On Monday, crude oil lost 1.45% as concerns that the deal between the West and Iran over its nuclear program weighted on the price. In this way, light crude declined to slightly above the monthly low and closed the day below $92 per barrel.

On Sunday, the five permanent members of the United Nations Security Council, Germany and Iran agreed to begin implementing the nuclear accord on Jan. 20. Under terms of the deal, Iran will stop producing near-weapons grade nuclear fuel and start rolling back or freezing other nuclear work next week. The agreement will offer Iran $7 billion in relief to economic sanctions, $4.2 billion related to oil sales.

This news fueled concerns that the deal would resume exports and add more crude to an already well-supplied market. In reaction to this, as mentioned earlier, light crude gave up earlier gains and declined to slightly above the monthly low.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

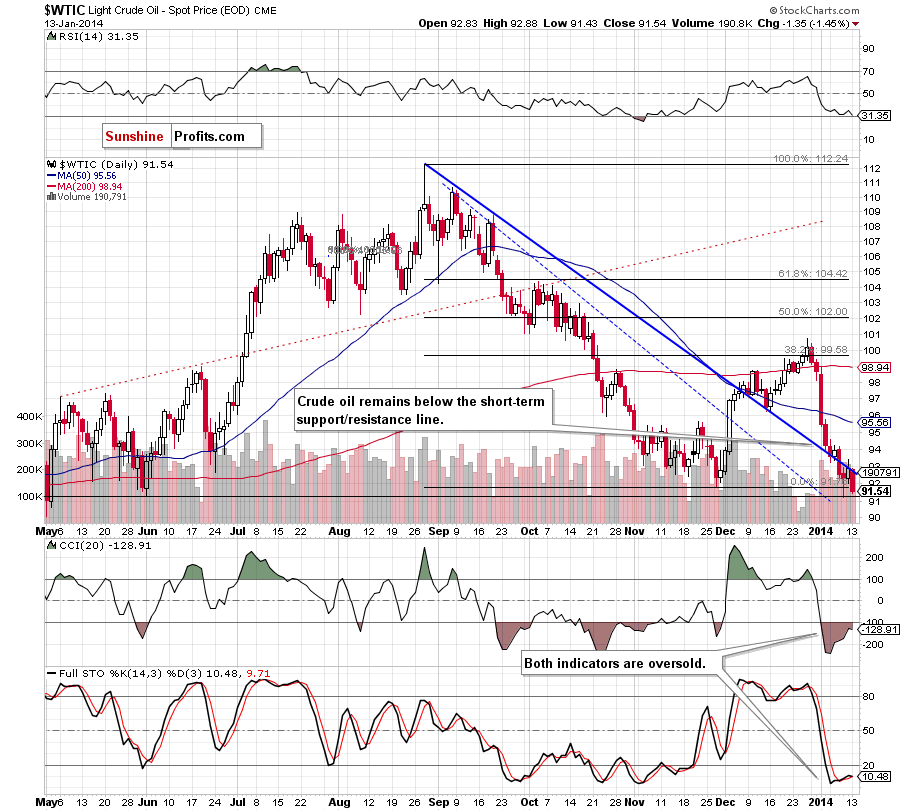

On the above chart, we see that crude oil bounced below the short-term declining support/resistance line and declined once again. With this downswing, light crude approached the monthly low. If this support level holds, we may see a post-double-bottom rally. However, before we see such price action, the buyers will have to push the price above the previously-broken short-term declining support/resistance line and yesterday’s high of $93.38. This assumption is reinforced by the position of the indicators at the moment. The RSI remains close to the level of 30, while the CCI and Stochastic Oscillator are oversold (a buy signal remains in place). Additionally, there are positive divergences, which is a positive sign and may encourage oil bulls to act in the coming day (or days).

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

On the above chart, we see that oil bears re-tested the strength of the short-term declining support line once again. Although WTI Crude Oil gave up the gains and declined yesterday, it still remains above this line and the January low, which is a positive sign. Additionally, when we factor in the position of the indicators, we see that the RSI still remains slightly above the level of 30, which suggests that a pause or an upward correction is just around the corner. On top of that, buy signals generated by the CCI and Stochastic Oscillator remain in place, which may encourage oil bulls to act in the near future.

Once we know the above, let’s take a look at the NYSE Arca Oil Index (XOI) chart.

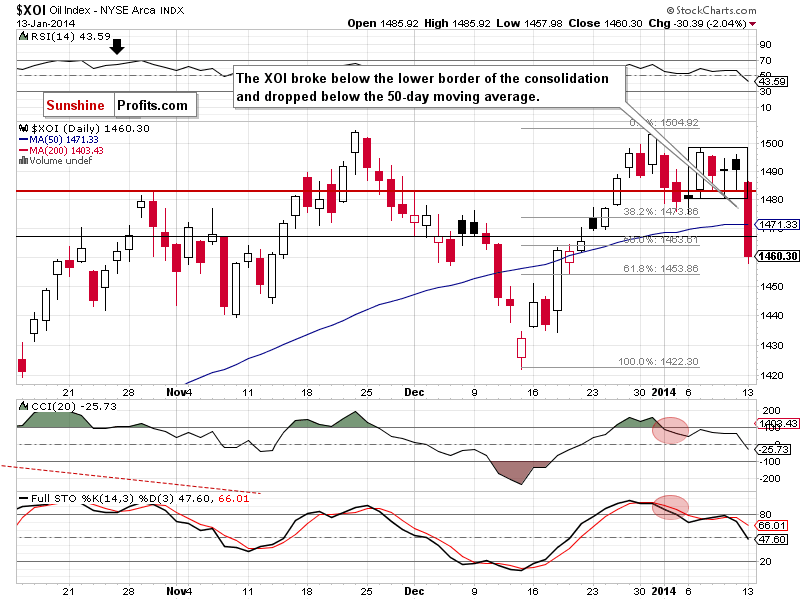

Looking at the above chart, we see that the situation deteriorated significantly as the oil stock index broke below the lower border of the consolidation range between Wednesday’s low and high.

In our previous Oil Trading Alert, we wrote the following:

(…) if the XOI extends its decline, the first downside target will be Monday’s low (slightly above the 38.2% Fibonacci retracement level) and the 50-day moving average (currently at 1,471).

As you see on the above chart, the oil stock index not only reached these levels, but also dropped below the next Fibonacci retracement level. Therefore, further deterioration should not surprise us – especially when we take into account sell signals generated by the CCI and Stochastic Oscillator. If this is the case, the first support level will be the 61.8% Fibonacci retracement level around 1,453. Please note that the nearest resistance level is the previously-broken 50-day moving average.

Summing up, although crude oil declined once again, we didn’t see a breakdown below the January low. Taking into account the fact that the CFD rebounded after reaching the short-term support line and combining it with the position of the indicators, another attempt to come back above the short-term support/resistance line (in case of crude oil) should not surprise us.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): We do not suggest opening any positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Oil Investment Updates

Oil Trading Alerts