Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

Yesterday, crude oil moved sharply higher, which resulted in an invalidation of two earlier breakdowns, but is this improvement stable and reliable?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

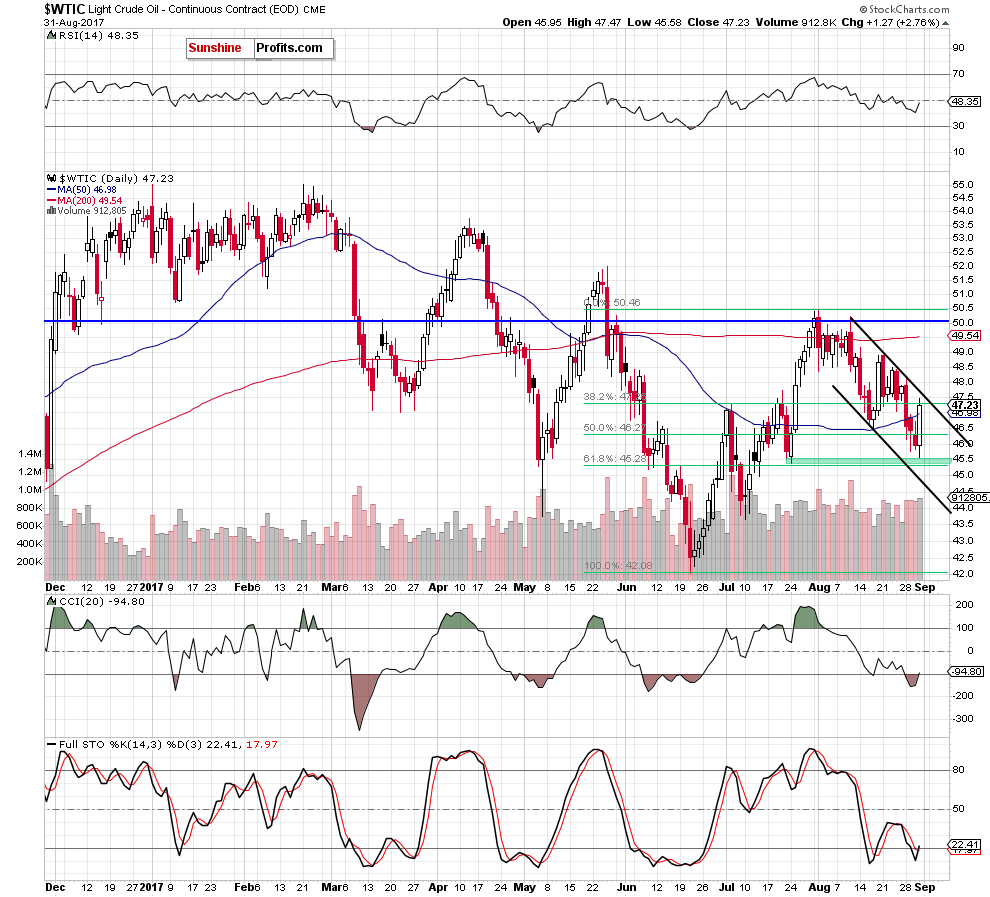

Yesterday, crude oil rebounded sharply, invalidated the earlier breakdown under the 50% Fibonacci retracement and the 50-day moving average. Despite this bullish development, the black gold is still trading in the black declining trend channel, which suggests that one more move to the downside can’t be ruled out.

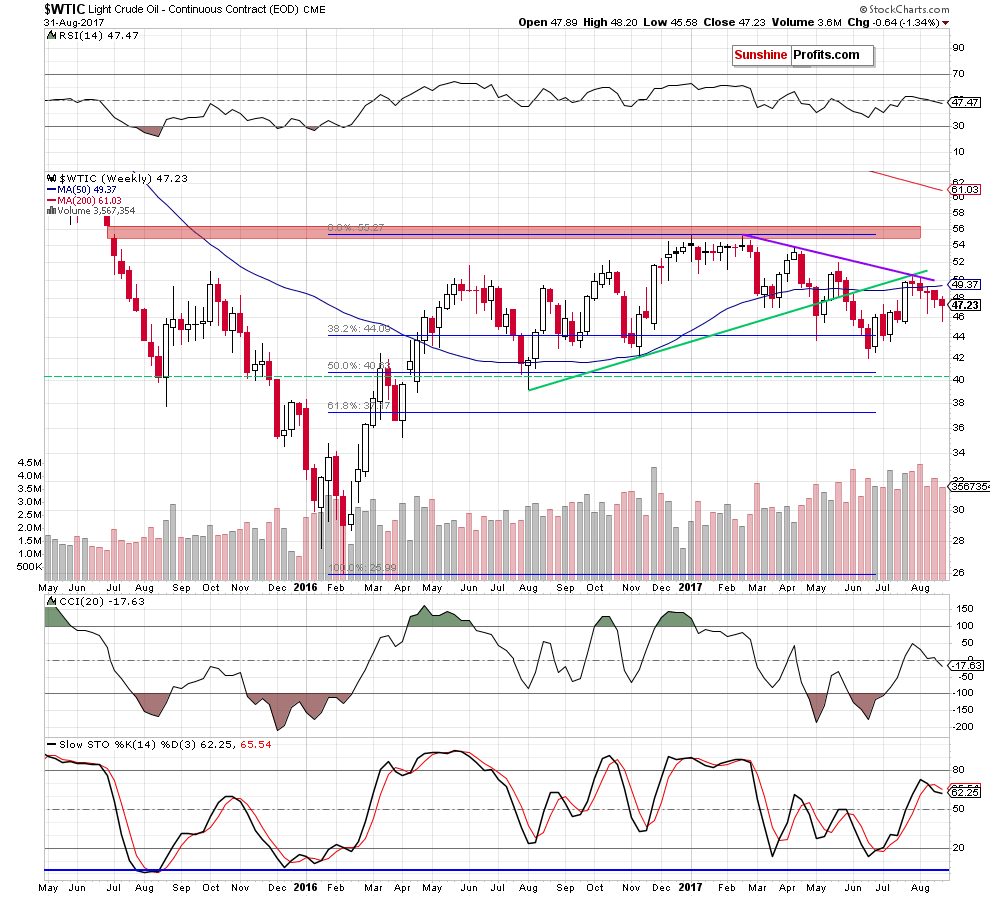

Additionally, when we take a look at the weekly chart below, we can see that the sell signals generated by the medium-term indicators remain in place, supporting oil bears and another attempt to move lower.

On top of that, the commodity remains under the purple declining resistance line, the long-term green line (which also serves as the resistance) and the 50-week moving average, which together create a solid resistance area.

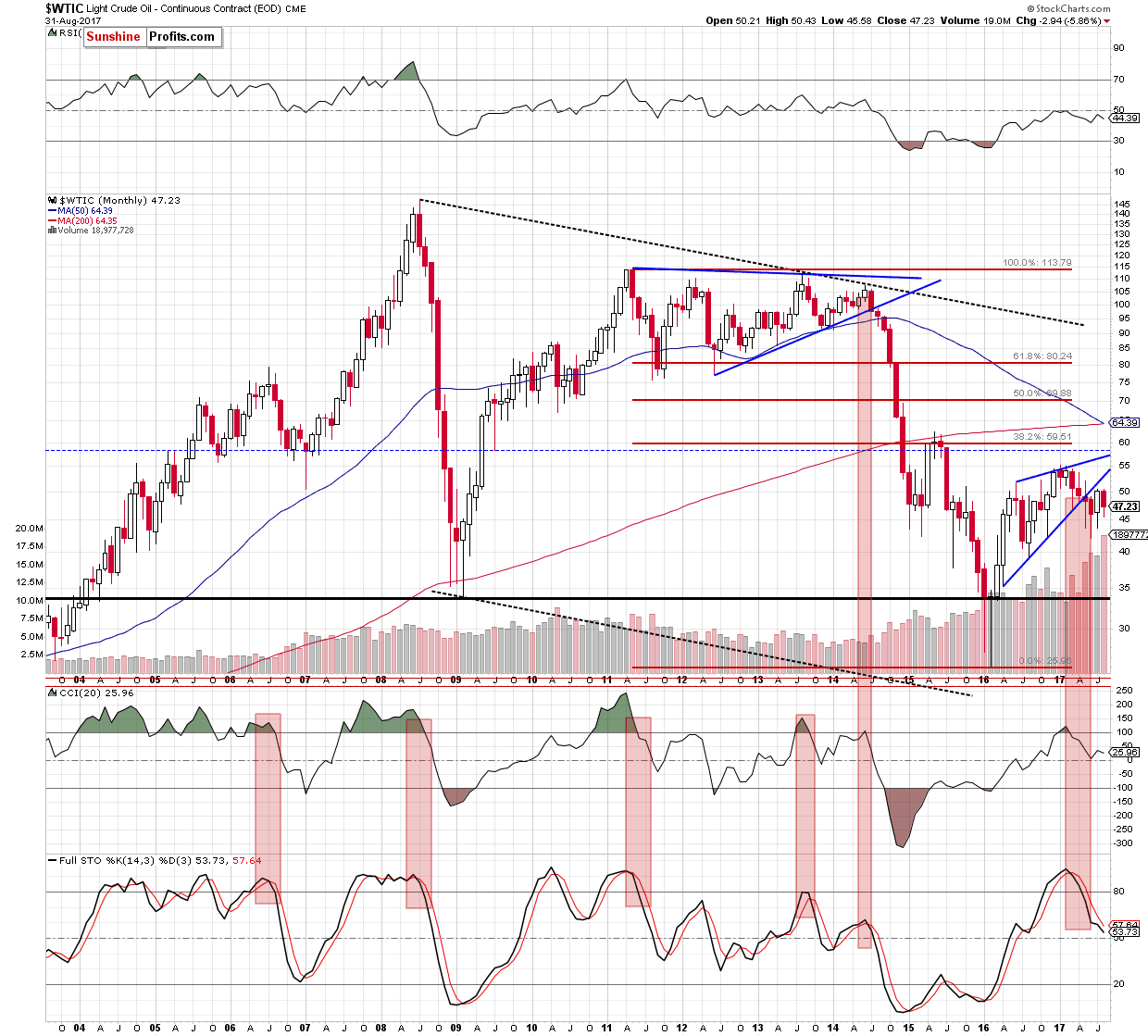

Finishing today’s Oil Trading Alert please take a closer look at the monthly chart.

From the long-term perspective we see that the black gold lost almost 6% in the previous month and closed August under the lower border of the blue rising wedge. What’s interesting the last month’s decline materialized on huge volume (we haven’t seen such huge value since more than 10-years), which suggests that oil bears are not weak as it could seem after yesterday's session and further deterioration (and significant move to the downside) is still ahead of us especially when we factor in the sell signals generated by the long-term indicators. Therefore, profitable short positions continue to be justified from the risk/reward perspective.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts