On Tuesday, crude oil closed lower once again and lost 0.77%. Light crude extended losses as investors worried about a potential seventh straight weekly increase in domestic supplies amid weak demand and high crude production. In this way, the price of light crude hit a fresh monthly low of $93.07.

On Tuesday, most of the trading was driven by positioning ahead of Wednesday's oil inventory report from the Energy Information Administration and resulted in a drop to levels not seen since June. As we wrote in our previous Oil Trading Alert, last week the EIA data showed that crude oil stocks were near the highest end-October level since 1930. Today, the EIA data is expected to show that U.S. supplies rose by 1.9 million barrels in the week ended Nov. 1. Therefore, investors are concerned that weekly U.S. supply data will reveal the world's largest economy is awash in crude.

Meanwhile, the American Petroleum Institute showed that crude oil stockpiles rose by 871,000 barrels last week, as refinery operations were up 1.2 percentage points. The projected oil supply increase would add to swelling U.S. stockpiles, which have risen by 28.2 million barrels, or roughly 8%, in the past six weeks as refiners have curbed their crude processing amid seasonal maintenance work and unplanned outages.

Additionally, the Institute for Supply Management's non-manufacturing Purchasing Managers’ Index for October rose to 55.4 from 54.4 in September. Forecasters had expected a slight decline. The ISM Employment index also climbed to 56.2 from 52.7 the prior month.

These, better-than-expected, readings once again raised speculations that the Federal Reserve will soon begin to scale back its economic stimulus program and pushed the price of crude oil lower – similar to what we saw in the previous week.

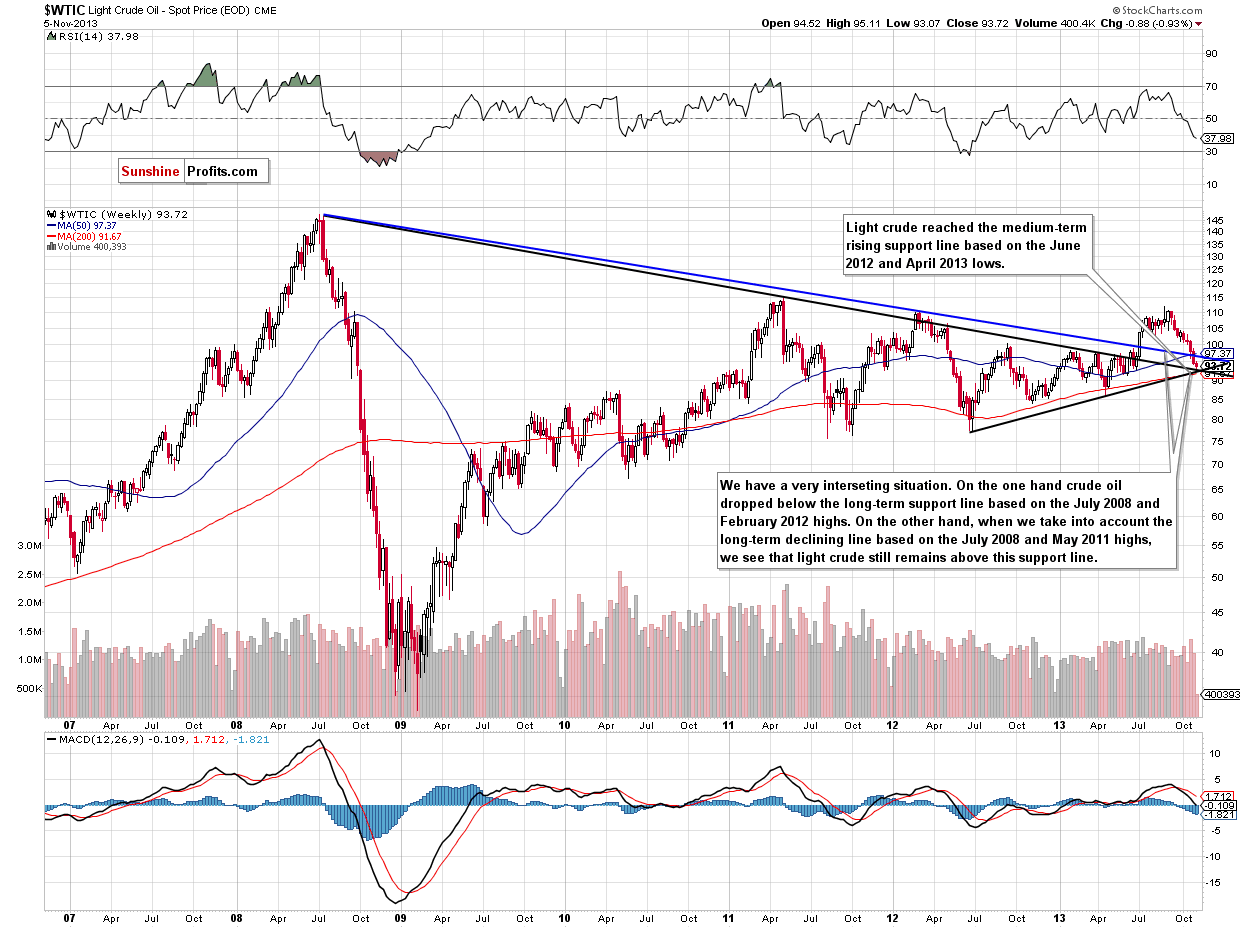

Once we know the major factors which pushed the price of light crude lower, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

On Tuesday, after the market’s open, light crude slightly increased, but it didn’t manage to come back above $95. The sellers quickly noticed the opportunity to trigger another downswing and pushed the price lower. In the following hours, crude oil dropped below $94 and hit a new monthly low of $93.07. With this downward move, light crude reached a support level based on the bottom of the corrective move that we saw back in June (in terms of daily closing prices).

As you see on the above chart, crude oil reached the medium-term rising support line based on the June 2012 and April 2013 lows (currently around $93 per barrel). Additionally, it also reached the long-term support line based on the July 2008 and May 2011 highs.

Quoting our previous Oil Trading Alert:

(…) it’s worth mentioning that the RSI declined once again and dropped below the 30 level to its lowest level since April. Back then, such a low value of the indicator had a positive impact on light crude. Looking at the above chart, we may see similar price action in the near future – especially when we take into account a positive divergence in the Commodity Channel Index.

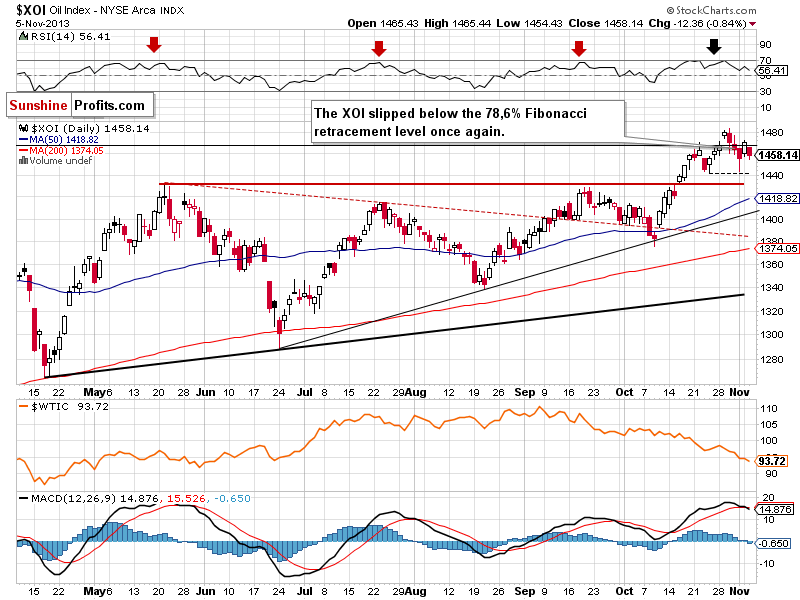

Before we summarize, let’s move on to the XOI daily chart.

Yesterday, after a lower open, the oil stocks index declined and reached a daily low at 1.454. With this corrective move, the XOI dropped below the 78.6% Fibonacci retracement level (close to 1,467) and closed the day below it. In this way, Monday’s breakout was invalidated, which is a bearish sign. Therefore, we may see further deterioration. In this case, the nearest support level is the bottom of the recent corrective move at 1,443. A further one lies at 1,428-1,430 and it is based on the May and September highs. On the other hand, if the buyers do not give up, we will likely see another attempt to move above the 78.6% Fibonacci retracement level.

Summing up, crude oil declined once again and dropped to a new monthly low, which is a bearish sign. However, looking at the medium-term picture, we see that light crude reached two important support levels. When we factor in the position of the daily indicators and the short-term support level based on the bottom of the corrective move that we saw in June (in terms of daily closing prices), it seems that a bigger pullback in crude oil is just around the corner and the room for further decline is limited.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: unclear

Trading position (short-term): Taking into account the medium-term picture and the position of the daily RSI, which is extremely oversold, we do not suggest opening short positions.

Thank you.

Nadia Simmons

Sunshine Profits' Crude Oil Expert

Oil Investment Updates

Oil Trading Alerts