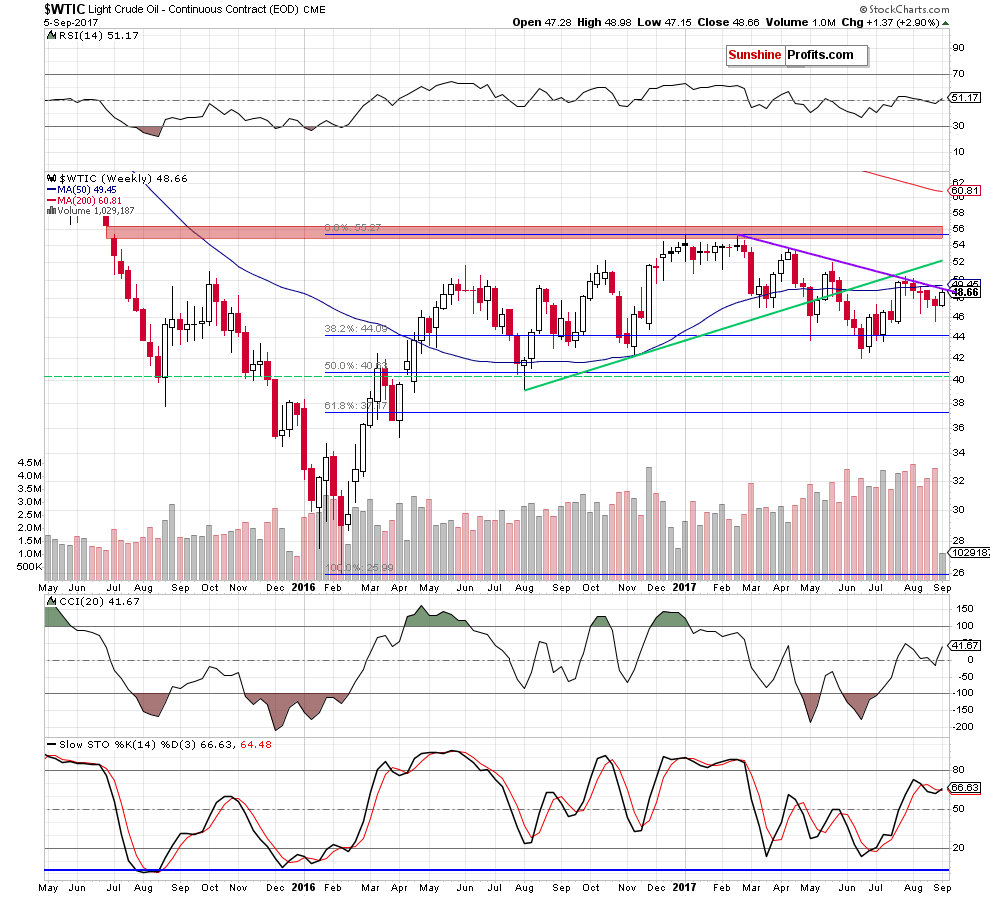

Looking at the weekly chart, we see that this week’s upswing took the black gold to the purple declining resistance line based on the previous highs and the 50-week moving average. As you see, the combination of these resistances was strong enough to stop oil bulls in the previous months, which suggests that we may see a similar price action this week.

Are there any other technical factors that could stop further improvement? Let’s examine the very short-term chart and find out.

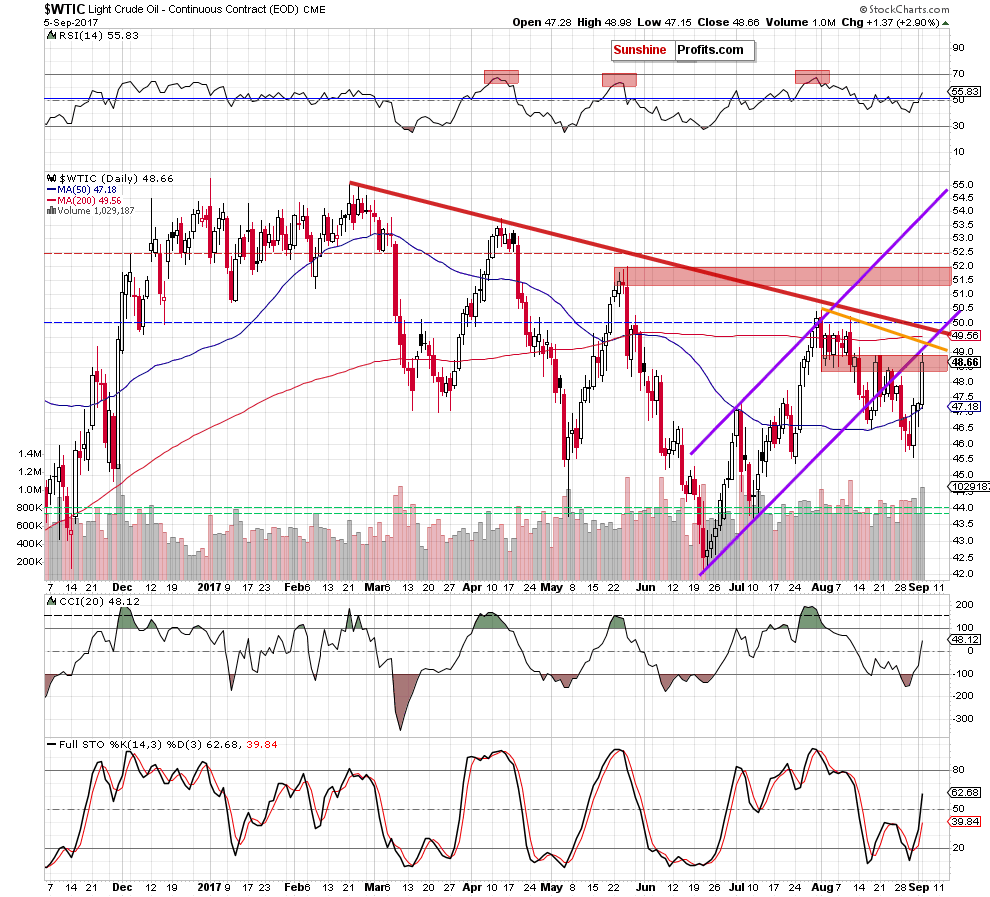

From the daily perspective, we see that crude oil moved sharply higher yesterdy, breaking above the 50-day moving average and the last week’s highs. Thanks to this increase light crude climbed to the red resistance zone created by the early August lows and later peaks (around $48.37-$50.43) and approached two important lines: the orange resistance line based on the August highs and the previously-broken lower border of the purple rising trend channel.

What’s next for light crude?

Additionally, not far from current levels (around $49.56-$49.90) are two other resistance levels: the medium-term red declining resistance line based on the February and April peaks and the 200-day moving average, which together with the above-mentioned resistance lines could stop oil bulls and trigger a reversal (maybe even tommorow) in the very near future.

On top of that, if the commodity increases to the lower border of the purple rising trend channel and then reverses and declines, we will see another verification of the earlier breakdown under this short-term resistance, which will give oil bears a very important reason to act in the following days.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil is still trading under several very important resistance levles, which could stop oil bulls and trigger anothr move to the downside in the very near future.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short (already profitable) positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts