Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yet again on Friday, crude oil went higher. Is there a trend change simmering underneath? After all, black gold is at new 2019 highs. Let’s examine both the medium- and short-term changes and what we should better do about the outlook.

Charts are courtesy of http://stockcharts.com.

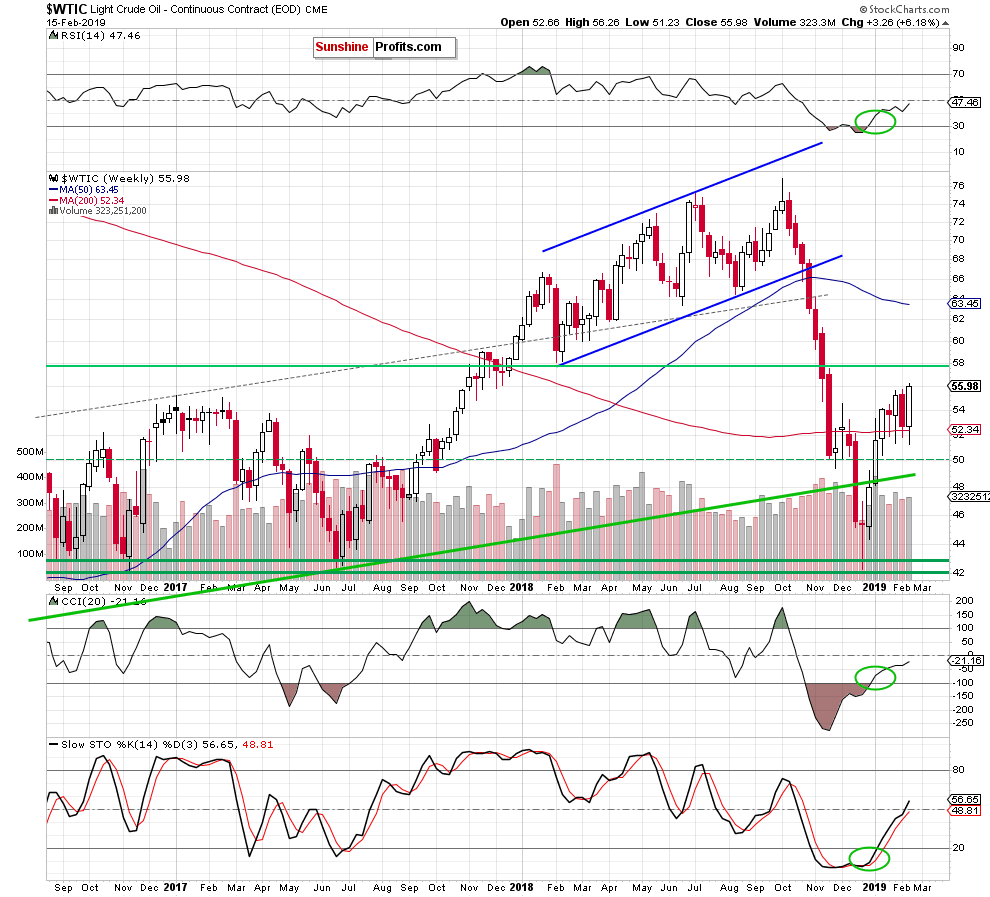

On the weekly chart, we see that the 200-week moving average encouraged the buyers to act, which resulted in a quite sharp rebound. As a result, the commodity hit a fresh 2019 peak and the preceding bearish engulfing pattern (discussed here) was invalidated for now.

How did this increase affect the daily chart?

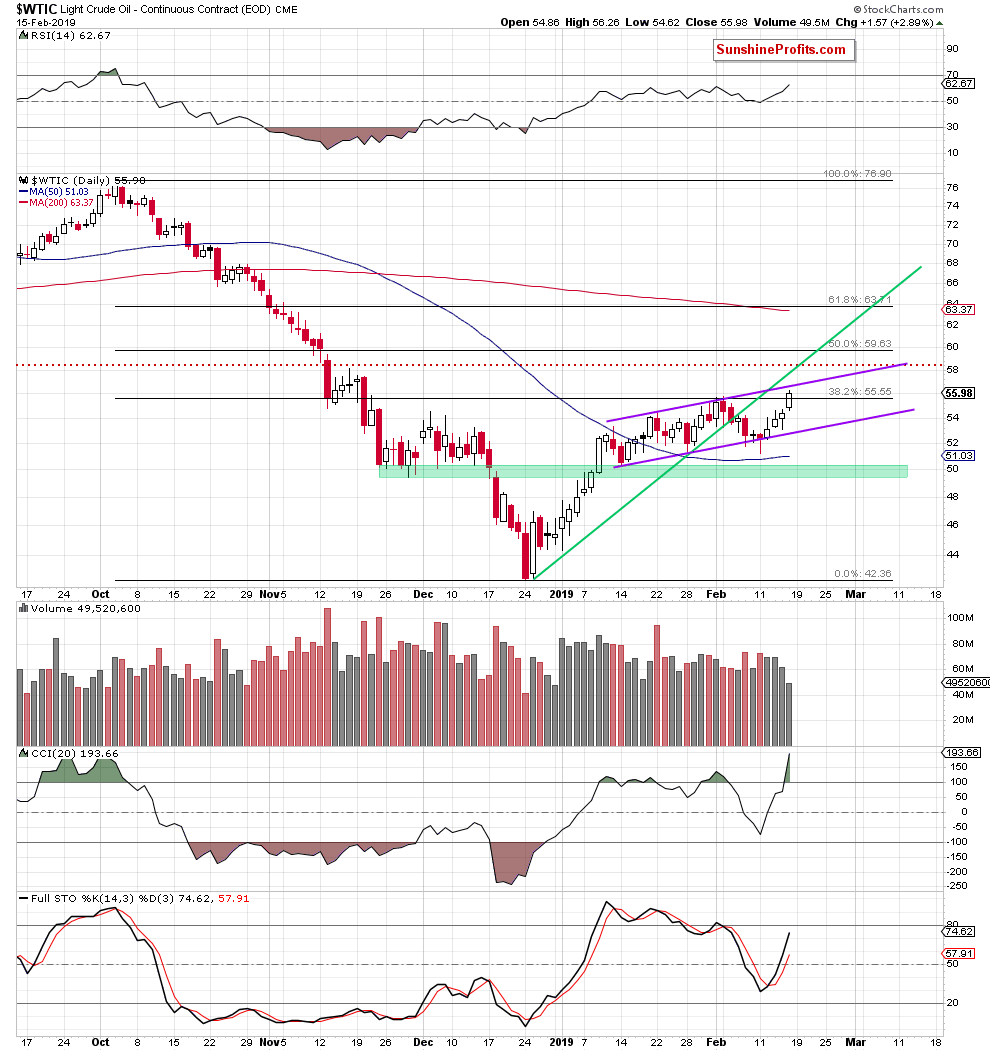

From this perspective, we see that Friday’s move not only took the price of light crude above the previous highs, but also above the 38.2% Fibonacci retracement. Thanks to it, the commodity also invalidated the potential top head and shoulders formation which is therefore no longer in the making.

Bullish factors? Yes. However, there are several reasons to doubt the continuation of the upward move. Let’s discuss them one by one.

First, despite Friday’s move, the commodity is still trading inside the purple rising trend channel. Its upper border has been strong enough to stop the buyers several times in the past, which increases the probability that we’ll see a similar price action in the very near future, too.

Second, crude oil still remains below the previously broken green line based on the previous important lows, which serves as an additional resistance.

Third, the CCI increased well above the level of 100. Last time we saw a similar reading of the indicator was before and at the October peak, which suggests that such a high level of CCI can precede another local top this time around, too.

Last but not least – actually, the most important – is the volume. As you see on the daily chart, it decreases from session to session, showing smaller involvement of the buyers in recent increases, which doesn’t bode well for any further rally. Of course, a new trading week is just getting started and we’ll carefully evaluate all the new information it brings us.

Taking all the above into account, we think that the space for gains is likely limited and reversal in the coming day(s) would not surprise us in the least.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist