Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Friday, crude oil wavered between small gains and losses, but then finished the day on Thursday closing price. Is this the first sign of oil bulls’ weakness?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Looking at the above charts, we see that the overall situation in the medium- and short-term remains unchanged as crude oil closed Friday session and the previous week under major resistance lines and levels. Earlier today, we haven’t seen any important breakout/breakdown, which could change the technical picture of black gold. Therefore, we believe that what we wore in our last Oil Trading Alert is up-to-date also today:

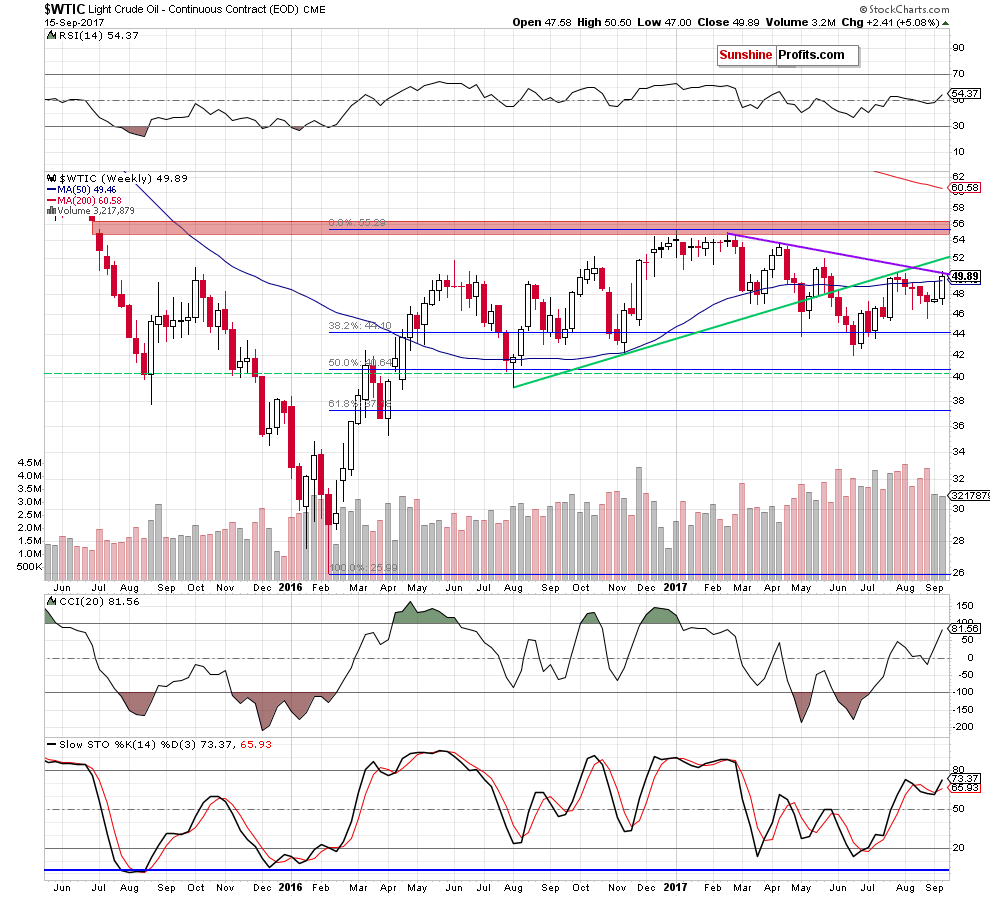

On the weekly chart, we see that although black gold moved higher and climbed above the 50-week moving average, the purple declining resistance line based on the February and April peaks continues to keep gains in check. Therefore, we think that as long as there is no breakout (and a weekly closure) above this key resistance further improvement is doubtful.

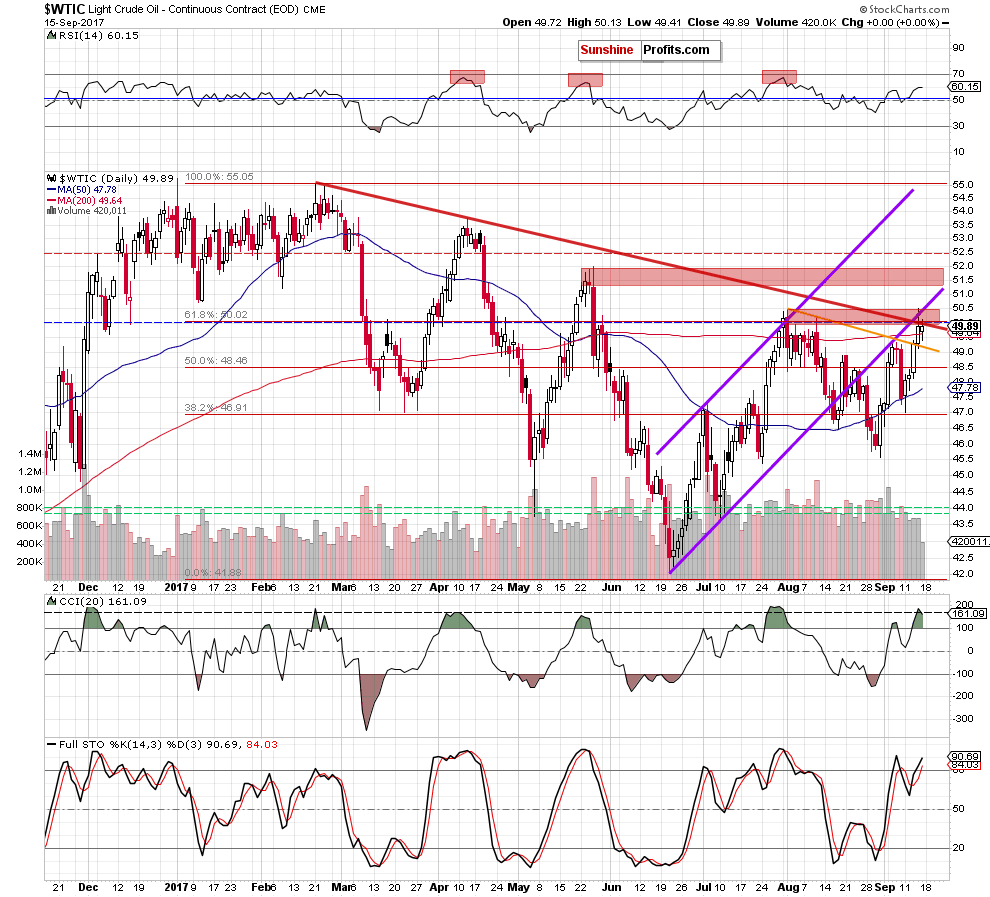

Additionally, (…) on the daily chart, we can notice (…) an increase to the red resistance zone created by the red declining resistance line, the barrier of $50, August highs and the lower border of the purple rising trend channel.

Despite Thursday improvement, these resistances were strong enough to stop further improvement and trigger a pullback. As a result, light crude reversed and slipped below them, invalidating the earlier tiny breakouts. Such price action is a negative development, which increases the probability of lower prices in the coming week.

Additionally, the size of volume, which accompanied yesterday move didn’t increase (in contrast to the price of the commodity), which increases doubts about oil bulls’ strength and further rally.

What does it mean for black gold?

(…) if the commodity increases to the lower border of the purple rising trend channel and then reverses and declines, we will see nothing more than another verification of the earlier breakdown under this short-term resistance, which will give oil bears a very important reason to act in the following days.

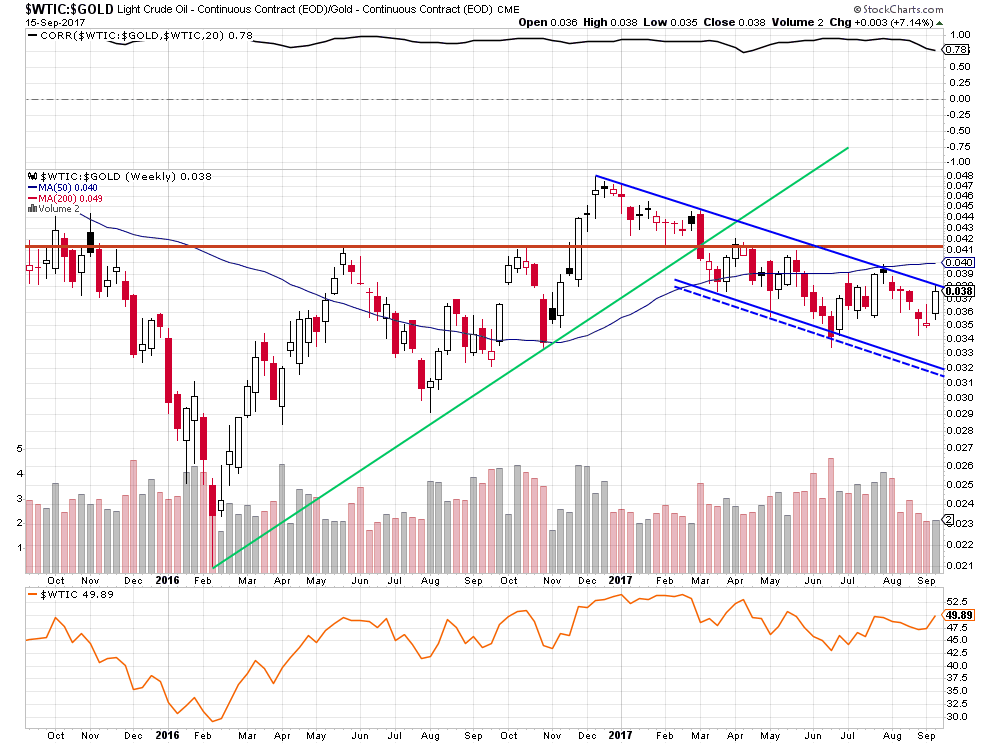

Finishing today’s Oil Trading Alert, please take a look at the current situation in the oil-to-gold ratio.

Looking at the above chart, we see that the recent increase took the ratio to the upper border of the blue declining trend channel once again. As you see, this resistance stopped the bulls in July, which suggests that we may see similar price action in the very near future. This means that if the ratio reverses and declines from current levels, we’ll likely see a decline in crude oil as positive correlation between the ratio and the commodity is still in cards.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil remains under the major resistances and the size of volume doesn’t confirm oil bulls’ strength.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short profitable positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts