Trading position (short-term; our opinion): Short positions (with a stop-loss order at $52.52 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Wednesday, crude oil gained over 2% and climbed to the last week highs. Will oil bulls manage to push the pair higher?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

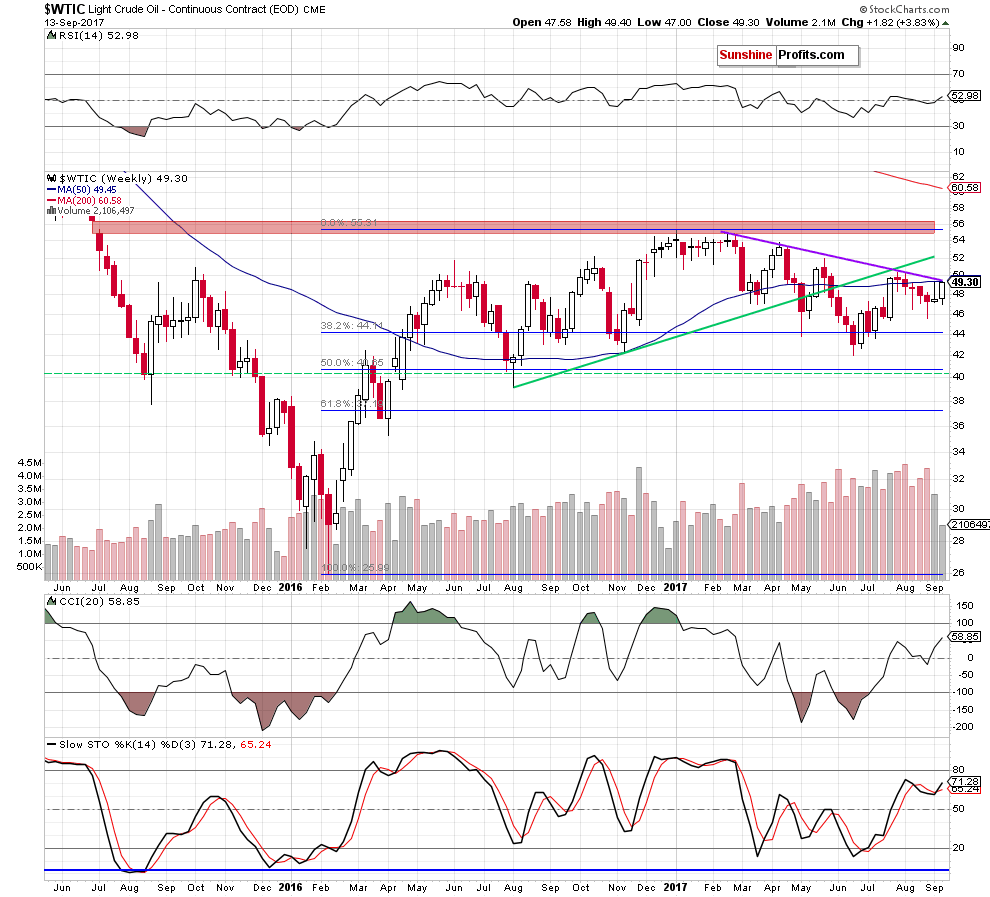

Looking at the weekly chart, we see that crude oil extended gains and came back to the purple declining resistance line based on the previous highs and the 50-week moving average. As you see the combination of these resistances was strong enough to stop oil bulls in the previous months and also last week, which suggests that as long as there is no breakout (and a weekly closure) above them further improvement is doubtful.

How this week move affected the very short-term chart? Let’s take a closer look at the chart below and find out.

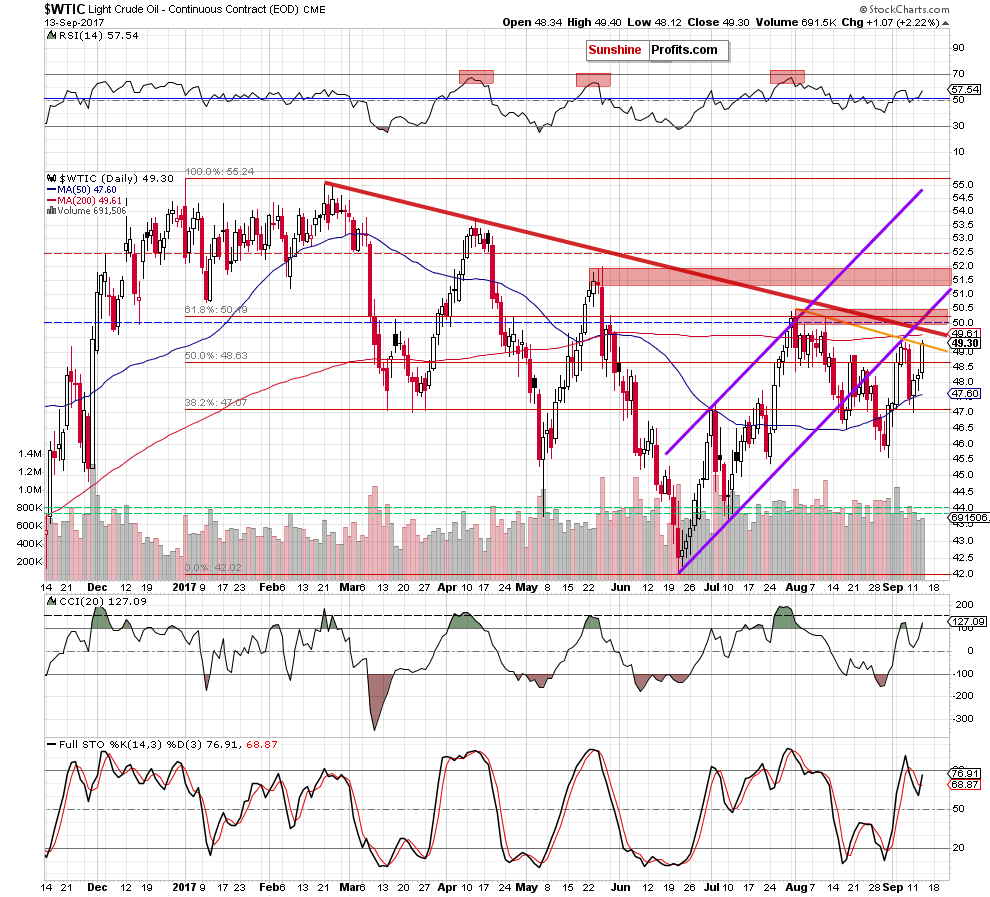

From today’s point of view, we see that yesterday increase took light crude to the last week highs and the orange resistance line based on the August peaks, which serve as the nearest resistance area.

Additionally, slightly above these levels we can also see two other resistances: the medium-term red declining resistance line based on the February and April peaks and the 200-day moving average. If they don’t stop oil bulls, we believe that the red resistance zone (created by the barrier of $50, August highs and the lower border of the purple rising trend channel) together with the medium-term resistances stop further improvement – similarly to what we saw in the past.

On top of that, please keep in mind that although light crude increased, the size of volume, which accompanied yesterday move wasn’t significant, which raises some doubts about oil bulls’ strength and further rally.

What’s next for light crude?

In our opinion, even if the commodity increases to the lower border of the purple rising trend channel and then reverses and declines, we will see nothing more than another verification of the earlier breakdown under this short-term resistance, which will give oil bears a very important reason to act in the following days.

Summing up, profitable short positions continue to be justified from the risk/reward perspective as crude oil remains under the major resistances and the size of volume doesn’t confirm oil bulls’ strength.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions with a stop-loss order at $52.52 and the initial downside target at $45.80 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts