Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, crude oil moved sharply lower, which resulted in a drop below several important supports. Will oil bears use these circumstances to trigger even greater declines in the coming days?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

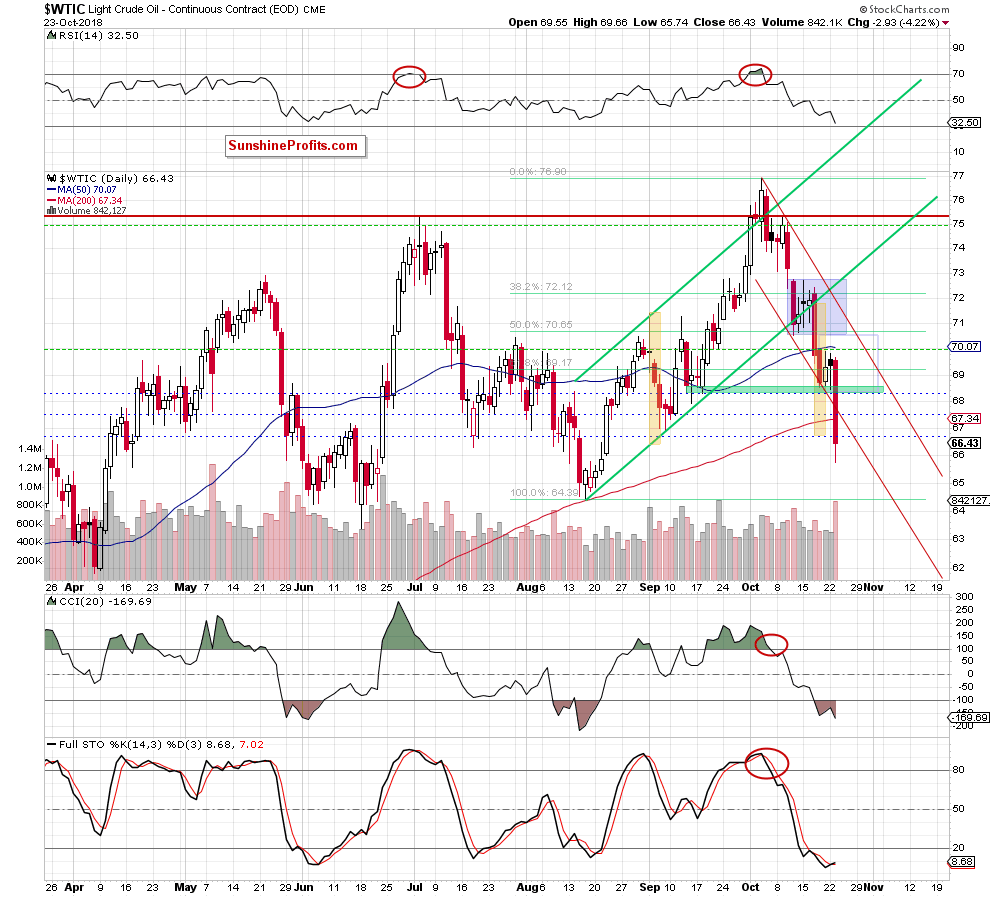

Looking at the daily chart we see that crude oil moved sharply lower, which resulted in a breakdown not only below the green support zone, but also under the lower border of the red declining trend channel, the 200-day moving average and the early September lows.

Thanks to yesterday’s decline the commodity slipped to the area where the size of the downward move corresponded to the height of the green rising trend channel, which triggered a tiny (compared to the size of earlier drop) rebound before the session’s closure. Additionally, the Stochastic Oscillator generated a buy signal, suggesting that reversal may be just around the corner.

Nevertheless, despite these factors, we should keep in mind that yesterday’s volume was significant, which confirms oil bears’ strength. On top of that, Tuesday’s drop affected the broader picture of the commodity.

What do we mean by that? Let’s take a look at the weekly chart below.

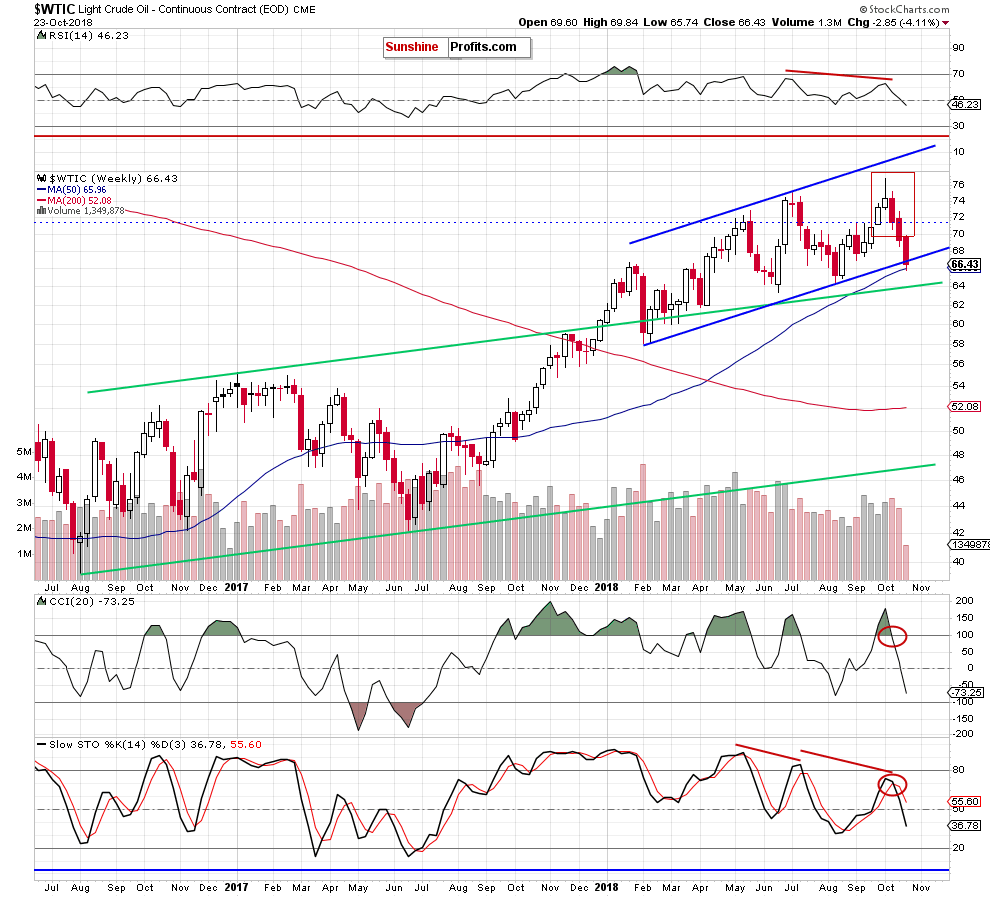

From this perspective, we see that yesterday’s decline took the price of black gold under the lower border of the blue rising trend channel, which is a bearish development – especially when we factor in the sell signals generated by the weekly indictors.

At this point it is worth noting that Tuesday’s drop pushed crude oil also below two other long-term supports about which we wrote yesterday.

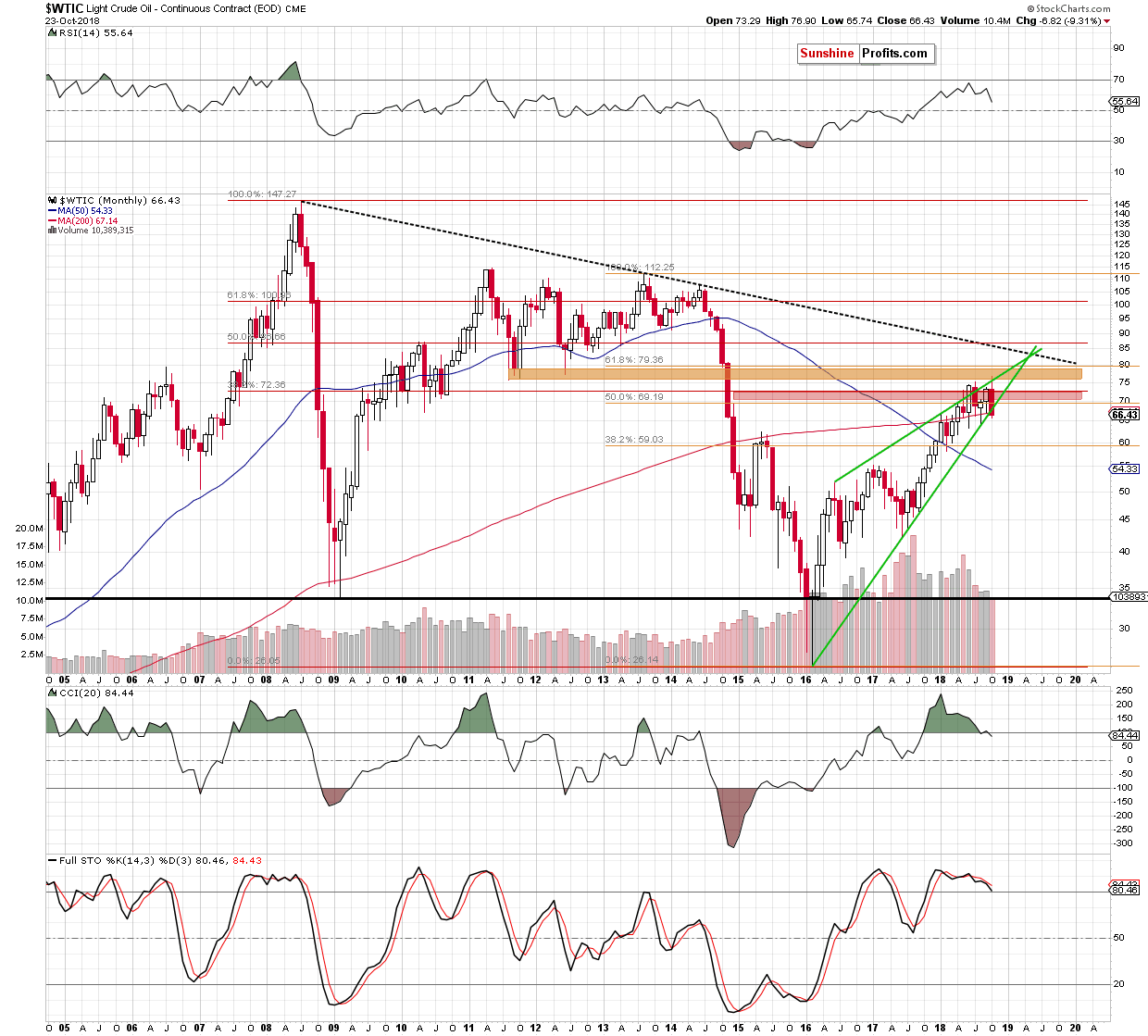

The first thing that catches the eye on the monthly chart is the breakdown under the lower border of the green rising wedge and the 200-month moving average, which doesn’t bode well for oil bulls (in this case the CCI and the Stochastic Oscillator also supports further deterioration in the following days, weeks or even months).

Nevertheless, in our opinion, a significant downward move will be more likely and reliable if oil bears manage to close the whole week (and preferably a whole month) under these important support lines.

Until this time a rebound and a verification of yesterday’s breakdowns (under the https://www.sunshineprofits.com/admin/sp_new_sections/articlebase/lower border of the blue rising trend channel marked on the weekly chart, the 200-month moving average, the lower border of the very short-term red declining trend channel seen on the daily chart or even the lower border of the green wedge marked on the monthly chart) should not surprise us.

Therefore, if the situation develops in line with the above assumption and crude oil increases from here, we’ll re-open full (150% or even 200% of the regular size of the position) short positions at higher prices in the following days. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts