Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Let's take a closer look at the chart below (chart courtesy of www.stockcharts.com and www.stooq.com ) and assess the likely crude oil price path ahead.

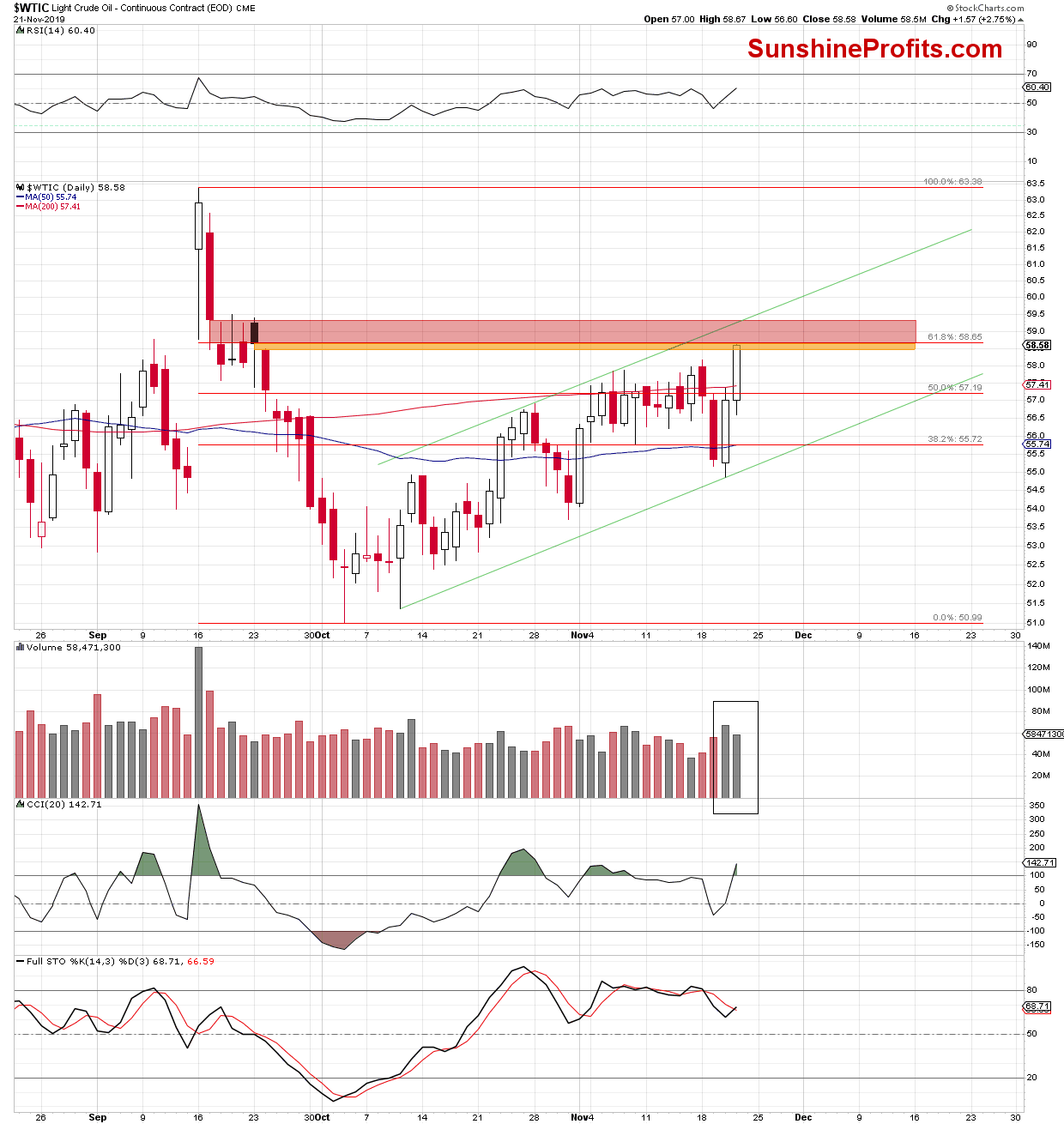

Crude oil has broken above its previous peaks, and closed the September gap. While these are certainly bullish developments, the volume of yesterday's upswing declined. This puts a question mark over the sustainability of higher prices.

This is especially the case when we factor in the fact that black gold has climbed to the strong resistance area created by the 61.8% Fibonacci retracement, and the red and orange gaps. This strong combo is further reinforced by the upper border of the rising green trend channel and the Sept 18-23 peaks.

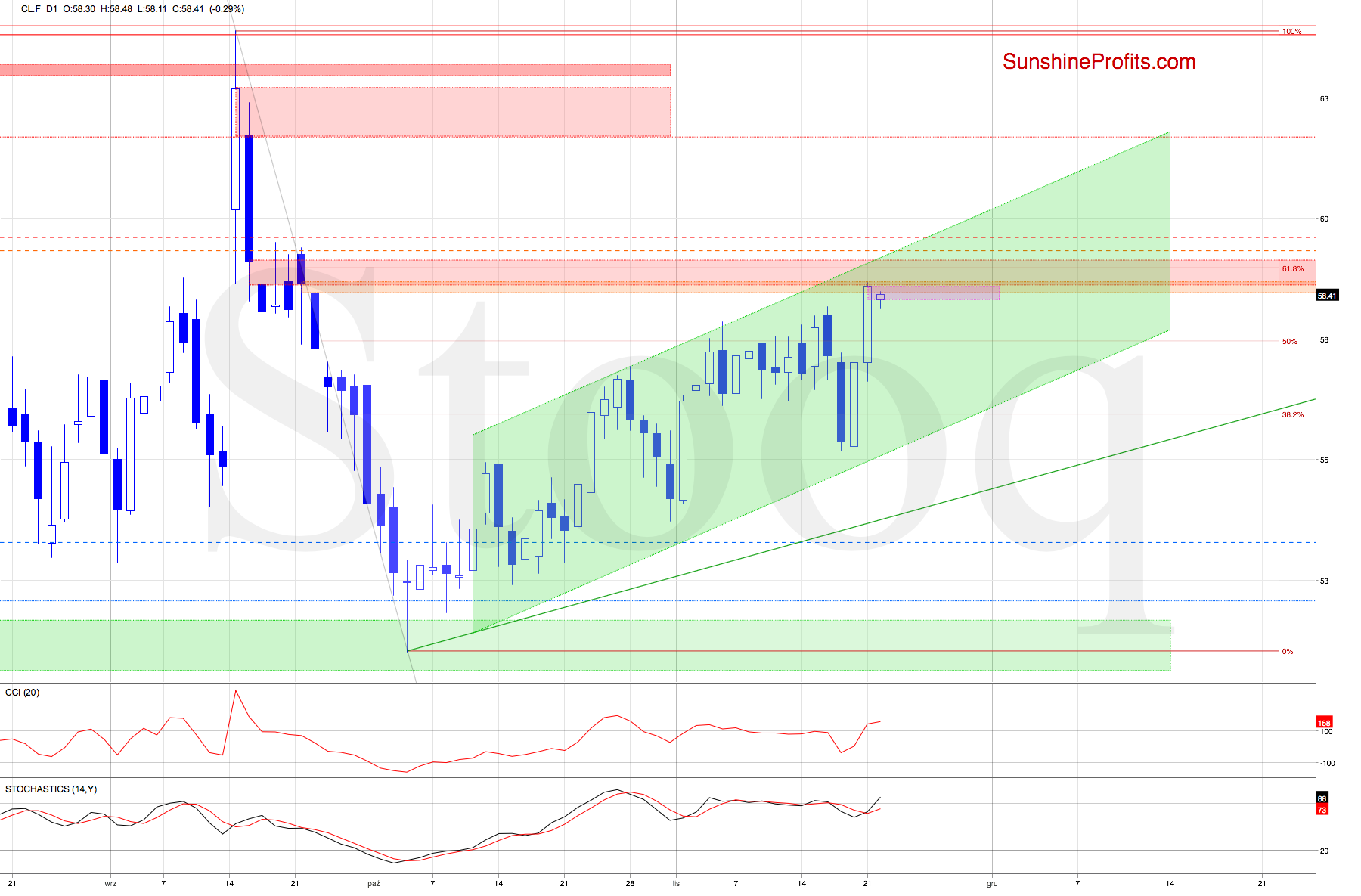

How did all the above reflect in today's pre-market trading? Let's check the chart below.

Crude oil futures opened today with the bearish pink gap, which suggests that the above-mentioned mix of resistances could stop the bulls and trigger a reversal in the coming week.

Such a scenario will be more likely and reliable if we see the commodity close below the pink gap later in the day.

Summing up, the two-day oil upswing closed the September bearish gap, but it's meeting a new set of resistances: the 61.8% Fibonacci retracement, and the red and orange gaps. There's also the upper border of the rising green trend channel and the Sept 18-23 peaks in the proximity. Combined, they could trigger a reversal, especially if today's pink gap remains unclosed. The short position remains justified.

Trading position (short-term; our opinion): Short position with a fresh stop-loss order at $59.60 and the initial downside target at $53.28 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist