Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

Crude oil bears appear to be reigning supreme. After repelling the bulls on Friday, black gold is on a daily downswing today. The market seems to be focused on demand growth concerns, respectable stockpiles and sizable shale production, and less easily charmed by geopolitical flare-ups or any Saudi Arabia - Russia deal. Is there any hope for the bulls on the horizon?

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com www.stooq.com).

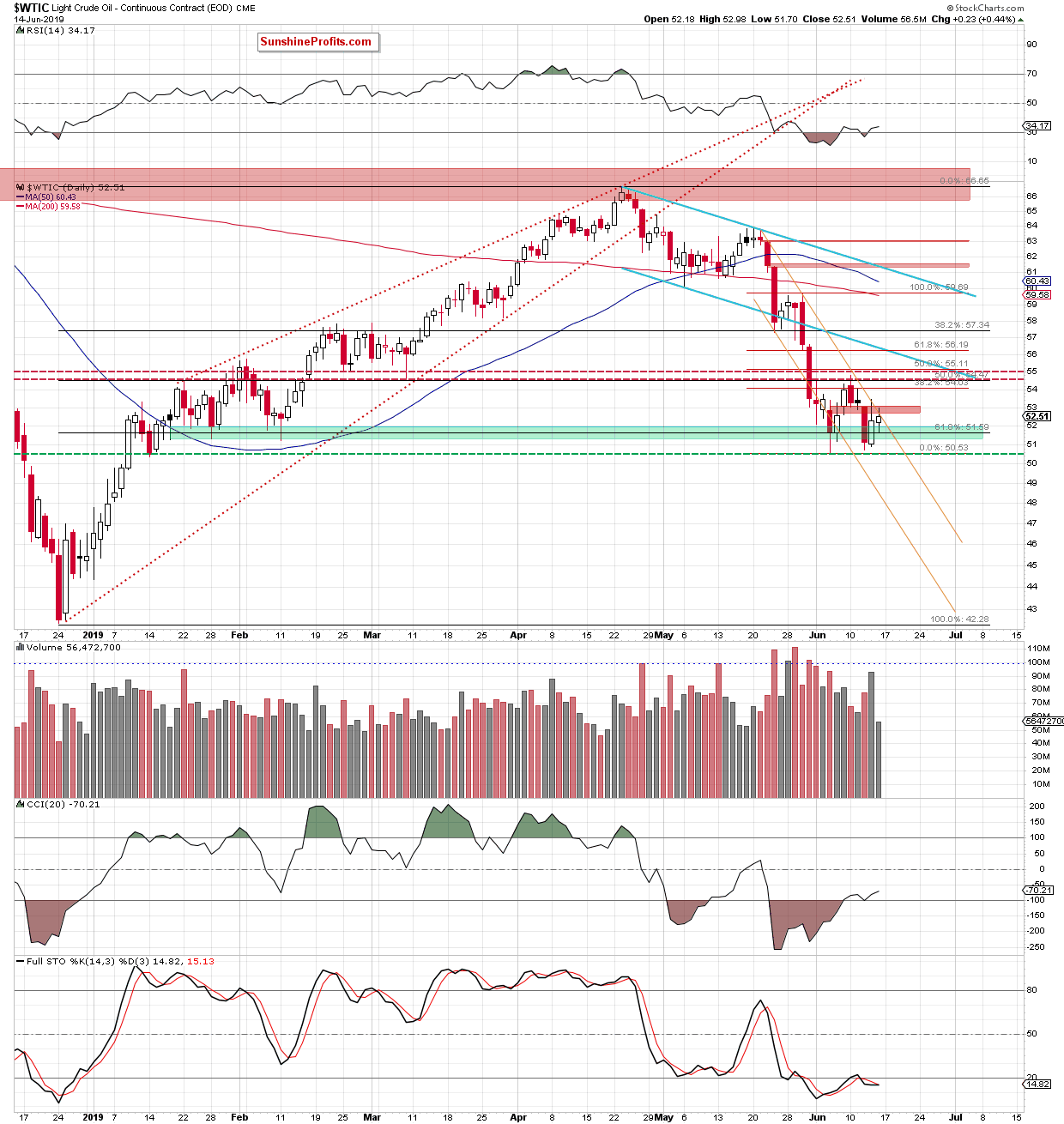

The most prominent short-term feature of the above daily chart is the declining orange trend channel. Crude oil is still trading inside of it and also below the red gap which continues to serve as the nearest resistance.

Regarding Thursday's upswing, we have written these words on Friday:

(...) The upper knot (...) hints at the bulls having issues overcoming the nearest resistances. It suggests their weakness.

The above comment remains up-to-date. Let's take a look at the weekly chart now.

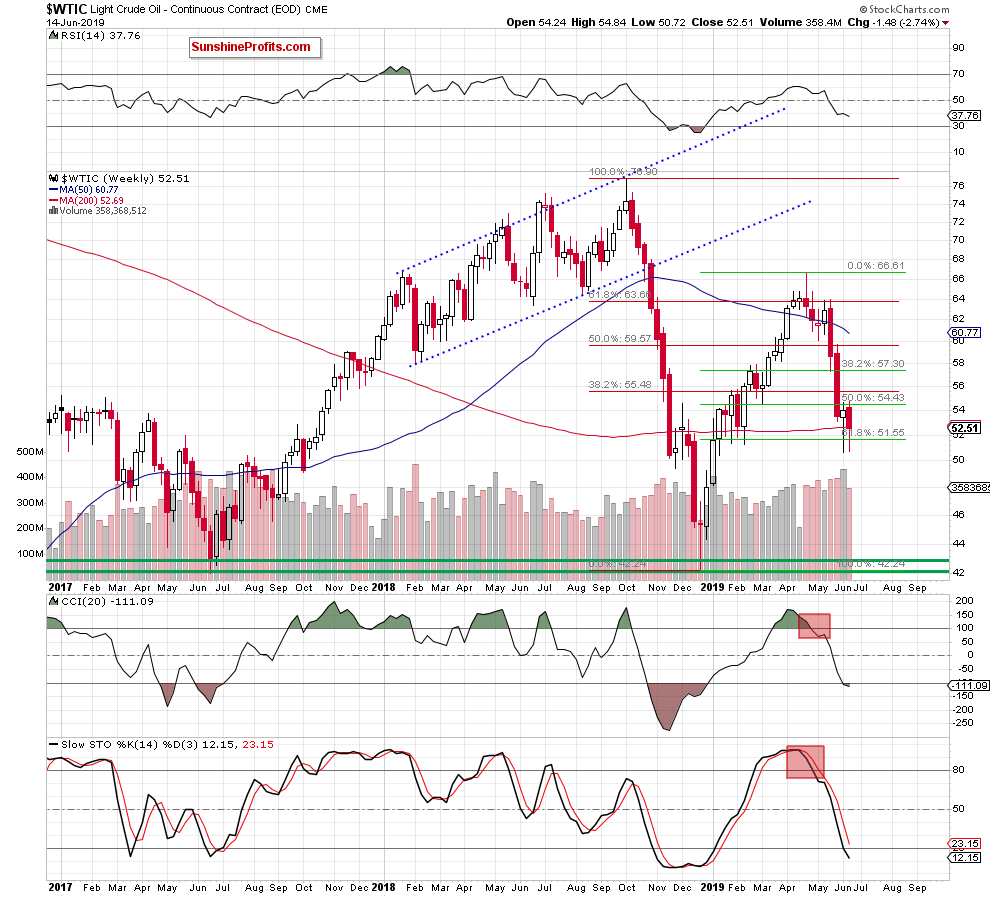

We see that black gold bears have managed to close the week below the 200-week moving average. The upswing attempt earlier today didn't even reach the red gap on the daily chart. A reversal and a comeback to the upper border of the declining orange trend channel followed.

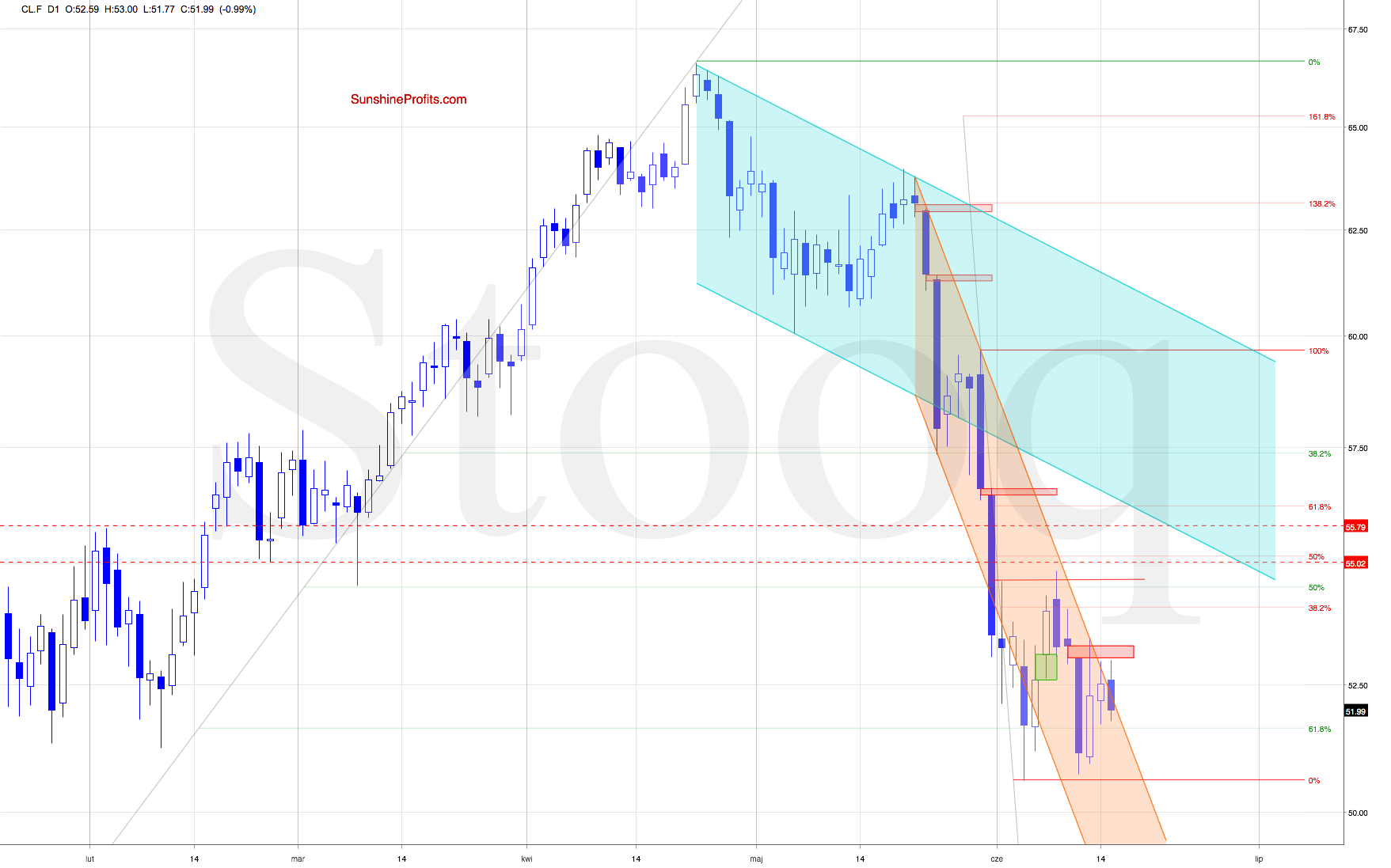

As can be seen on the crude oil futures chart below, this way light crude invalidated the earlier breakout above the declining orange trend channel. This increases the likelihood of seeing additional deterioration later today.

Summing up, Friday's upswing fizzled out and the bears clearly have the upper hand today. Oil is still trading well below the 38.2% Fibonacci retracement and is back inside the declining orange trend channel. At a minimum, one more downswing remains likely. This is supported by the position of the daily Stochastic Oscillator. The weekly chart shows black gold finishing below the 200-week moving average and the weekly indicators being on sell signals. The short position remains justified from the risk/reward point of view.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist