Trading position (short-term): no positions.

On Friday, crude oil lost 0.46% as concerns over slow economic growth in emerging markets weighed on the price. Despite this drop, crude oil gained almost 3% last week on higher fuel demand, the start-up of Transcanada's oil pipeline and bullish agency forecasts. Thanks to this news, light crude closed the week slightly below $97 per barrel.

On Friday, crude oil declined from a three-week high as oil investors worried that slow economic growth in emerging markets could weigh on crude consumption. The declines were sparked by the news that manufacturing activity in China, the world's second-largest economy, fell to a six-month low in January.

As a reminder, a preliminary Chinese HSBC Manufacturing PMI fell to 49.6 for January from 50.5 in December, missing market expectations for a rise to 50.6.

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

In our last Oil Trading Alert, we wrote:

(…) light crude (…) approached the 70.7 Fibonacci retracement (around $97.96). Although this is not a very strong resistance level, it seems that after a three-day rally it could be enough to encourage oil bears to act. This assumption is reinforced by the Fibonacci price projection (based on the Jan. 13 and Jan 21 lows and the Jan. 15 high), which shows that the 100% projection is at $96.86 and suggests that the upside target was reached yesterday. Taking these facts into account, we will likely see a corrective move in the near future, but this potential correction will likely be limited by the 50-day moving average which serves as support.

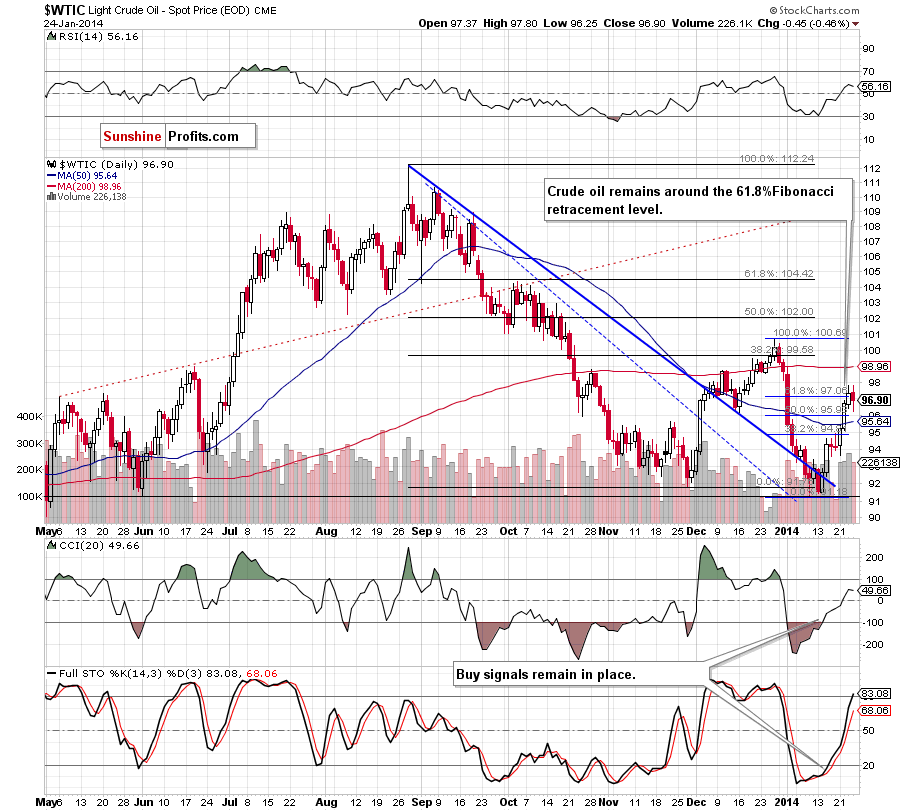

On the above chart, we see that crude oil gave up the gains and pulled back on Friday. With this downswing, light crude declined below the 61.8% Fibonacci retracement level and invalidated the breakout above this resistance level, which is not a positive sign. Despite this drop, the current correction is shallow and the indicators are not overbought (buy signals generated by the CCI and Stochastic Oscillator remain in place). From this perspective, the very short-term uptrend is not threatened and further improvement after a pullback (which seems not over yet) is likely to be seen.

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

Quoting our last Oil Trading Alert:

(…) WTI Crude Oil reached (…) a strong resistance zone created by the 200-day moving average, the 127.2% projection and the 70.7% Fibonacci retracement level (…) Taking into account this strong resistance zone, the size of the recent rally and the position of the indicators, it seems that oil investors will likely lock in gains in the coming day (or days) the first downside target for the sellers would be the previously-broken 50-day moving average which serves as support

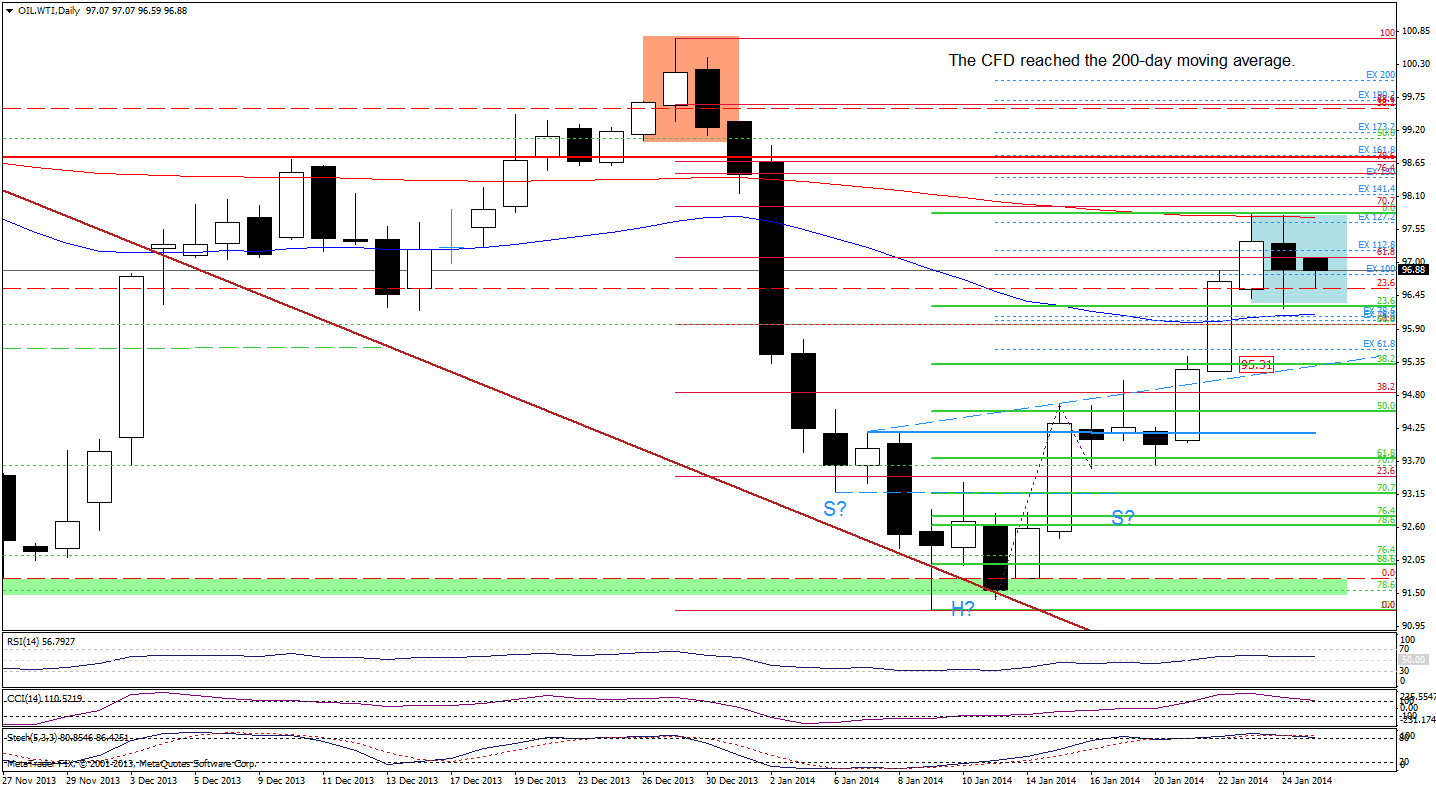

Looking on the above chart, we see that the CFD declined and approached the 50-day moving average on Friday. Although the proximity to this support encouraged oil bulls to act and WTI Crude Oil rebounded, it still remains below the strong resistance zone.

As you see on the daily chart, recent days have formed a consolidation. If the CFD breaks above Thursday’s high, we will likely see further improvement and the first upside target will be around $98.47 where the 76.4% Fibonacci retracement and the 150% projection are. On the other hand, if the price declines below the 50-day moving average, we will likely see a drop to around the 38.2% Fibonacci retracement level based on the recent rally at $95.31. Please note that taking into account the strong resistance zone and the position of the indicators (the CCI and Stochastic Oscillator are overbought and very close to generating sell signals), the latter scenario is more likely.

Summing up, crude oil gave up the gains and invalidated the breakout above the 61.8% Fibonacci retracement level, which is not a positive sign – especially when we factor in the current situation in the CFD (which remains below the strong resistance zone and the indicators are very close to generating sell signals) and the fact that crude oil declined after reaching the 100% Fibonacci projection. Taking these circumstances into account, another downswing should not surprise us. That’s why we think that the risk/reward ratio is no longer favorable enough to keep the speculative long position open and that our previous decision to close it and take profits off the table was justified.

Very short-term outlook: bullish

Short-term outlook: bullish

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): We do not suggest opening any positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts