Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil extended losses after the market’s open, but oil bulls stopped their opponents and trigged a rebound in the following hours. Will the drop in the oil rig count and OPEC and non-OPEC oil producers’ consensus trigger a rally to a fresh 2018 high in the coming week?

On Friday Baker Hughes report showed that the oil rig count fell by 5 to 747. Although this is good news for oil bulls, we should keep in mind that the number of oil rigs remains much higher than a year ago (back then it stood at 551), which caused a rise in U.S. production to 9.75 million barrels per day in the previous week. On the other hand, OPEC and non-OPEC oil producers agreed during the weekend that they should continue cooperating on production cuts after the end of 2018, which could encourage oil bulls to act in the coming days. But what obstacles they will have to overcome on their way to the north?

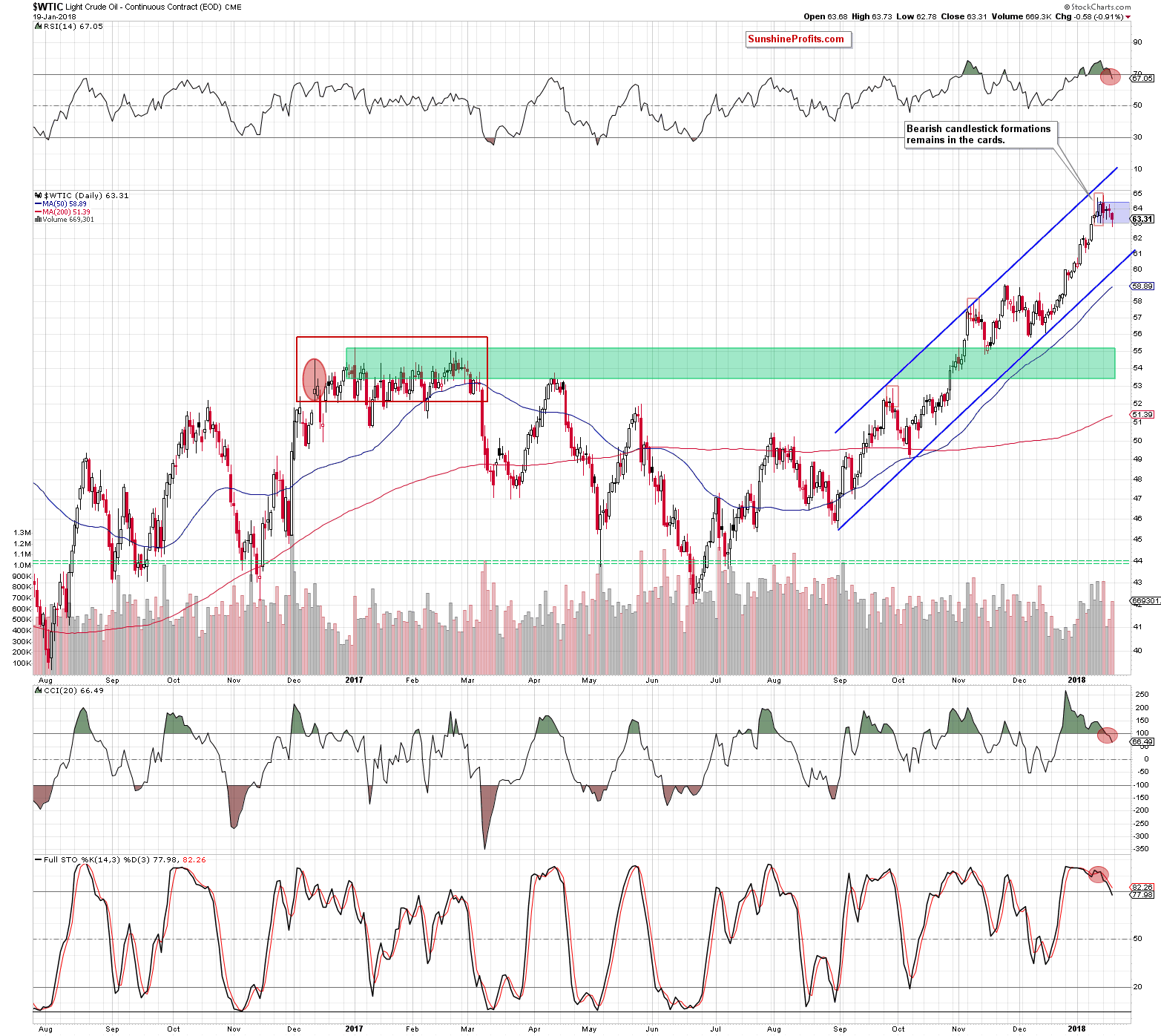

Let’s take a look at the daily chart below chart (charts courtesy of http://stockcharts.com).

Today’s alert is going to be quite brief, because crude oil didn’t do anything that would change the outlook on Friday. The only thing that black gold did at the end of the previous week is that it moved initially lower, but then reversed and rebounded, closing the session inside the blue consolidation. In this way, the commodity invalidated a tiny breakdown under the lower border of the formation, which is a positive sign (at least at the first glance).

Nevertheless, we should keep in mind that two bearish candlestick patterns remain in the cards and the sell signals generated by the indicators are still in play, supporting oil bears and lower prices of crude oil in the coming week.

Earlier today, we haven’t seen any important breakout/breakdown, which could change the overall situation. Therefore, the comments that we made on Friday are still valid and if you haven’t had the chance to read our last alert, we encourage you to do so today:

Who Will Take Control in Oil Market? #2

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts