Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Friday’s close doesn’t offer many hints at first sight. Where can the bulls find support for oil price to move up? Or is it the bearish outlook that is justified here? Please accept our invitation to find out the rich details.

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

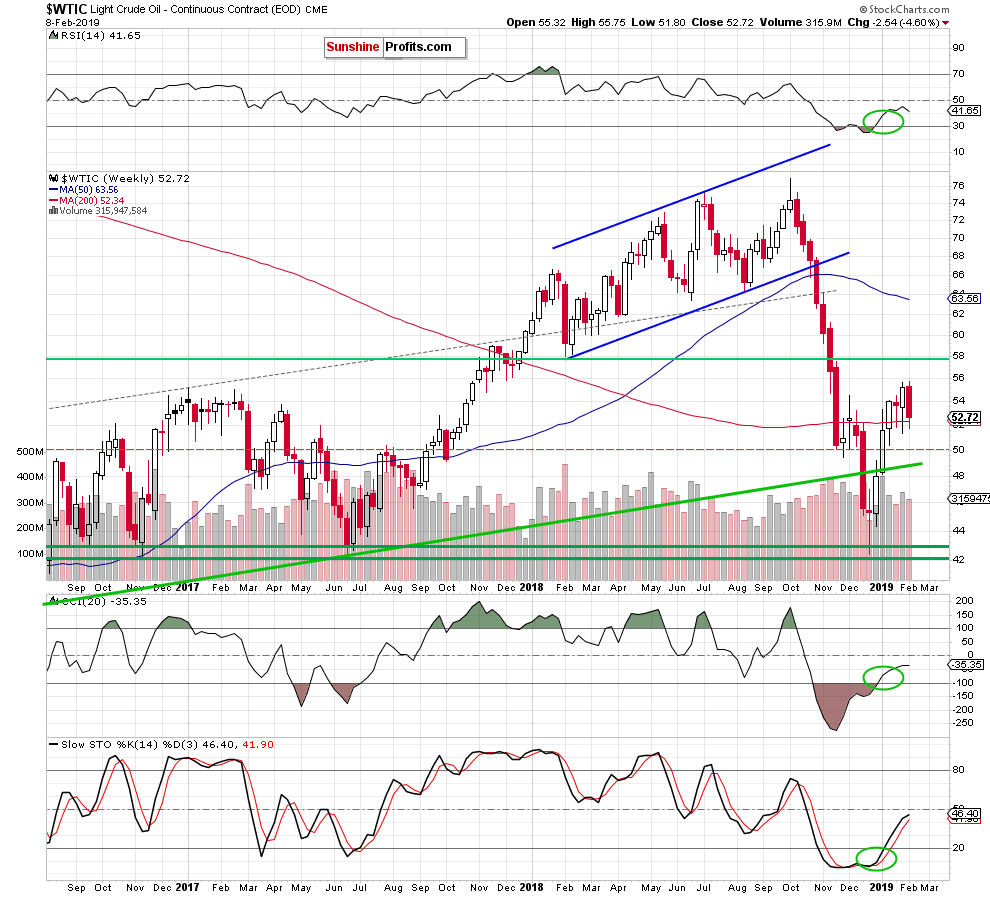

On the weekly chart, we see that crude oil lost over 4% in the previous week, making our short positions profitable. Thanks to this downswing, the sellers created bearish engulfing pattern, which suggests further deterioration in the coming week(s). This candlestick pattern consists of a relatively small white candle that is followed by a large red candle that engulfs the previous white candle. It indicates a trend change – here, from up to down.

Additionally, last week’s move to the downside took the commodity to the previously broken 200-week moving average. This is the nearest support at the moment.

How did this move affect the daily chart? Let’s check below.

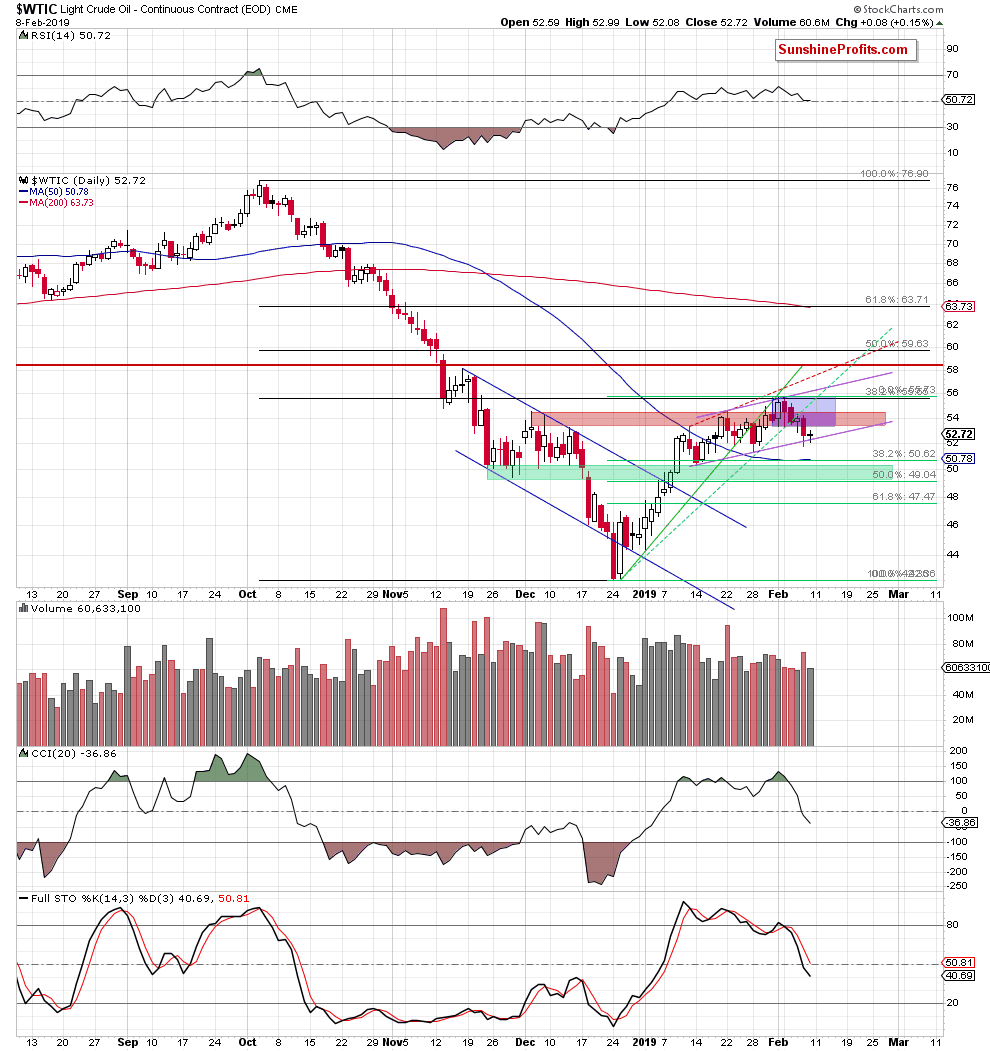

We see that crude oil retested the strength of the lower border of the purple rising trend channel again on Friday, but there was no visible breakdown below it. It raises some doubts about the strength of the sellers. Despite oil bulls pushing the price marginally higher, black gold still closed another day below the lower border of the blue consolidation and the red resistance zone. Combined with the sell signals by the daily indicators on the cards, this suggests lower oil prices in the coming day(s).

Additionally, Friday’s meager upswing materialized on lower volume than Thursday’s big drop. It suggests that oil bulls are still not strong enough to trigger another move to the upside.

As long as there is no breakdown below the lower border of the rising purple trend channel or an invalidation of the breakdown below the two above-mentioned resistances, another bigger move to the downside or upside is not likely to be seen and short-lived moves in both directions shouldn’t surprise us.

However, taking into account the bearish engulfing pattern formation on the weekly chart and the daily perspective of last week’s price action, we continue to believe that the odds favor another bigger move to the downside.

Summing up, the already profitable short position continues to be justified from the risk/reward perspective as crude oil closed another day below both the blue consolidation and the red resistance zone. Additionally, Friday’s volume was smaller than during earlier decline, which in combination with the sell signals generated by the daily indicators increases the probability of another downswing in the coming days.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.