Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

Although yesterday’s data from the U.S. Energy Information Administration showed that crude inventories rose by almost 8 million barrels and gasoline stocks increased for an eighth consecutive week, the price of the commodity gained 0.97%. How did this move affect the very short-term picture?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

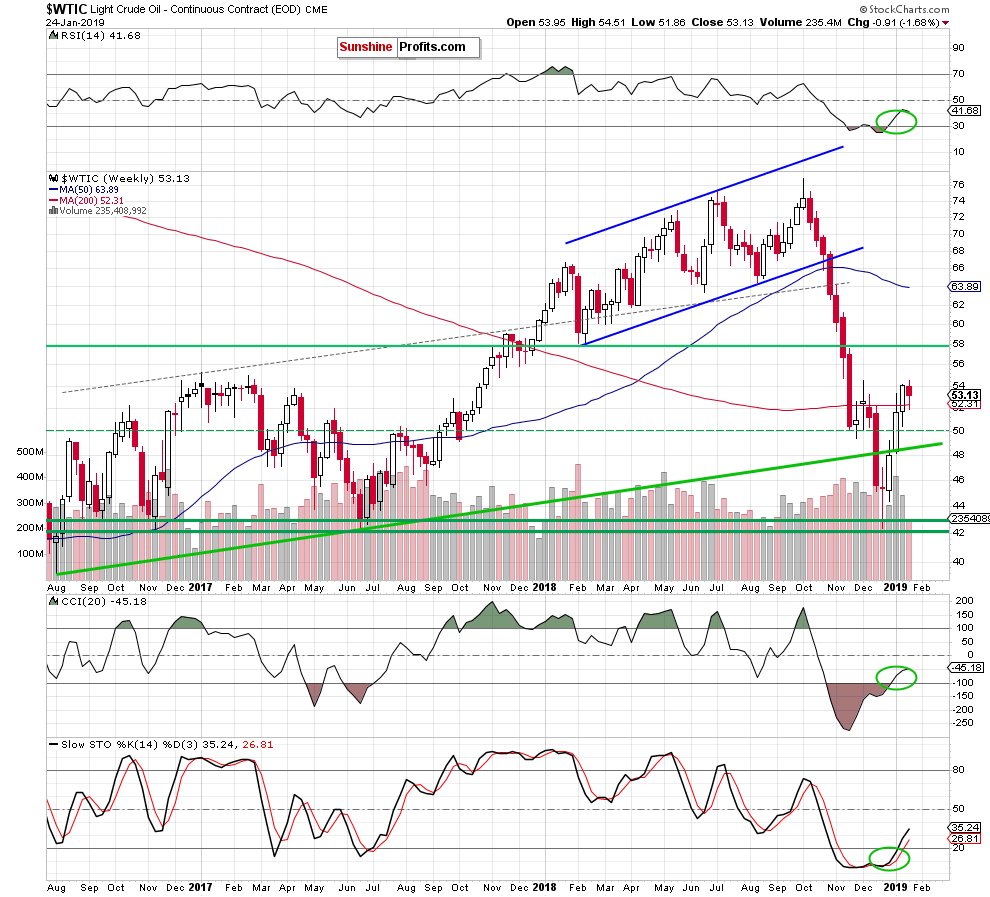

Looking at the above charts, we see that the price of black gold remains above the green support line based on the December and early-January lows, the 200-week and 50-day moving averages and the very short-term purple support line based on the previous January lows, which means that what we wrote yesterday is up-to-date also today:

(…) crude oil is still trading above the 200-week moving average and the buy signals generated by the indicators remain in the cards, supporting oil bulls and higher prices of black gold in the coming weeks.

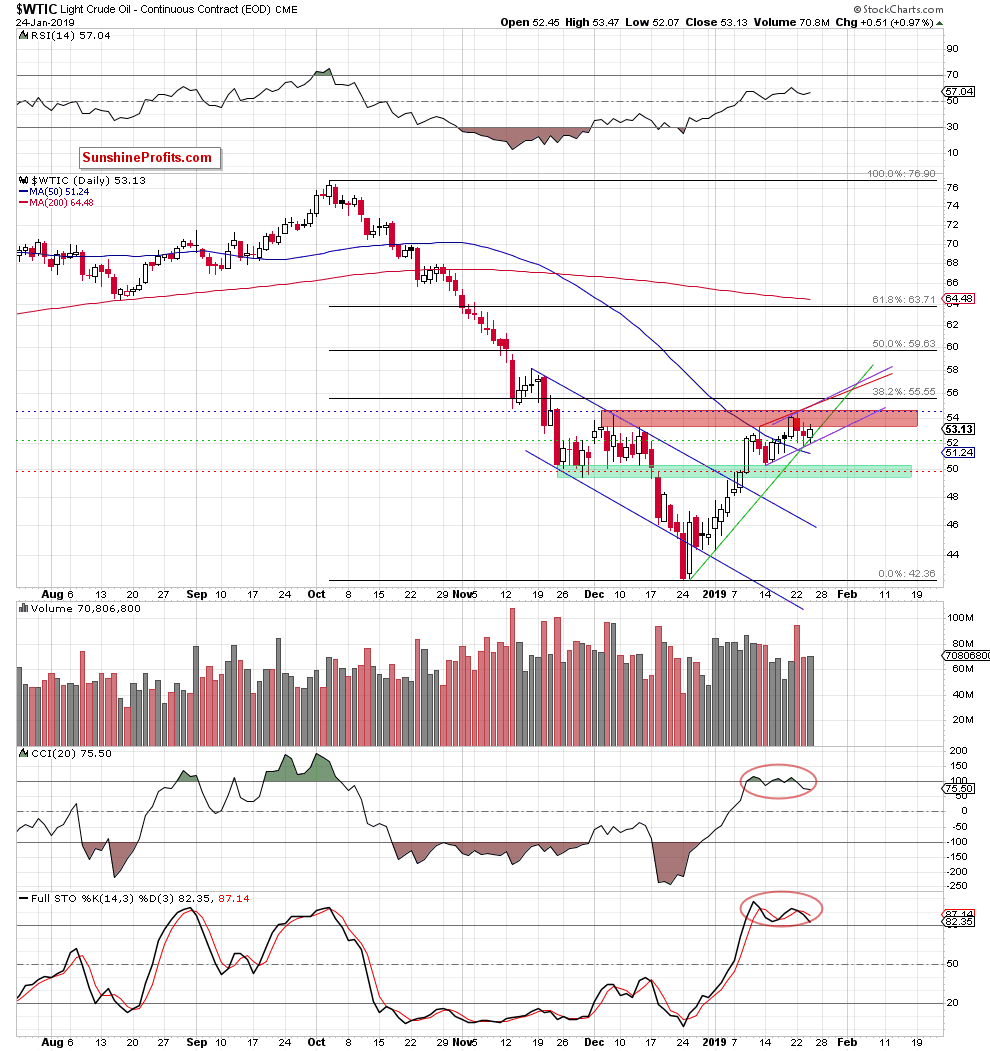

(…) at the daily chart, we can also notice that the commodity is trading above the previously-broken 50-day moving average and the green support line based on the December and early-January lows, which continue to keep declines in check.

Nevertheless, looking at the same chart, but this time from the position of a bear searching for factors that can encourage him to act, we can see a few disturbing circumstances.

First, the commodity climbed to the red resistance zone created by the December peaks.

Second, thanks to the recent increases black gold approached the 38.2% Fibonacci retracement based on the entire October-December decline, which together with the proximity to the above-mentioned red zone triggered a pullback in recent days.

Third, the CCI and the Stochastic Oscillator generated sell signals, suggesting further deterioration. Nevertheless, taking into account the fact that we have already seen something similar in the middle of the month (during the previous correction of the upward move), we consider this factor to be the least significant at the present moment.

So, what’s next for the commodity?

Taking all the above into account, we think that as long as the price of light crude remains above the green rising support line based on the previous lows and both moving averages long positions continue to be justified from the risk/reward perspective.

However, if the bulls fail and the commodity closes today’s or one of upcoming sessions below these key supports, we’ll likely close our long position and consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $47.96 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager