On Friday, crude oil gained 0.66% as speculation that the Fed will scale down its bond-buying program faded after weaker-than-expected U.S. jobs data. Thanks to that news light crude rebounded slightly and closed the day at $92.89.

On Friday, the Labor Department said that the U.S. economy added 74,000 jobs in December (compared to expectations for a 196,000 increase), while the U.S. private sector added only 87,000 jobs last month, disappointing expectations for a 195,000 rise.

As mentioned earlier, these disappointing numbers weakened expectations that the Fed would cut its stimulus program this month once again, which had a positive impact on crude oil and pushed the price higher.

Please note that investors will be closely watching U.S. data on retail sales, inflation and consumer sentiment during this week.

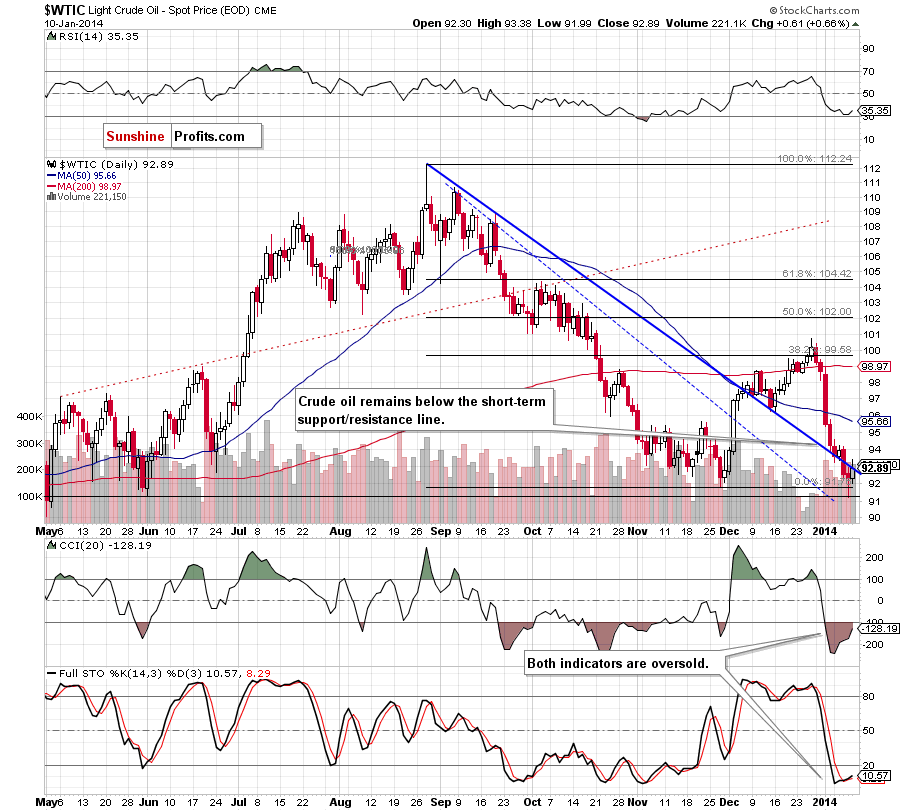

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com).

On the above chart, we see that crude oil rebounded slightly after the breakdown below the November low and closed the day on the previously-broken short-term declining support/resistance line. This upswing materialized on relative high volume, which hints at the strength of the buyers. Looking at the position of the indicators, we see that the RSI rose after a drop to its lowest level since November, while the CCI and Stochastic Oscillator are oversold (the latter generated a buy signal), which is a positive sign and may encourage oil bulls to act in the coming day (or days).

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

On the above chart, we see that after an invalidation of the breakdown below the November low and the short-term declining support line WTI Crude Oil remains above these two levels (which still serve as support). This is a positive signal – especially when we factor in the position of the indicators. The RSI still remains slightly above the level of 30, which suggests that a pause or an upward correction is just around the corner. On top of that, the CCI and Stochastic Oscillator generated buy signals, which may encourage oil bulls to act in the near future.

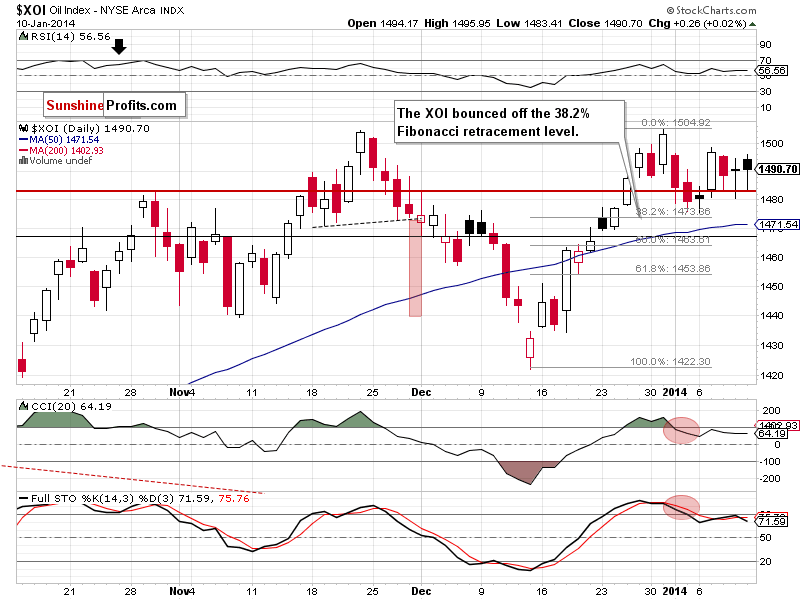

Once we know the above, let’s take a look at the NYSE Arca Oil Index (XOI) chart.

Looking at the above chart we see that the situation hasn’t changed much, therefore, what we wrote in our last Oil Trading Alert remains up-to-date.

(…) the oil stock index remains in a consolidation range between Wednesday’s low and high. From this perspective, we should consider two scenarios. If the buyers manage to push the oil stock index higher, we will likely see another attempt to break above the level of 1,500. On the other hand, if the XOI extends its decline, the first downside target will be Monday’s low (slightly above the 38.2% Fibonacci retracement level) and the 50-day moving average (currently at 1,471).

Please note that the XOI didn’t invalidate the bullish candlestick pattern (a morning star), which still supports buyers.

Summing up, crude oil rebounded slightly and temporary moved above the short-term support/resistance line. Although we haven’t seen an invalidation of the breakdown so far, Friday’s upswing materialized on relative high volume, which hints at the strength of the buyers. Therefore, another attempt to come back above this line should not surprise us.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): We do not suggest opening any positions at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Oil Investment Updates

Oil Trading Alerts