Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

Monday’s session took crude oil to two important supports, which encouraged oil bulls to act in the previous week. Will they be strong enough to trigger another rebound from current levels or maybe a fresh low is still ahead of us?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

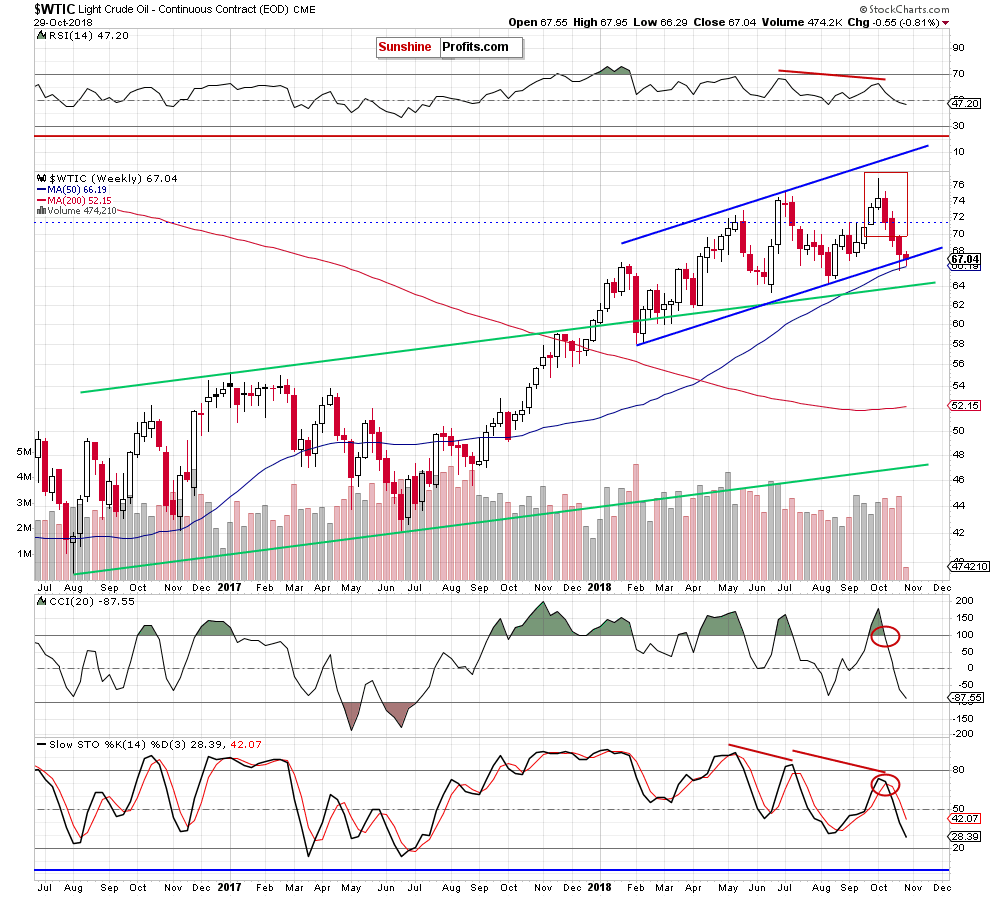

Looking at the medium-term chart, we see that crude oil extended losses on Monday, which resulted in a drop to the previously-broken lower border of the blue rising trend channel.

How did this decline affect the very short-term chart of the commodity?

Before we answer to this question, let’s recall the quote from our last alert:

(…) Nevertheless, this scenario [a pro-growth one] will be more likely and reliable if we see at least one more daily closure above the 200-day moving average and the CCI generates a buy signal. Until this time another re-test of the strength of the lower line of the red channel can’t be ruled out.

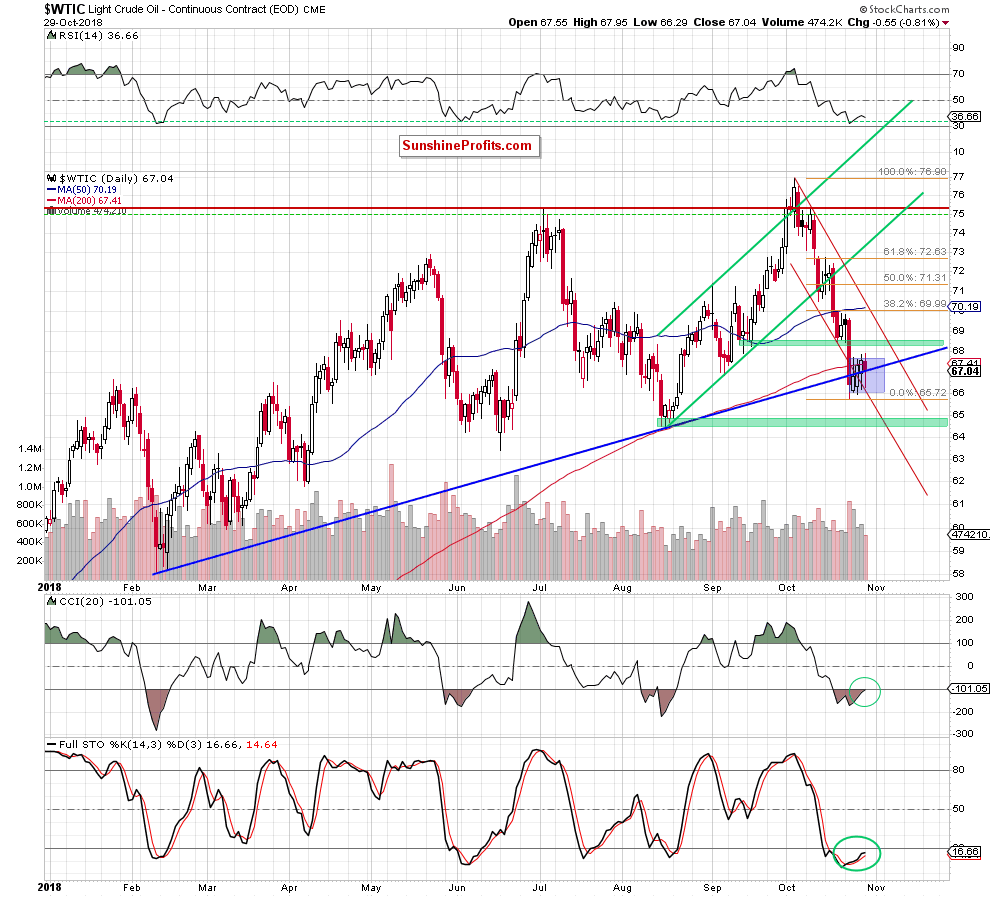

From today’s point of view, we see that oil bulls not only failed to close the day above the 200-day moving average but allowed their opponents to close the day below it, leading to invalidation of the earlier tiny breakout.

This is a show of weakness, which doesn’t bode well for the bulls – especially when we factor in the fact that the Stochastic Oscillator remains below the level of 20 and the lack of buy signal in the case of the CCI.

Taking all the above into account, it seems that lower prices of crude may be just around the corner. If this is the case and the commodity extends losses in the very near future (maybe even later in the day), we can see not only a re-test of the lower border of the very short-term red declining trend channel, but also a test of the last week’s low or even a drop to the next support area created by the mid-August lows (around $64.50-$65) in the following days.

Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts