Trading position (short-term; our opinion): Already profitable short positions with a stop-loss order at $77.44 and the initial downside target at $67.95 are justified from the risk/reward perspective.

On Friday, crude oil extended Thursday’s gains and closed the day slightly above $71. At the first glance, it doesn’t look very attractive from a bearish point of view, but did the last move of the previous week change anything in the short-term perspective?

Let’s examine the recent changes on the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

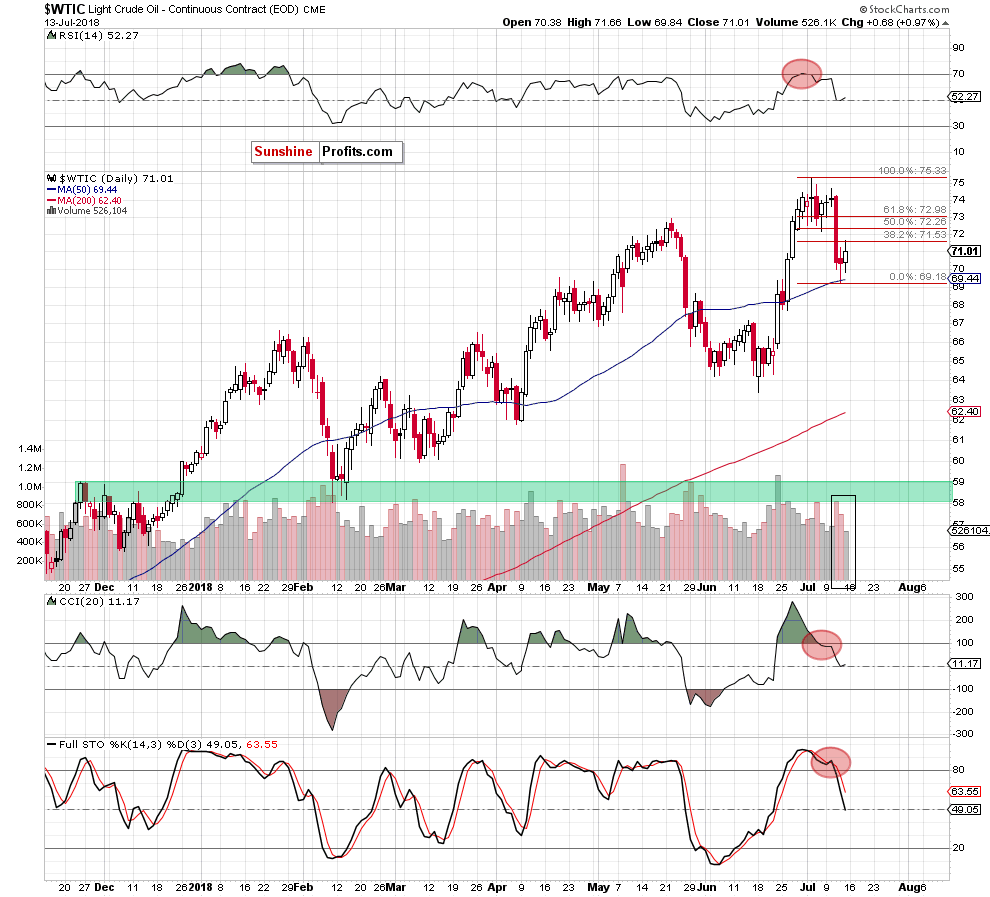

Looking at the daily chart, we see that although crude oil extended gains on Friday, the size of rebound was quite tiny, because light crude increased only to the 38.2% Fibonacci retracement.

After this move, the commodity pulled back, which doesn’t confirm oil bulls’ strength – especially when we factor in Friday’s volume that was much lower than during earlier declines. Additionally, the sell signals generated by the indicators remain in the cards, supporting oil bears and further deterioration in the coming week.

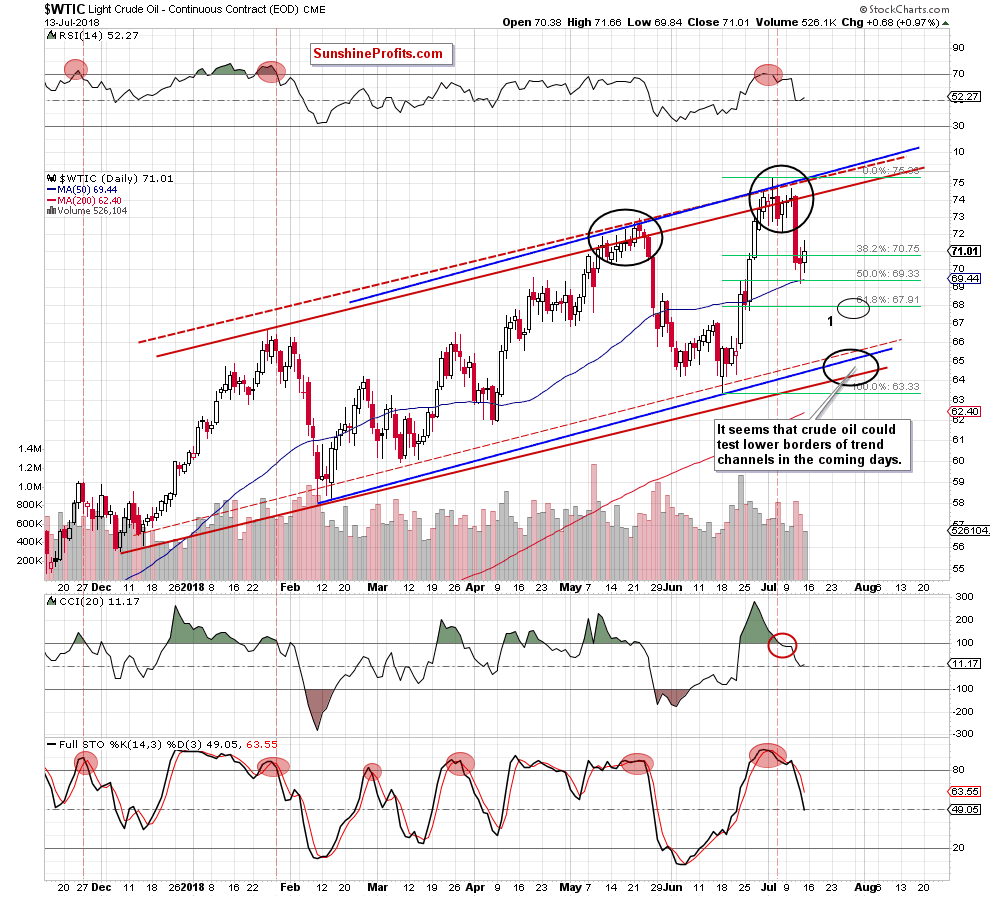

The pro-bearish scenario is also reinforced by the long- and medium-term pictures about which we wrote more in our last Oil Trading Alert (if you haven’t had the chance to read it, we encourage you to do so today, because it’s up-to-date).

Connecting the dots, if black gold extends losses from Friday’s levels, oil bears will not only test the nearest support area (created by the recent low, 50% retracement and the 50-day moving average), but also push the price of crude oil to (at least) around $67.91-$68, where the 61.8% Fibonacci retracement and late June lows are.

Nevertheless, if this last support is broken, the way to lower levels will be open. So, how low could black gold go if oil bears show their claws? We believe that the best answer to this question will be the quote from our last Oil Trading Alert:

(…) all the above suggests that crude oil will likely drop to around $65 and test lower borders of the rising trend channels in the following days (we marked this area with the black ellipse on the daily chart).

Summing up, already profitable short positions continue to be justified from the risk/reward perspective as crude oil remains under many important resistances, which in combination with the sell signals generated by the indicators, all negative factors about which we wrote in our previous alerts and a very pro-bearish picture that emerges from the oil-to-platinum ratio suggests that further deterioration and lower prices of crude oil are more likely than not in the coming week.

Trading position (short-term; our opinion): Already profitable short positions with a stop-loss order at $77.44 and the initial downside target at $67.95 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts