Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective.

Although Tuesday's price action could surprise many fans of oil bears and further drops in crude oil prices, three unsuccessful attempts to break below the lower border of the rising tend channel quite loud and clearly suggested that another upswing was just around the corner. What does yesterday's rise mean for oil and why is it worth observing the price of the commodity more than usual around September 24/25?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Quoting our yesterday’s Oil Trading Alert:

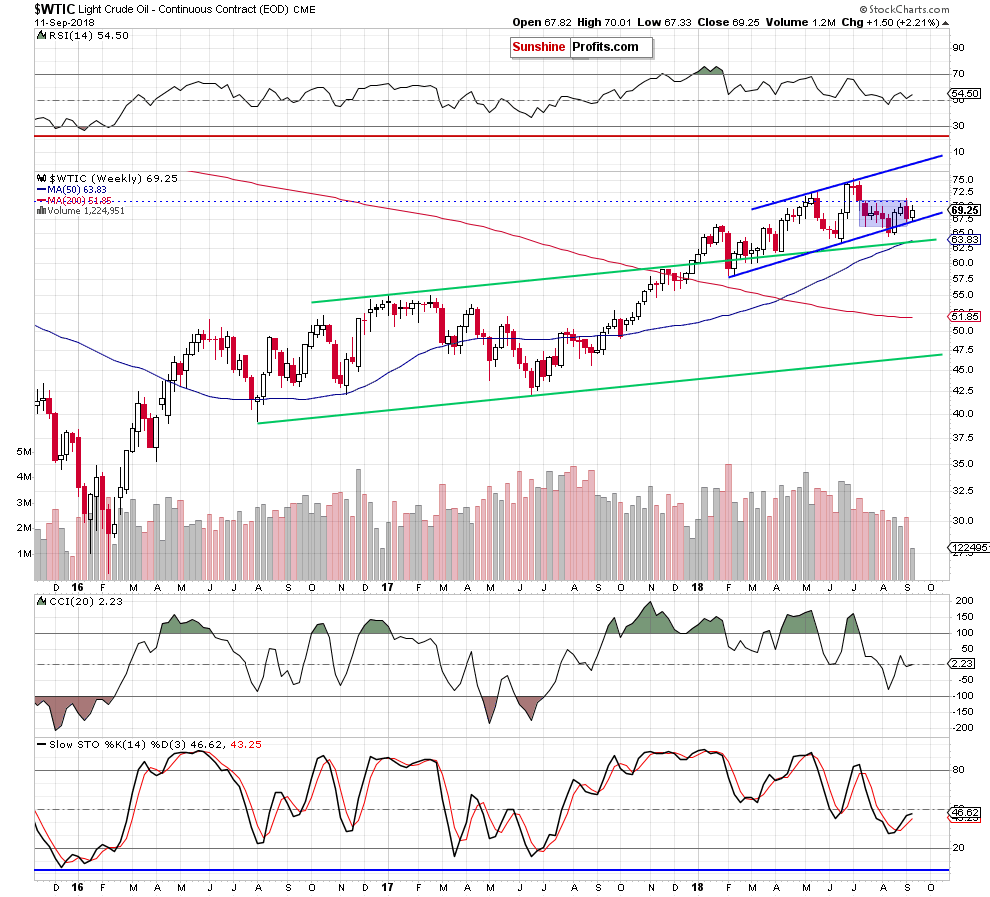

(….) although crude oil moved a bit lower during yesterday’s session, the commodity is still trading above the blue support line (the lower border of the medium-term blue rising trend channel seen on the weekly chart) and the 61.8% Fibonacci retracement.

This means that the overall situation in the short term remains almost unchanged and one more rebound from here is very likely – especially when we factor in the fact that oil bulls withstood the selling pressure in this area two times in a row.

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil bounced off the blue support line and the 61.8% Fibonacci retracement during yesterday’s session.

As you see, Tuesday’s upswing was quite sharp and materialized on sizable volume (higher than the one we could observe in previous days during downswings), which increases the probability that oil bulls will fight for higher levels in the coming days.

This scenario is also reinforced by an invalidation of the earlier breakdown under the 50-day moving average and a buy signal generated by the Stochastic Oscillator.

So, how high could the price of black gold go?

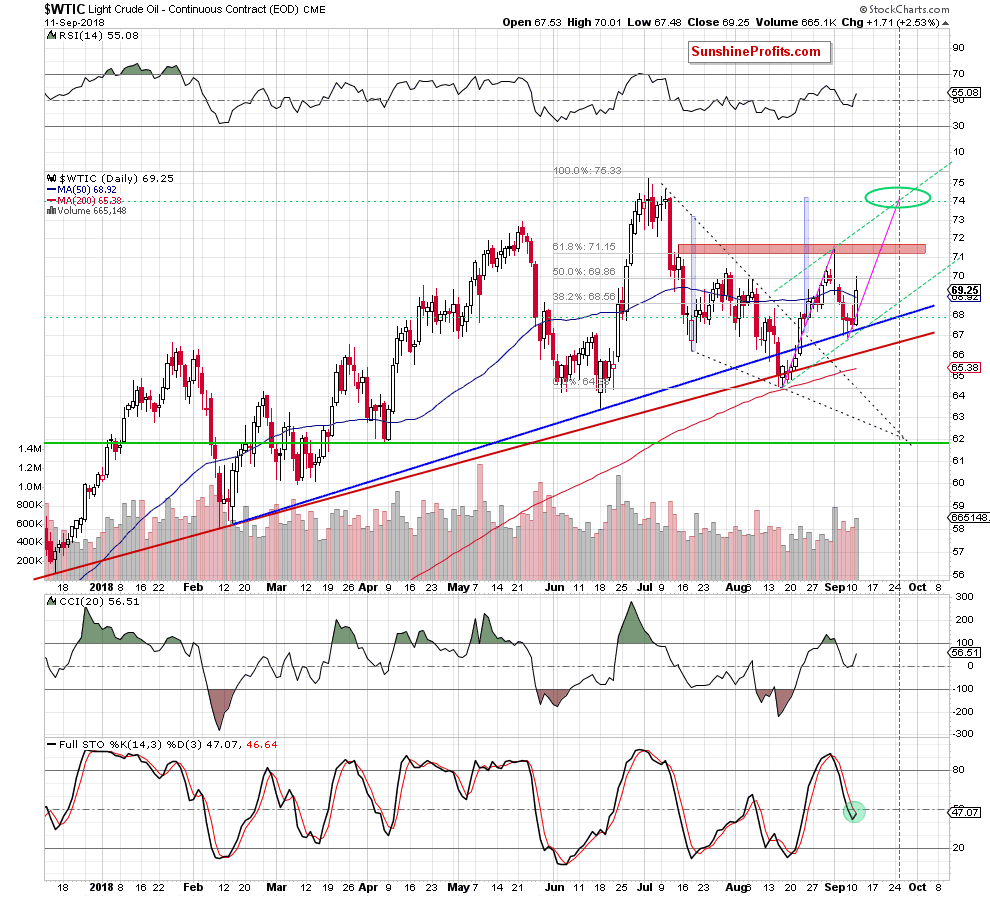

In our opinion, the first upside target will be the red resistance zone (created by the 61.8% Fibonacci retracement, the mid-July and the Sept highs), which stopped oil bulls in the previous week.

However, if it is broken, we can see a rally even to around $74 and the 2018 peaks in the following week(s). Why there? Well, there are several reasons why we placed the next target here.

First, taking into account the height (we marked it with the blue rectangle) of the declining triangle (created by the black dotted resistance line based on the July 10 and the August 7 and the black dotted support line based on the July 18 and the August 16 lows) and the breakout above its upper line, we see that crude oil should increase to around $74.26 (we also marked this range with the blue rectangle).

Second, in the above-mentioned area, the commodity was trading at the turn of June and July, but there was no fresh high after the July 3 peak, which shows that oil bears settled in for good in this zone. Therefore, if the red resistance zone is broken, this area will likely attract the buyers like magnet.

Third, around $74 the price of the commodity will likely touch the upper border of a potential green rising trend channel marked with dashed lines (the support line is based on the mid-August and the last week lows and the resistance line is parallel to it and based on the September 4 peak).

Why we think that the price and the resistance line will meet there?

Looking at the daily chart, you can see two pink lines that we draw: the first one corresponds to the time in which crude oil formed the first wave (between the mid-August low and the September 4 peak); the second one is its shift in time and we based it on the last week's low. Based on this simple dependency (assuming that the upcoming increases will last approximately as long as the previous ones), we can see that black gold can still grow for about 2 weeks (until around September 24/25).

What’s interesting, around these dates, we also see a vertical pink line, which shows the place where the arms of the above-mentioned triangle (marked with time dotted lines) will intersect in the future.

What does it mean for cure oil? We think that the best answer to this question will be reading this interesting concept: Triangle Apex Reversal Pattern (for those who do not have time to delve into technical details… please note that in the place where the triangle’s arms are crossed, we can often see reversal).

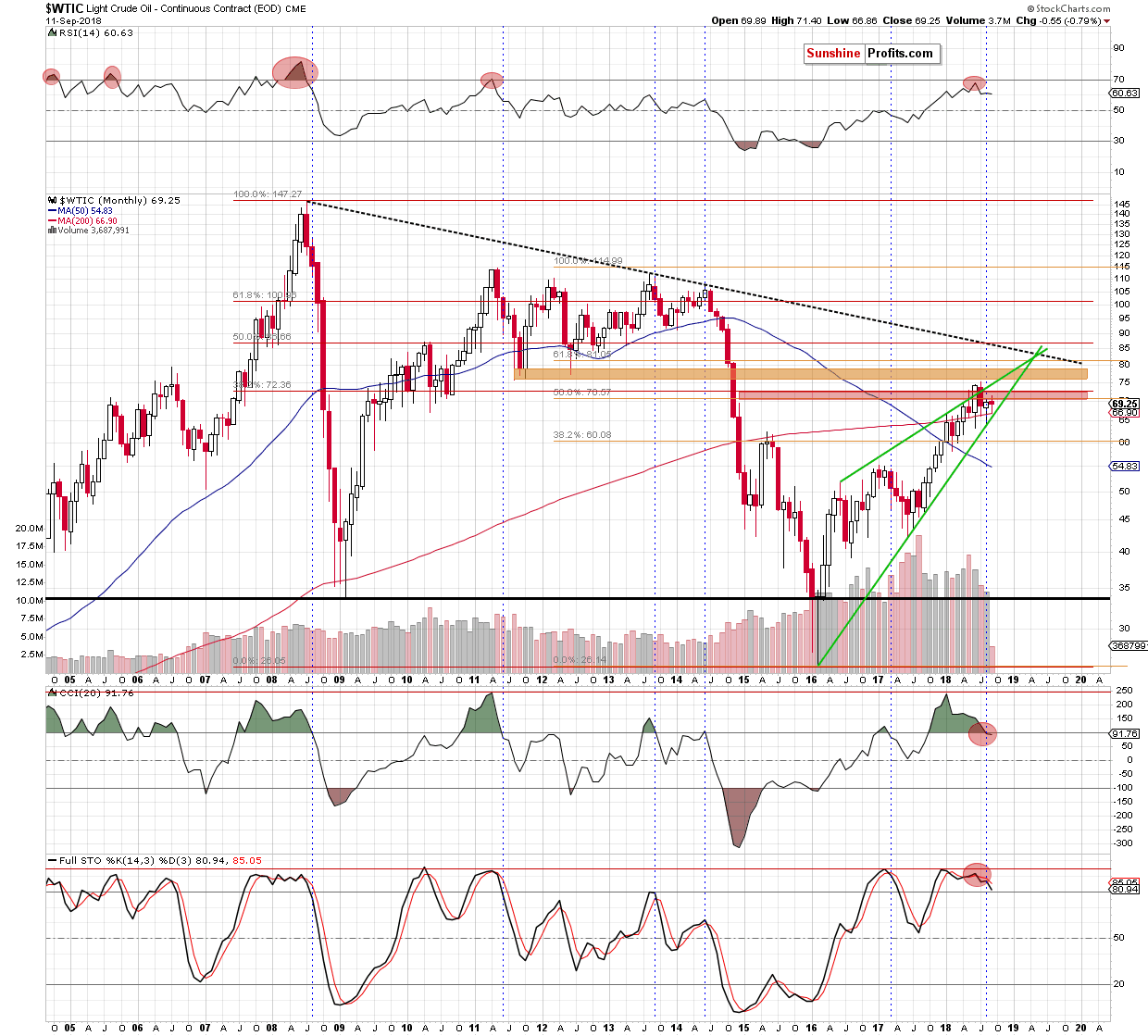

Are there any other reasons why the $74 region is important for the fate of oil? Let’s take a look at the monthly chart below.

From the long-term perspective, we see that around $74.30 the price of light crude will meet the previously-broken upper border of the green rising wedge, which will likely activate oil bears – similarly to what we saw at the beginning of July.

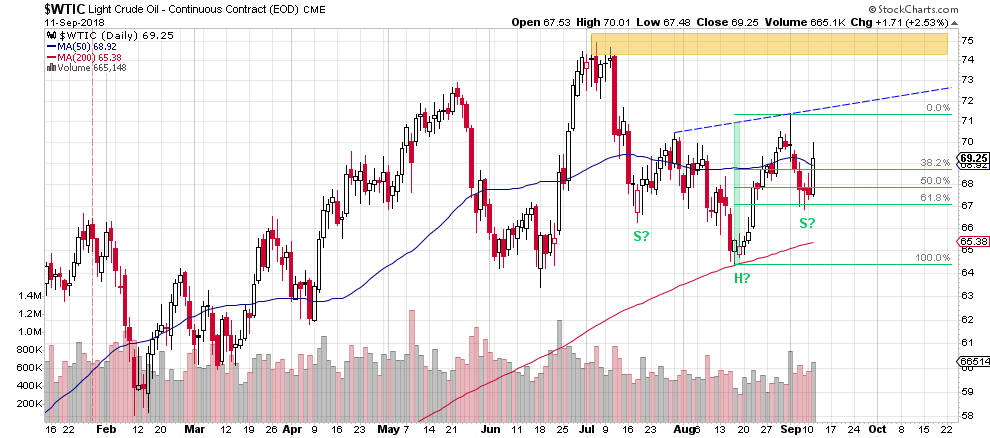

Nevertheless, before the buyers can celebrate and the price of black gold hit $74, oil bulls will have to cross one more resistance line – the blue dashed resistance line, which could be a neck line of a potential reverse head and shoulders pattern.

Finishing today’s alert, let's remind the comments that we made on this issue on Monday:

(…) the last week’s decline could be the right shoulder of the above-mentioned reversal pattern and the September high together with the late-July peak are the base on which we based the neckline of the formation.

Of course, this is only a preliminary assumption, which we consider as reliable only when the price of black gold rises above the blue dashed line seen on the above chart.

Until this time, we will carefully observe the behavior of both sides of the market to respond appropriately to emerging changes. Stay tuned.

Summing up, long positions continue to be justified from the risk/reward perspective as crude oil bounced off two important supports and invalidated the earlier breakdown under the 50-day moving average, suggesting further improvement in the following days.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts