Trading position (short-term; our opinion): Short positions with a stop-loss order at $74.06 and the initial downside target at $56.50 are justified from the risk/reward perspective.

The black gold moved visibly higher during yesterday’s session, but just because a price moved in a given direction, it doesn’t mean that it will keep moving higher. In some cases, the rallies can even be bearish. Was yesterday’s upswing one of them?

To a small extent, but yes, it was more of a bearish phenomenon than a bullish one and the reason is the size of volume that accompanied this move.

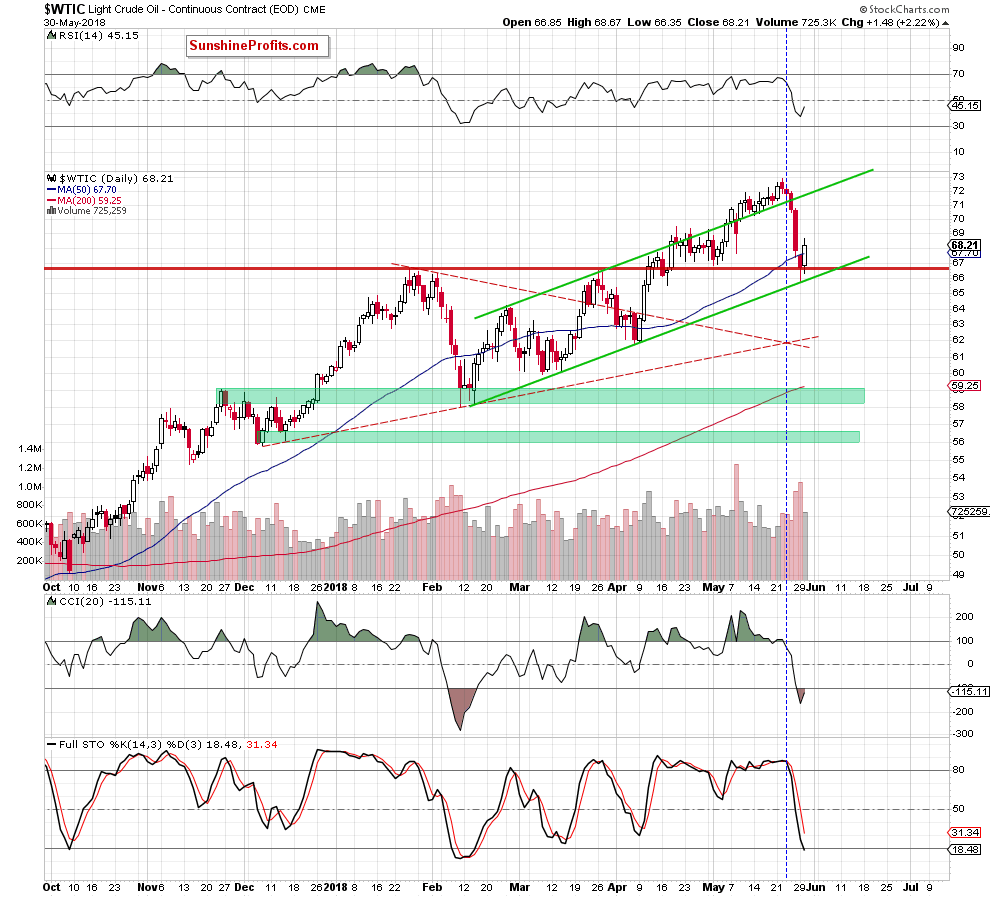

After several days of relatively low volume in mid-May, crude oil started to decline on increasing volume and finally plunged on huge volume. It now moved a bit higher one volume that was much lower than what we had seen during the recent slide. That’s a classic example of how volume should behave during a pause.

There were fewer buyers and fewer sellers as both parties are waiting to see what happens and if crude oil manages to break below the support. The above seems neutral, until one considers that if there are no buyers or sellers, the price will not stay at the same level – it will decline.

Huge volume during a rally would indicate buyer’s strength, but what we saw suggests that we have the situation in which the market simply needed to take a breather before the move continues.

Consequently, what we wrote previously about the weekly and monthly candlesticks remains up-to-date:

(…) We have, however, two important indications that remain in play.

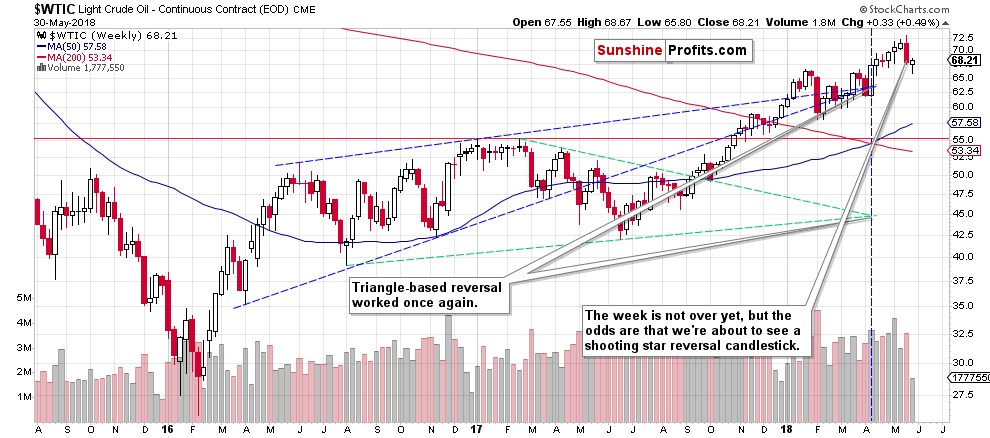

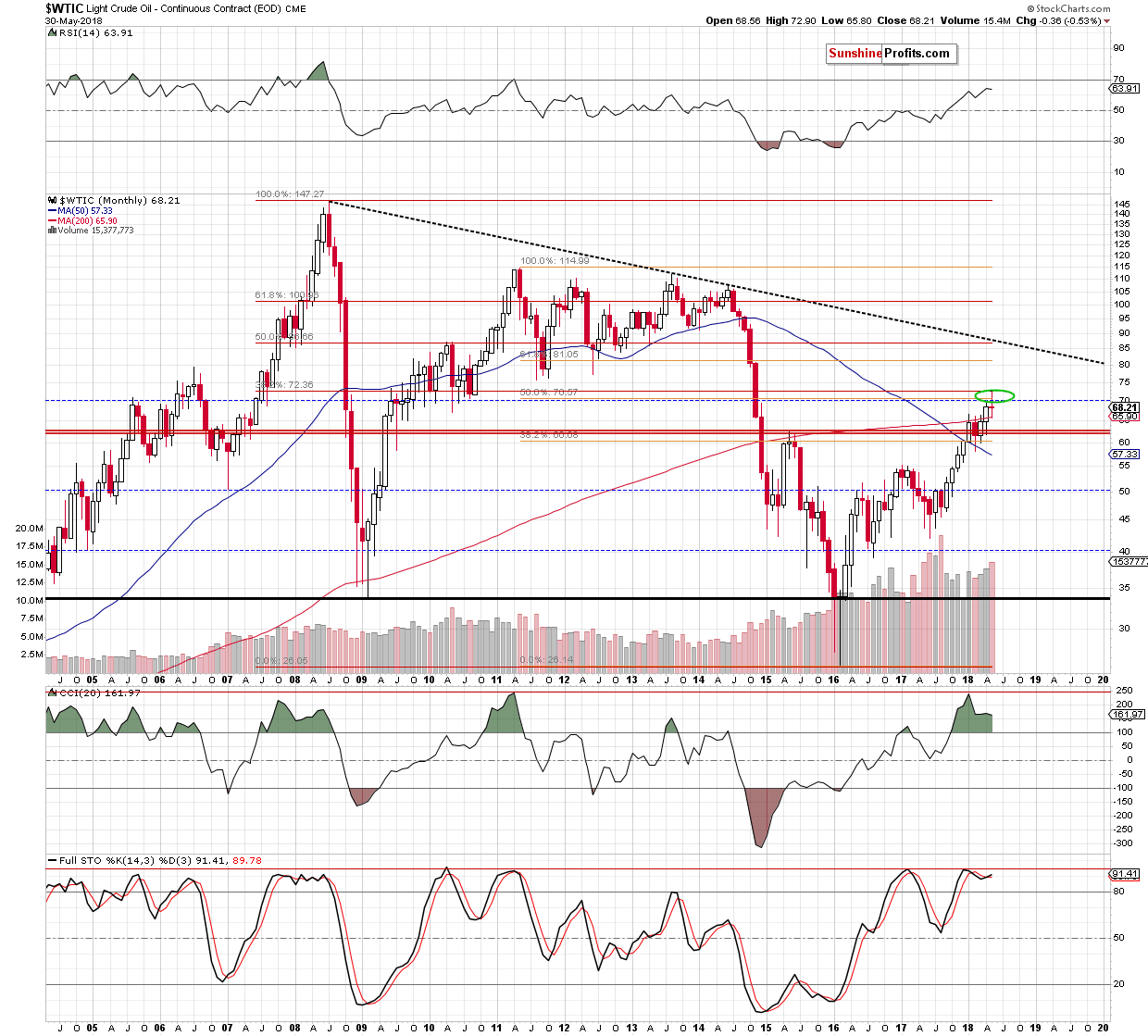

Just as daily reversals have implications for days, weekly reversals have implications for weeks and monthly reversals have implications for month. The key thing to keep in mind is that we have a bearish weekly reversal in play this week and if it plays out correctly and crude oil ends the week in the red, then we’ll also have a powerful monthly reversal. The implications extend well beyond the next few days. Let’s take a closer look at the charts for details.

The previous week’s reversal is likely to make crude oil decline this week and so far this week has been up. Well if you count today’s pre-market move lower, then it’s modestly down. Either way, there are two more sessions to go and it seems likely that the week will end in the red.

This, in turn, is likely to make the monthly candlestick to be a powerful reversal. The volume is already significant, so it’s quite safe to say that the volume after the full month will be big. In other words, the reversal is likely to be confirmed by the volume.

The implications are bearish for the following weeks, not just days.

Summing up, the outlook for the crude oil remains bearish and it seems that we’ll see even lower prices in the coming weeks despite this week’s small corrective upswing. In other words, it seems that the profits from the current short position will increase further.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $74.06 and the initial downside target at $56.50 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts