Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Oil keep going higher. Hesitantly, bit by bit, but still. While the charts show some early signs of deterioration, the question is when exactly is it likely to manifest itself in the open. Can it happen despite the Iran situation remaining tense? Let's dive into today's Alert to find out...

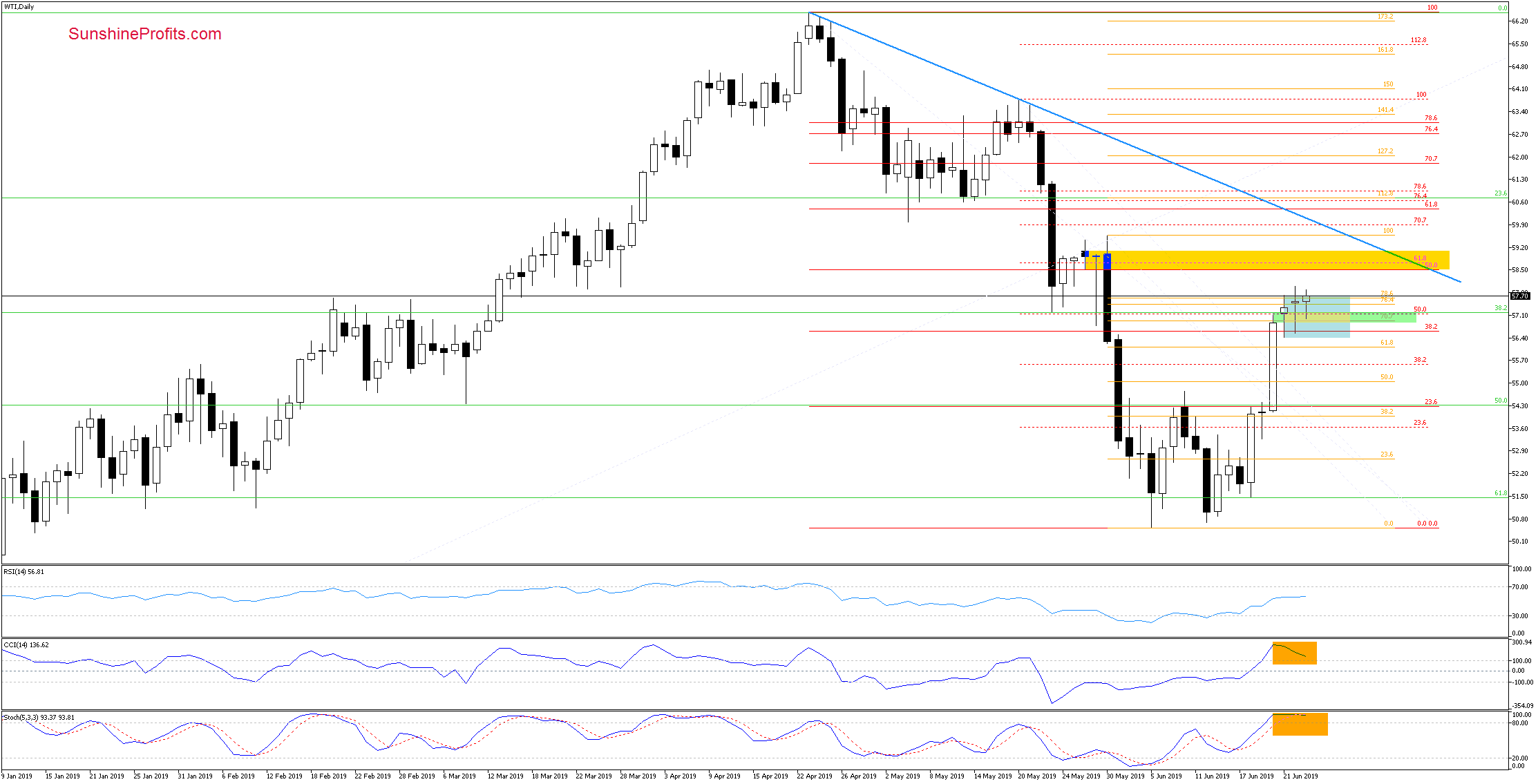

Let's take a closer look at the chart below.

Overall, the short-term situation hasn't changed much as crude oil is still trading in the narrow range around the green gap and yesterday's intraday high. While the daily indicators are in their overbought areas, they have not issued any sell signals just yet, and neither the green gap has been closed.

These factors point to the possibility of one more upswing in the near future. The target of such a move would be the yellow resistance zone marking the late-May highs.

Summing up, while last week's oil upswing appears to be losing steam, several aspects point towards one more push higher. As for now however, there's no opportunity worth acting upon in the oil arena.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist