Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Tuesday, crude oil extended losses, hitting a new August low, but will we see lower prices of the commodity in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

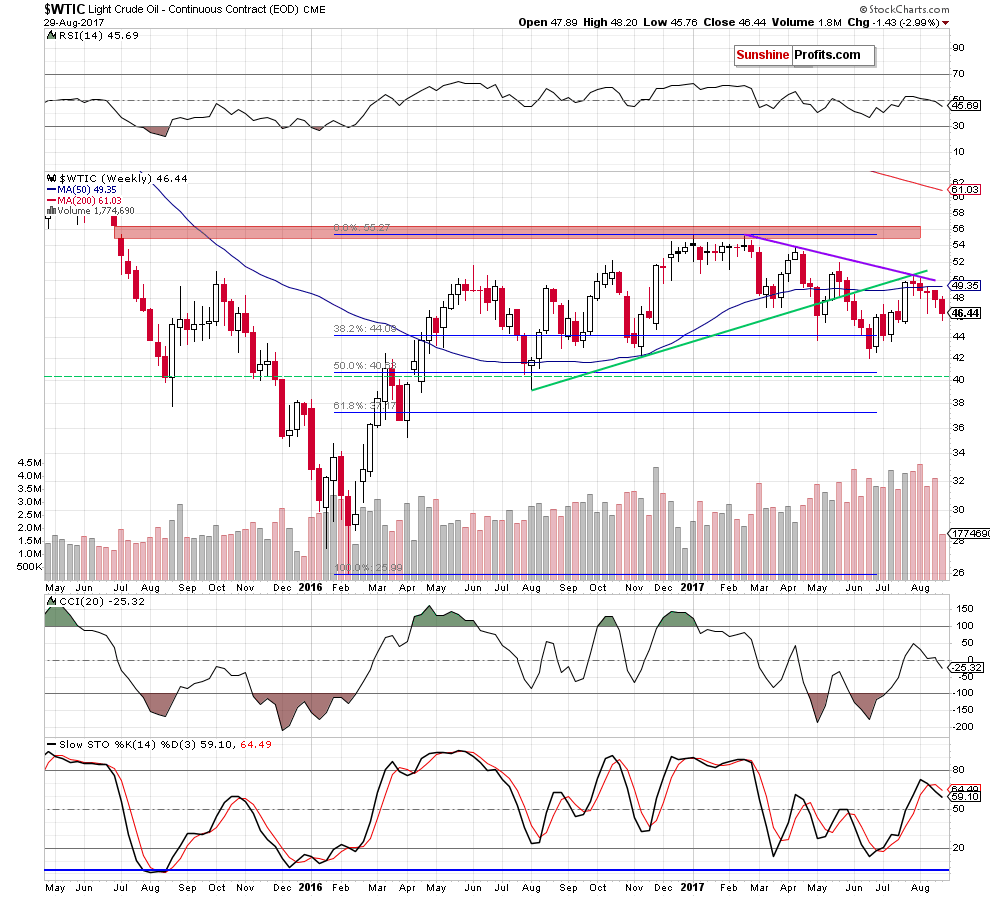

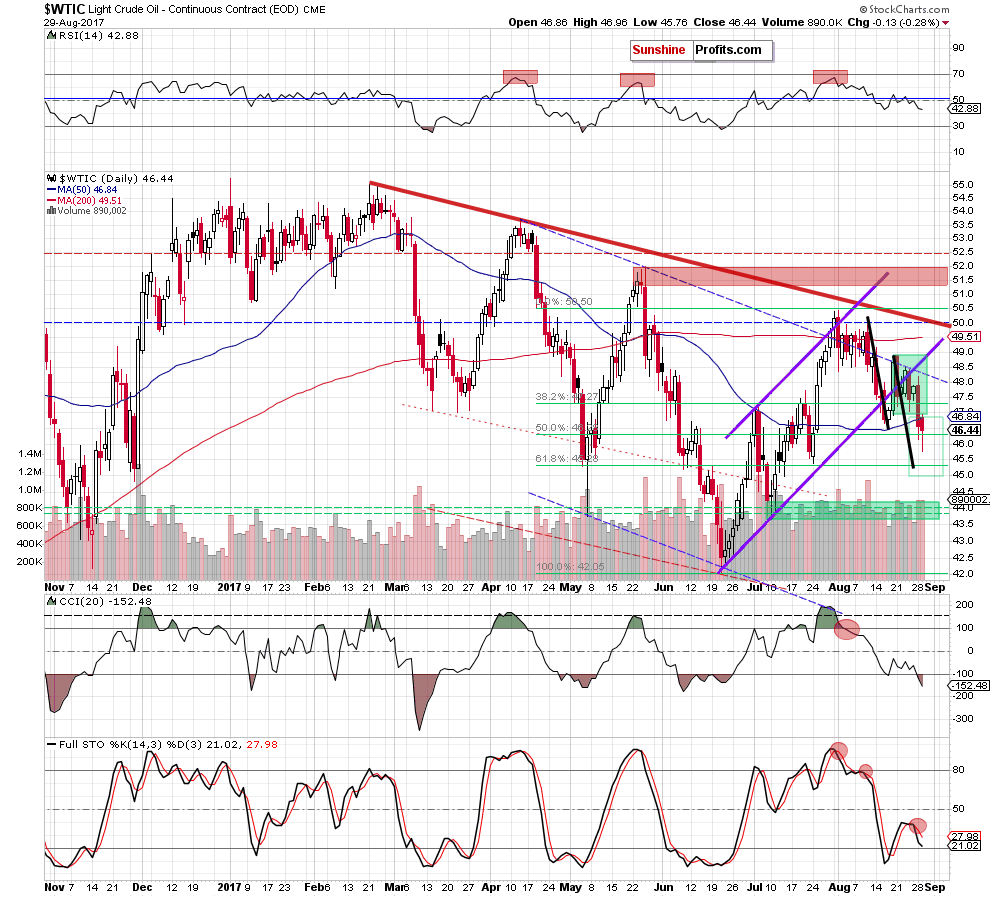

Looking at the charts, we see that although crude oil moved a bit higher after the market’s open, the lower border of the green consolidation together with the 50-day moving average stopped oil bulls, triggering a pullback. As a result, light crude extended losses and slipped to a fresh August low of $45.76. Despite this deterioration, the commodity rebounded and closed the day above the 50% Fibonacci retracement – similarly to what we saw on Monday.

What’s next?

We believe that the best answer to this question will be the quote from our yesterday’s Oil Trading Alert:

(…) In our opinion, although crude oil invalidated the tiny breakdown under the above-mentioned Fibonacci retracement, the next move to the downside is still ahead of us.

Why? Firstly, crude oil broke below the lower border of the green consolidation, which opened the way to around $45, where the size of the move will correspond to the height of the formation. Secondly, the commodity closed the day under the 50-day moving average, which invalidated the earlier breakout above it. Thirdly, when we take a closer look at the daily chart, we notice that slightly below our next downside targets (the late July low of $45.40 and the 61.8% Fibonacci retracement) the size of the current downward move will be equal to the downswing, which we saw between August 10 and August 17 (both moved we marked with the black line).

Additionally, yesterday’s downswing materialized on significant volume, which confirms oil bears’ strength and the direction of the current trend. On top of that, the Stochastic Oscillator re-generated the sell signal, giving oil bears another reason to act in the following days.

On top of that, yesterday’s price action (an increase to the lower border of the green consolidation and the 50-day moving average and reversal from these levels) suggests that crude oil verified the earlier breakdown under these levels, which is an additional negative factor.

Finishing today’s Oil Trading Alert please note that although the API reported that crude oil inventories dropped by 5.8 million barrels and distillates stocks fell by 490,000 barrels, these numbers were compiled before the impact of Hurricane Harvey. What’s interesting, the report also showed that gasoline supplies rose by 480,000 barrels and crude oil inventories in the hub at Cushing, Oklahoma, increased by 580,000 barrels. Taking the above into account, we think that the report would be more bearish if it had taken into account the impact of the hurricane. Therefore, in our opinion, an increase in crude oil inventories is just a matter of time and we’ll likely see it in the upcoming government reports (if not today it will probably appear in a week or two).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil extended losses, verifying the earlier breakdown under the lower border of the green consolidation and the 50-day moving average and hitting a fresh August low. Additionally, the size of volume was significant yesterday, which increases the probability of another move to the downside in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at $52.52 and the initial downside target at $45.80 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts