Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil gained 0.63%, which resulted in a climb above the first resistance line, but will we see further improvement in the coming days?

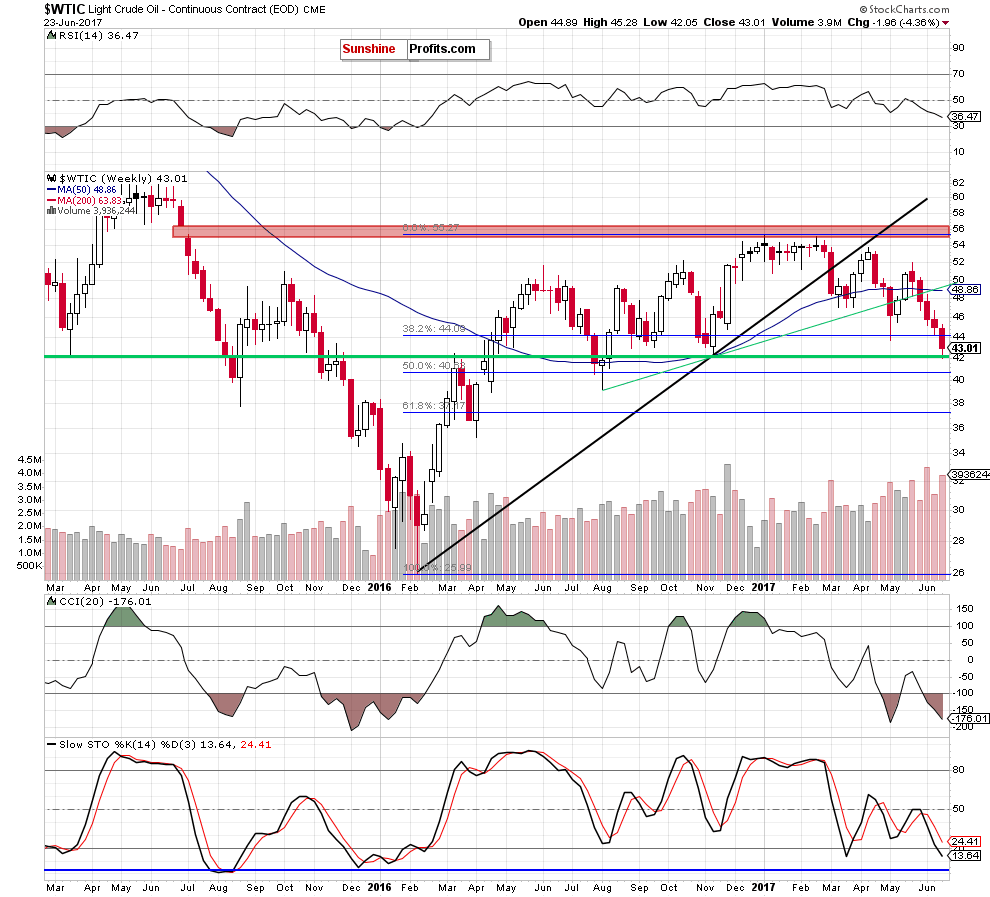

Medium-term Picture of Crude Oil

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Looking at the weekly chart, we see that although crude oil bounced off the mid-November low, the commodity is still trading under the previously-broken 38.2% Fibonacci retracement. Additionally, the sell signals generated by the medium-term indicators remain in cards and the size of volume, which accompanied the last week’s decline was bigger than week earlier, which suggests that oil bears could not say the last word yet.

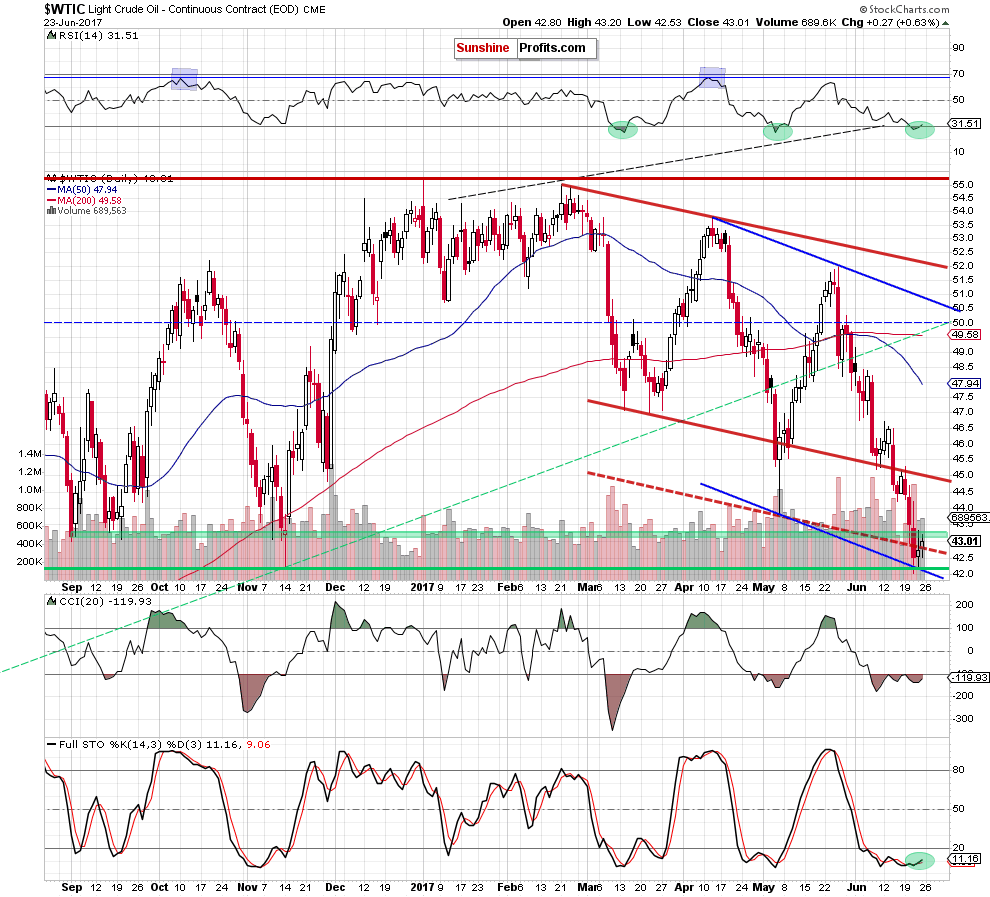

Very Short-term Picture of Black Gold

Does it mean that further deterioration is just around the corner? Let’s examine the very short-term chart to look for more clues about future moves.

On Wednesday, we wrote the following:

(…) Taking (…) into account (…) the current position of the indicators (the RSI dropped to the lowest level since early May, the Stochastic Oscillator generated the buy signal and there is a visible positive divergence between the CCI and the price of light crude) it seems to us that the space for declines is limited. Why? Because even if light crude breaks below the green support zone and the red dashed support line, not far from current levels are also the mid November low and the lower border of the blue declining trend channel, which together could stop oil bears and trigger a reversal in the coming day(s).

From today’s point of view we see that the combination of the above-mentioned factors encouraged oil bulls to act, which resulted in a climb above the red dashed line. Additionally, the commodity closed Friday’s session above it, which is a positive development – especially when we factor in buy signals generated by the RSI and the Stochastic Oscillator (while the CCI is very close to doing the same).

Nevertheless, we should keep in mind that the black gold still remains under the green zone created by the September and November lows, which stopped further increases on Thursday. Therefore, in our opinion, higher prices of light crude will be more likely and reliable if we see a breakout above this area (around $43.60).

As always, we’ll keep you - our subscribers - informed should anything change.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts