Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Friday's downswing in oil has given way to a strong opening earlier today. Apparently, the Xi-Trump meeting outcome has been welcome by oil traders. Let's step back and look at the charts - what has changed and what has not. What about the obstacles ahead for the bulls, will they have an easy time overcoming them?

Let's take a closer look at the charts below charts courtesy of http://stockcharts.com and www.stooq.com ).

Let's remember our Friday's observations:

(...) The fate of today's upswing turned out similar to both the Wednesday and Thursday attempts - it failed.

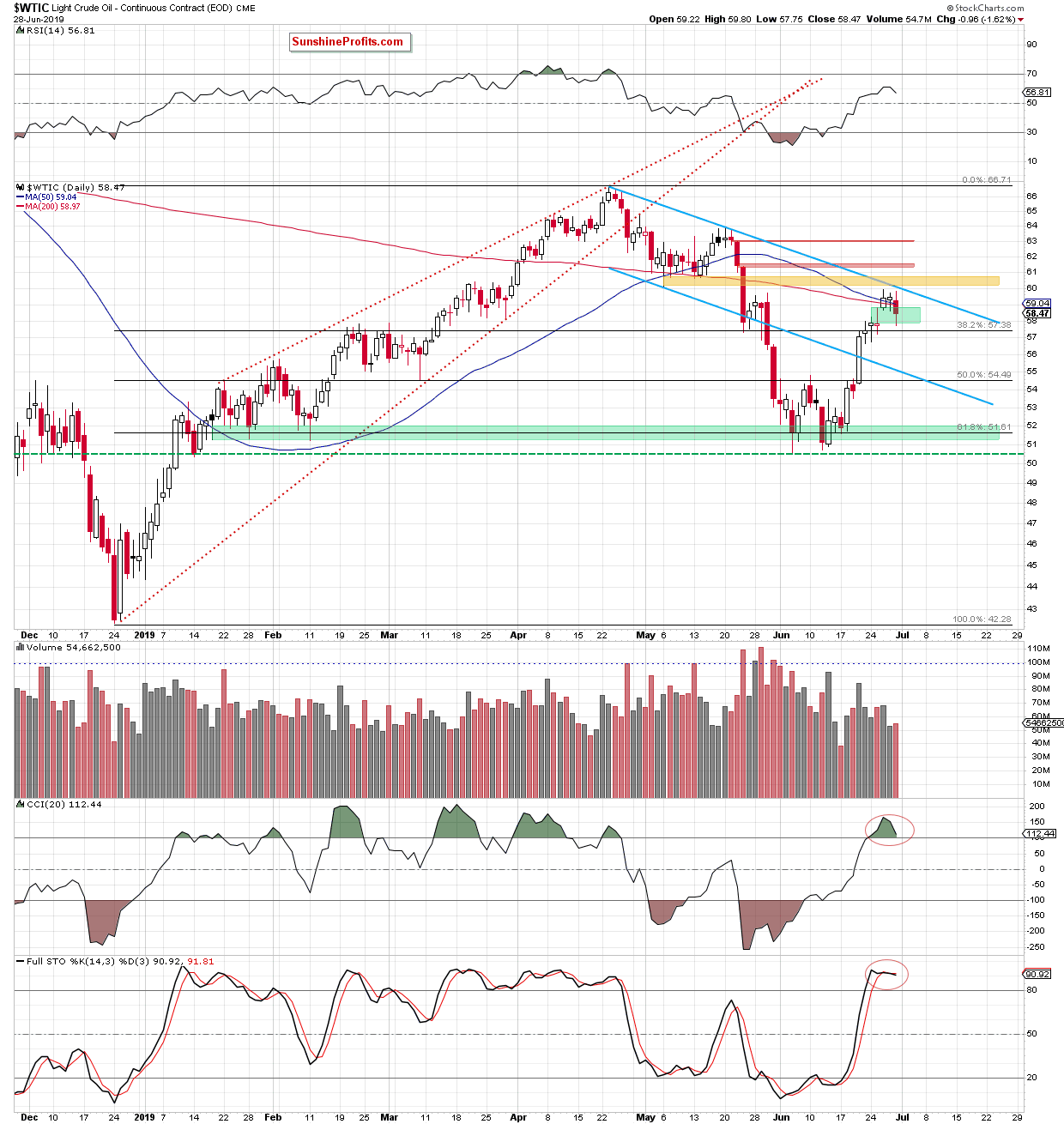

The yellow resistance zone and the declining blue resistance line proved too strong an obstacle for the bulls. A look at the current overbought position of the daily indicators and the declining volume (...) reveals that black gold is vulnerable to a downswing.

These were our Thursday's words:

(...) Therefore, a downward reversal coupled with a test of the lower border of yesterday's gap (or even a drop to the middle gap) seems to be reasonable for starters. It could be followed by another attempt to move higher (maybe even to the above-mentioned 61.8% Fibonacci retracement and the orange resistance zone) that eventually gives way to a bigger correction. That currently seems to be the most likely scenario.

The daily chart shows that crude oil declined during Friday's session, slipping to the lower border of the green gap. The sellers however didn't manage to hold their ground, and black gold rebounded to close the day well inside the gap. This way, the first part of our Thursday's scenario came true.

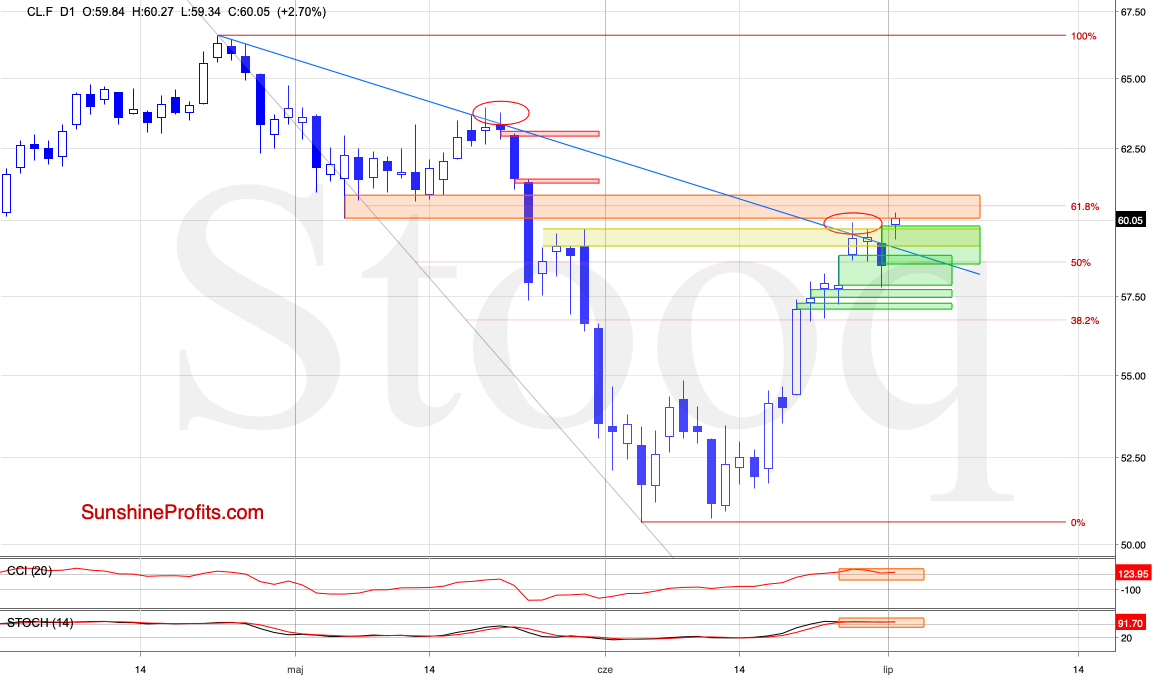

What about the second part? Can the new peak overcome Friday's 1.5% decline? Let's check the crude oil futures chart below.

Today's open has been marked with another gap, encouraging the buyers to push higher. Last week's peaks have been overcome and the price visited the orange resistance zone created by the early- and mid-May lows (marked with yellow on the first chart). Additionally, there's also the 61.8% Fibonacci retracement nearby.

These aspects point to a limited upside potential. This is especially so when we factor in the current position of the daily indicators - they're very overbought and on the verge of generating sell signals. Then, there's also the red gap ahead, serving as an additional resistance.

Should we see oil bulls' weakness coupled with unsuccessful attempts to go north, we'll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up, while Friday's decline has been erased with the strong start to today's session, the upside in oil remains limited due to the strong combination of resistances just ahead. Indeed, oil is turning south to trade at around $59.40 as we speak. The bearish scenario is further supported by the very overbought position of the daily indicators. Should we see the bulls stumble, we'll consider opening short positions. As for now however, the best course of action is to remain on the sidelines.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist