Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective.

Despite the fact that oil bears attacked quite quickly after the opening of the Friday session, the buyers didn’t give up and used the closest supports to stop the price drop. Thanks to their determination, black gold erased almost all session’s losses and closed the first September week above important levels. What last week's fall can mean for oil?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

From today’s point of view, we see that although oil bears pushed the price of black gold lower after Friday’s market open, their opponents kept cool and used two supports to make up for the loss.

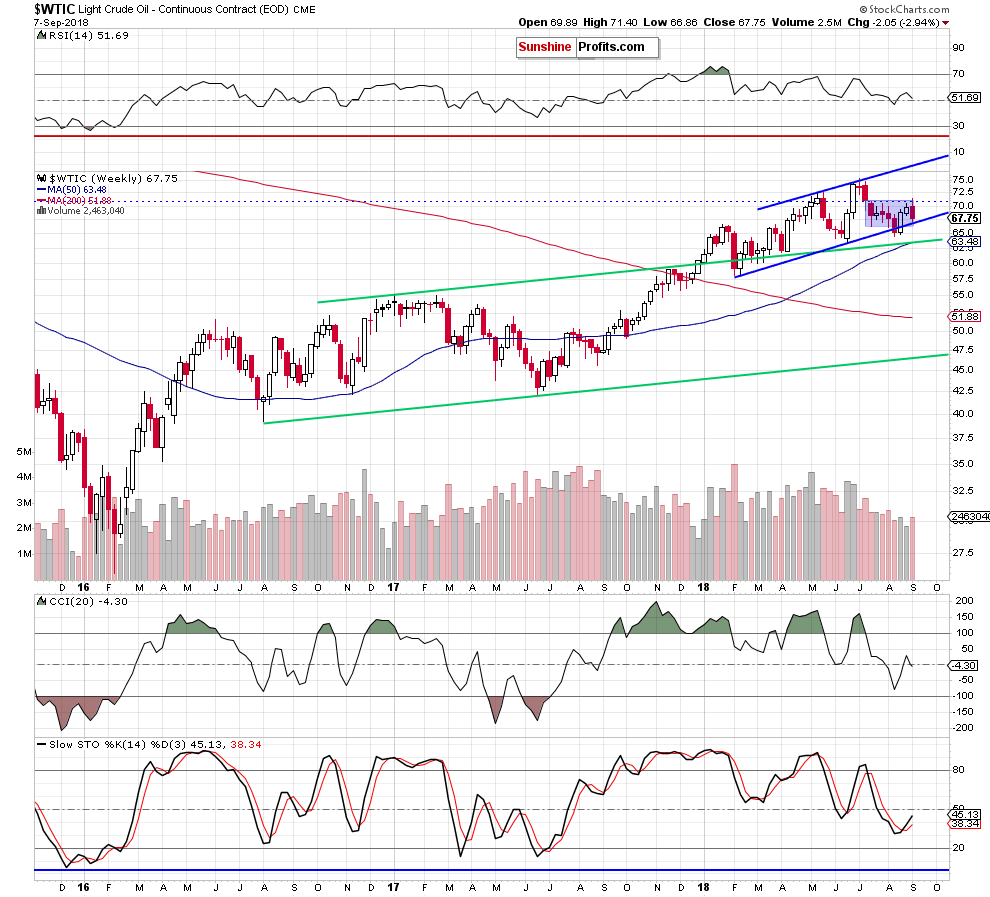

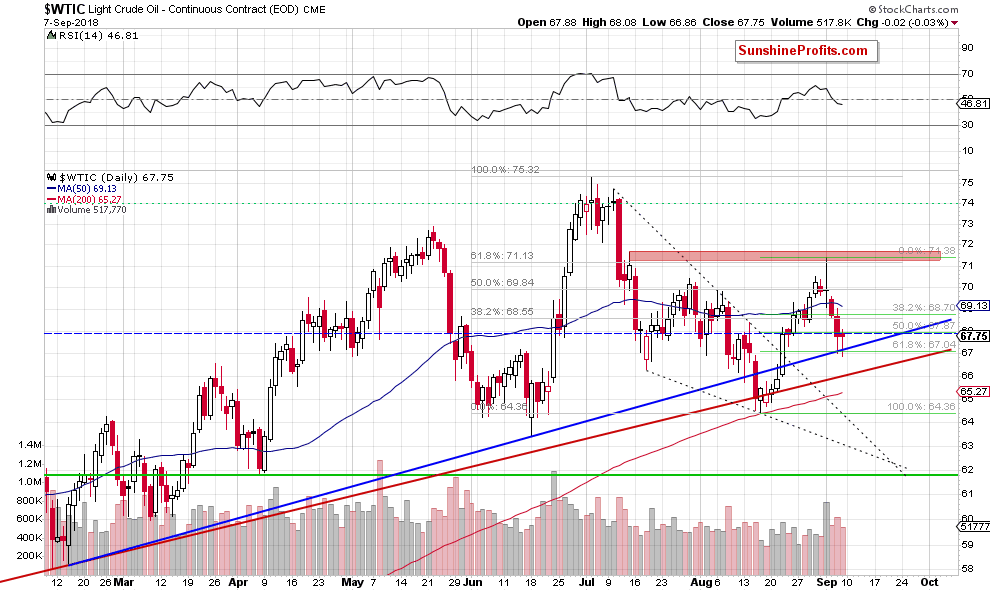

As you see on the charts, the lower border of the blue rising trend channel in combination with the 61.8% Fibonacci retracement withstood the selling pressure for the second time in a row, which increases its importance for crude oil future’s moves. In other words, as long as there is no daily/weekly closure below these supports another attempt to move higher is very likely.

Additionally, thanks to Friday’s rebound, crude oil erased almost entire move to the downside and closed the week inside the blue trend channel, which suggests that further improvement is just around the corner.

If this is the case and light crude moves higher from current levels, the first upside target will be the red resistance zone (created by the 61.8% Fibonacci retracement, the mid-July and the Sept highs), which stopped oil bulls in the previous week. However, if it is broken, we can see a rally even to around $74 and the 2018 peaks in the following week(s).

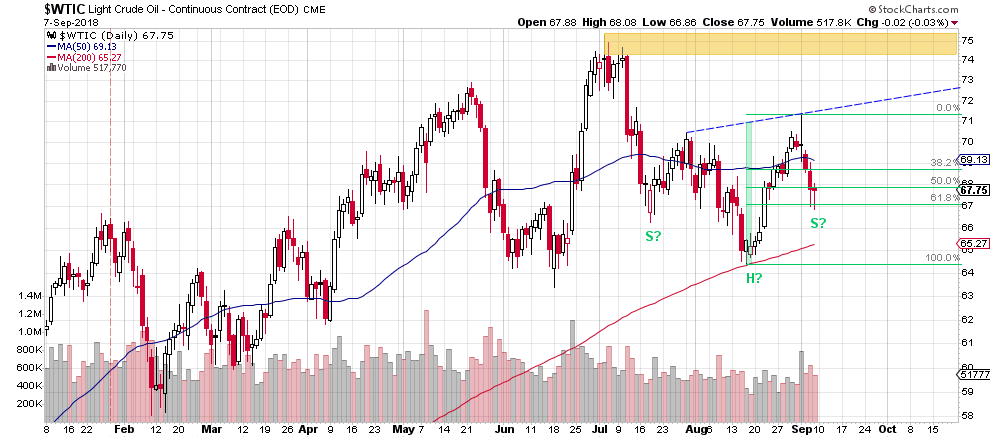

Finishing today’s alert, we would like to draw your attention to one more important issue – a potential reverse head and shoulders pattern. Let’s take a closer look at the daily chart once again.

From this perspective, we see that the last week’s decline could be the right shoulder of the above-mentioned reversal pattern and the September high together with the late-July peak are the base on which we based the neckline of the formation.

Of course, this is only a preliminary assumption, which we consider as reliable only when the price of black gold rises above the blue dashed line seen on the above chart.

Until this time, we will carefully observe the behavior of both sides of the market to respond appropriately to emerging changes. Stay tuned.

Summing up, long positions continue to be justified from the risk/reward perspective as crude oil bounced off two important supports and closed the previous week inside the blue rising trend channel, suggesting that higher prices of the commodity are just around the corner.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts