Trading position (short-term): In our opinion no positions are justified from the risk/reward perspective.

On Monday, crude oil lost 1.69% as weaker-than-expected Chinese economic data (released over the weekend) weighed on the price. In this way, light crude declined below $101 per barrel and approached the December high.

Although data released over the weekend showed that consumer price inflation in China rose 2% in February from a year earlier (in line with expectations) and producer price inflation declined 2% (compared to forecasts for a 1.9% drop), weak Chinese trade data fueled concerns over slowing growth in the world's second largest oil consumer and sent the price of crude oil below $101.

The data showed that Chinese exports declined 18.1% in February from a year earlier, disappointing expectations for a 6.8% increase. This significant decline in China’s exports led to a deficit of $22.98 billion last month, compared to a surplus of $31.86 billion in January (while analysts had expected a surplus of $14.5 billion in February). Meanwhile, although imports rose 10.1% (compared to forecasts for an 8% increase), China's February crude oil imports totaled 23.05 million metric tons, down 18.1% from January (according to customs data).

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

Quoting our last Oil Trading Alert:

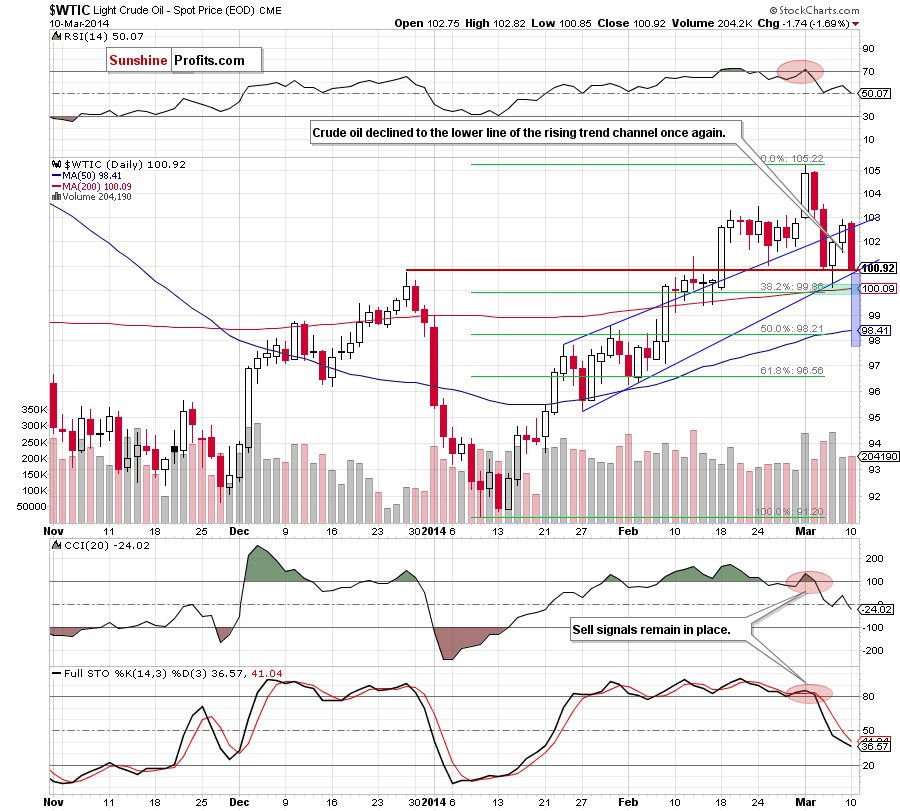

(…) Friday’s upswing materialized on relative small volume, which doesn’t confirm the strength of the buyers. Additionally, looking at the current position of the indicators, we clearly see that sell signals remain in place and support sellers. Taking all the above into account, it seems that although crude oil came back above the upper line of the rising trend channel, this improvement will be temporarily and we’ll see another attempt to move lower.

Yesterday, after the market open, oil bears showed their claws and triggered a downswing, which took crude oil to the lower line of the rising trend channel. In this way, light crude invalidated a breakout above the upper border of this formation, which is a bearish signal. If this support line encourage buyers to act, we may see a corrective upswing – even to around yesterday’s high. However, if they fail and crude oil drops lower, we will see a re-test of the strength of a support zone created by the 38.2% Fibonacci retracement (based on the entire rally) and the 200-day moving average. If this area holds, we will likely see another upward move (similarly to what we saw at the end of the previous week). Nevertheless, we should keep in mind that if this strong support zone is broken, we will see further deterioration and the first downside target will be the 50% Fibonacci retracement, which is a few cents below the 50-day moving average (currently at $98.41).

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

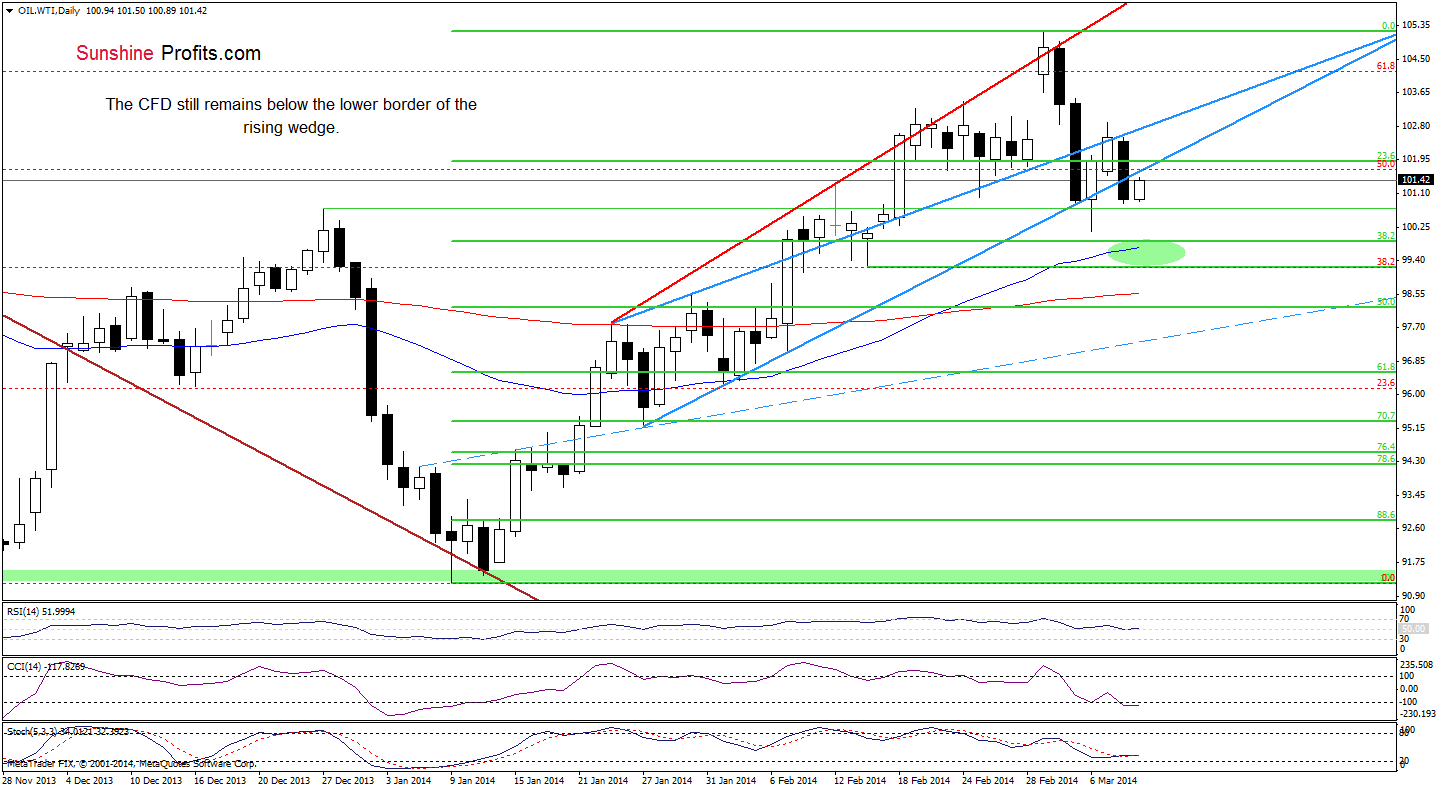

On the above chart, we see that the situation has deteriorated slightly as WTI Crude Oil declined below the lower border of the rising wedge. Despite this drop, the December high still holds, decelerating further deterioration. Nevertheless, as you see on the daily chart, although this support level encouraged buyers to push the CFD higher earlier today, the price remains below the resistance line. If oil bulls do not manage come back to the range of the rising wedge, we will likely see another attempt to reach one of the downside targets - 38.2% Fibonacci retracement or even to the Feb.14 low (we marked this area with a green ellipse). Please note that although the Stochastic Oscillator generated a buy signal, both other indicators still support sellers.

Summing up, the very short-term outlook for crude oil has deteriorated as crude oil reversed and decline below the upper line of the rising trend channel, reaching the lower border of this formation. As mentioned earlier, if this support line doesn’t encourage oil bulls to act, we will see a re-test of the strength of a support zone created by the 38.2% Fibonacci retracement and the 200-day moving average.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): In our opinion, if crude oil drops below the 38.2% Fibonacci retracement level and the 200-day moving average, we will consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts