Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

On Tuesday, crude oil wavered between small gains and losses inside two trading channels. Where will the commodity head next?

Crude Oil’s Technical Picture

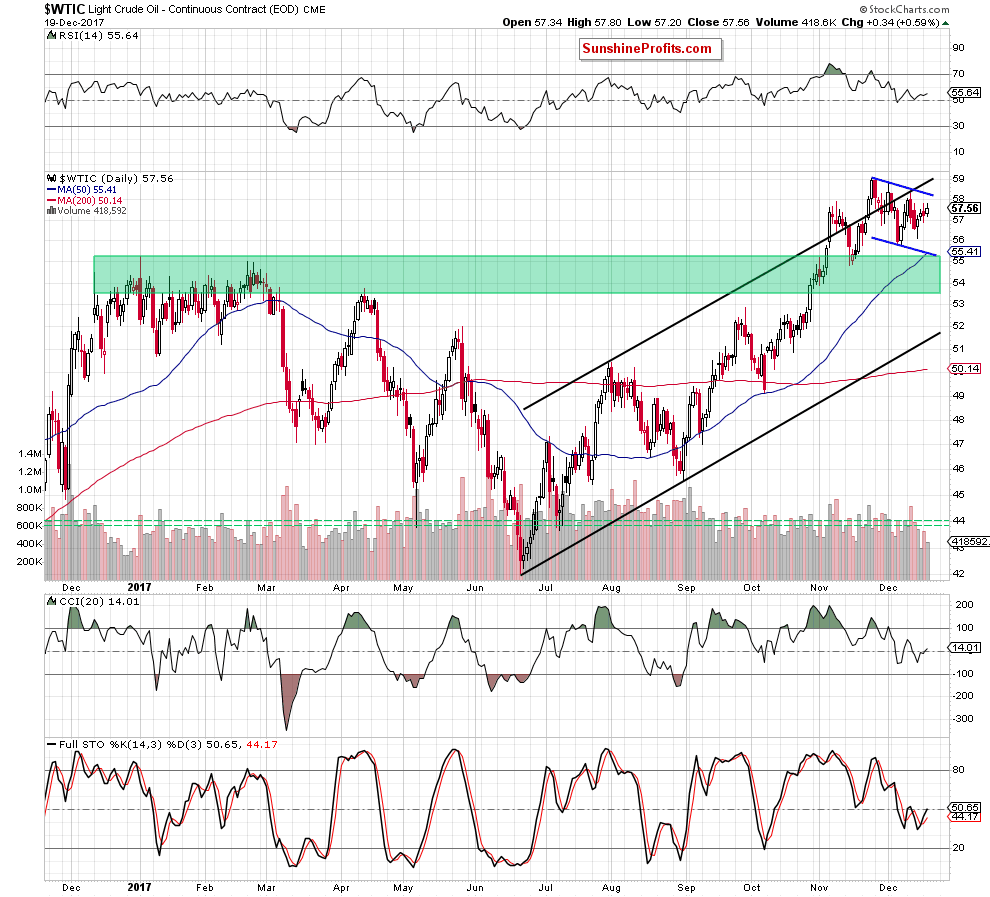

Let’s take a closer look at the daily chart of crude oil (charts courtesy of http://stockcharts.com).

Looking at the charts, we see that the situation didn’t change much yesterday as crude oil was trading between Monday’s high and low. Therefore, we believe that our last commentary remains up-to-date also today:

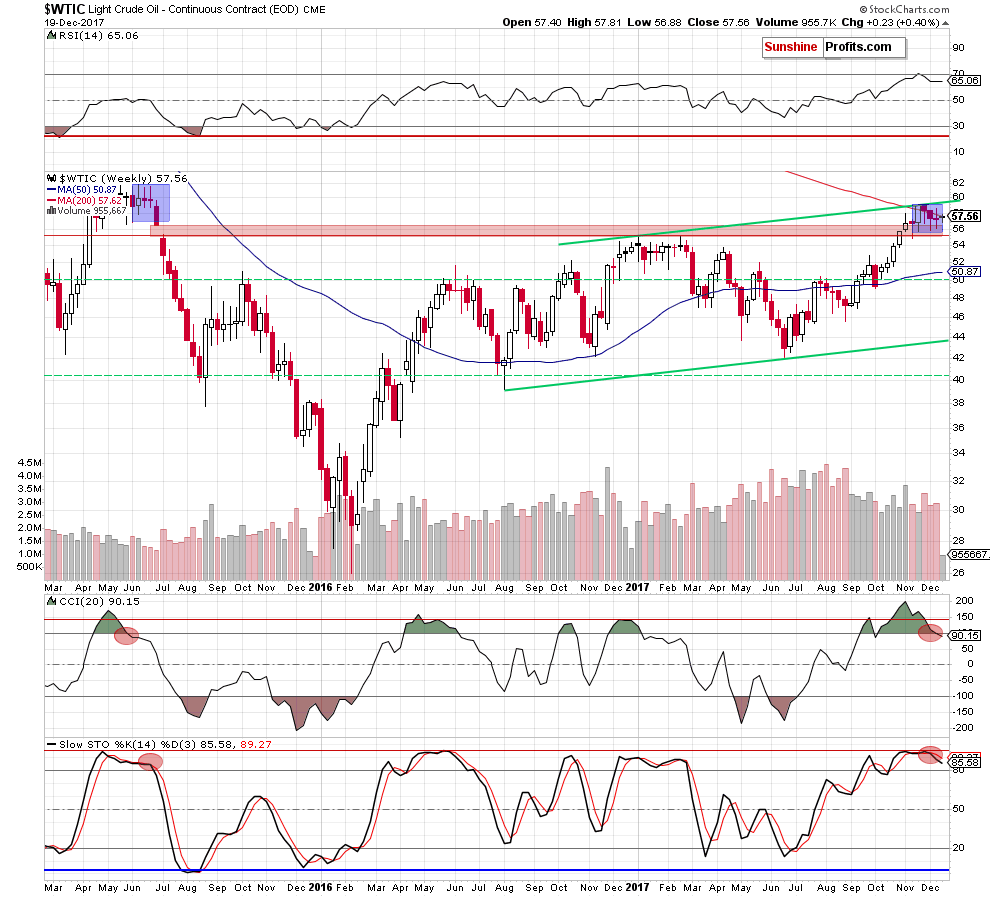

(…) black gold is still trading below the upper border of the black rising trend channel and the upper line of the blue declining trend channel. This means that the last week’s verification of the breakdown under the upper black line and its negative impact on the price are still in effect, supporting oil bears.

The commodity also remains under the 200-week moving average, which together with other bearish signals and similarities to the past (we wrote more about them in our Friday’s Oil Trading Alert) increases the probability of further deterioration in the coming week.

Finishing today’s alert, please not that earlier today, we haven’t seen any important breakout/breakdown, which could change the overall situation. Therefore, short positions continue to be justified from the risk/reward perspective.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts