Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.96 and the initial downside target at $62.85 are justified from the risk/reward perspective.

Looking at the daily chart of crude oil we can say that the last days were not very exciting. The price of black gold has fluctuated in a narrow price range and Tuesday's move seems to be the only event worth attention. Who have more arguments on its side to push the commodity more significantly in coming days?

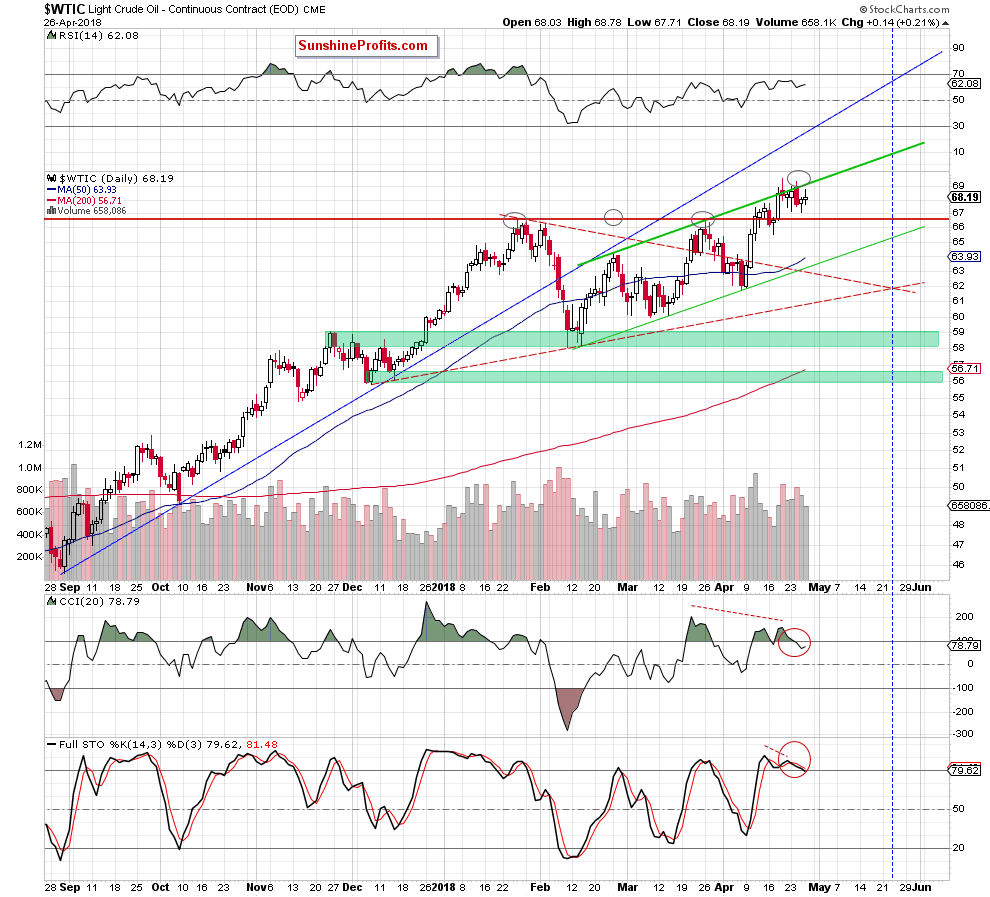

Let's take a look at the daily chart below (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that although crude oil moved a bit higher yesterday, the very short-term picture of the commodity remains almost unchanged as black gold is still trading under the previously-broken upper border of the green rising trend channel. Additionally, the shape of yesterday’s candlestick emphasizes the indecision of the buyers and the sellers.

Who will win the battle in this area? In our opinion, oil bears have more arguments on their side now. Why?

First, an invalidation of the breakout above the upper line of the trend channel and its negative impact on the price are still in effect.

Second, recent upswings materialized on smaller volume than Tuesday’s decline.

Third, the sell signals generated by the CCI and the Stochastic Oscillator suggests that the next bigger move will be to the downside.

Fourth, the long-term picture of crude oil shows that the space for gains is limited as the strong resistance zone is quite lose to current levels.

Fifth, the outlook, which emerges from the non-USD picture of crude oil also suggests that higher values of black gold are not likely to be seen in the very near future (we wrote more about this issue and the long-term picture of light crude in our Tuesday’s Oil Trading Alert).

Connecting the dots, we believe that short positions continue to be justified from the risk/reward perspective as a bigger move to the downside is just around the corner.

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $70.96 and the initial downside target at $62.85) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative note, due to your Editor’s travel plans for the rest of the week, the next few alerts will be shorter than the ones that we’ve been publishing recently. Of course, we will keep an eye on the market and we’ll keep posting the alerts on a daily basis, plus intraday alerts whenever the situation requires it.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts