Trading position (short-term; our opinion): profitable short position with a stop-loss order at $58.87 and the next downside target at $53.05 is justified from the risk/reward perspective.

Crude oil bulls finished poorly on Friday, and aren't faring much better earlier today. Have their achievements been reversed, and lower oil prices are the order of the day? Let's examine a few key charts that lead to a confident and profitable answer.

We'll take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

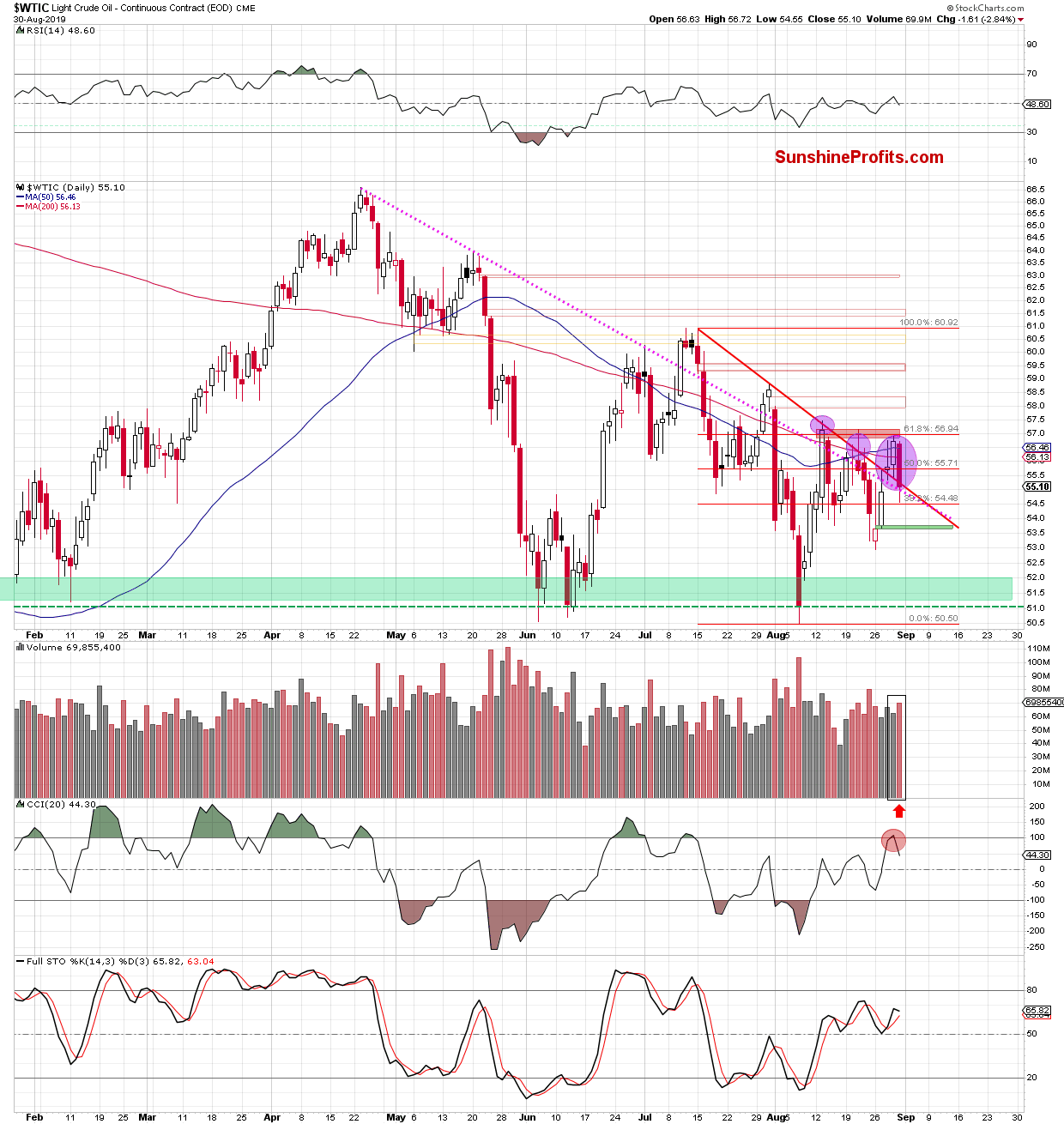

Crude oil has invalidated the earlier breakout above the declining red resistance line and the pink dotted line. This is similar to what we have seen several times in the past - we have marked such instances with purple circles.

Let's examine the volume of Friday's decline. As it's higher than that of the preceding upswing, it points to increasing involvement and strength of the bears.

Additionally, the CCI has issued its sell signal, further supporting the bears. As such, prices can be expected to move lower from here.

Let's examine the oil futures for more clues. What kind of picture are they painting for today's session?

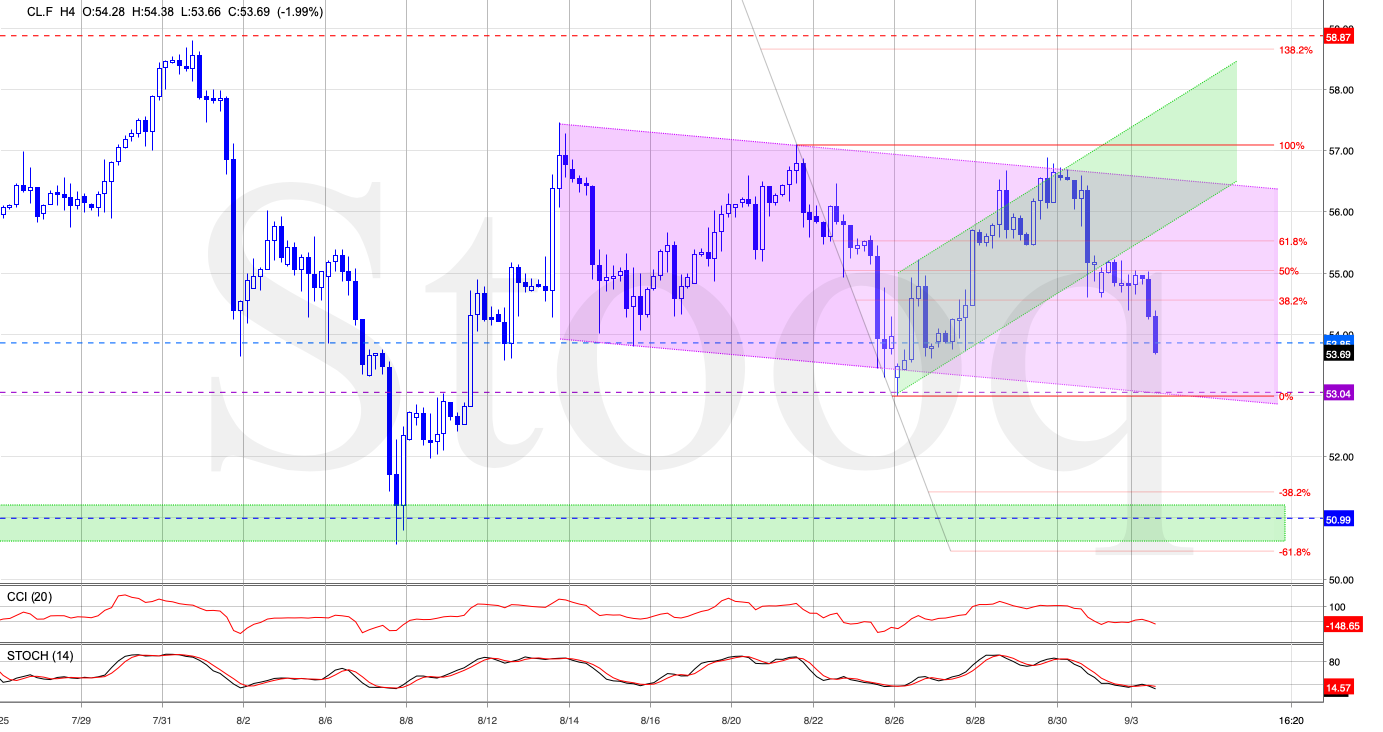

On Friday, the futures closed the bullish green gap that has been created earlier in the week. And today, the bears opened with the red gap. The bulls attempted to counter this bearish development, yet ran out of steam and the price headed lower.

In the process, the earlier breakout above the upper border of the declining red trend channel has been invalidated. This is certainly a bearish development.

The bears went on to test the green gap created at the end of August. If it is broken, the way to recent lows would be open. This is especially the case when we factor in the sell signal generated by the Stochastic Oscillator and the current situation in the 4-hour chart below.

We see that oil has broken below the rising green trend channel. The breakdown was verified and further deterioration followed. Prices have dropped below our initial downside target, making our short positions even more profitable.

The way to the lower border of the purple declining trend channel (at around $53.04) and the recent low is open now.

Summing up, the oil breakout above the declining red resistance line and the pink dotted line has been invalidated. The bears also closed an earlier bullish gap, taking the prices lower. As a result, our profitable oil short position has become even more profitable - and remains justified.

Trading position (short-term; our opinion): profitable short position with a stop-loss order at $58.87 and the next downside target at $53.05 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist