Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday, both the oil bears and bulls took a pause. Also yesterday, we asked here whether the bulls have an ace up their sleeves or not. Today’s upswing looks like one. Is that really so? Does it change the big picture and influence our trading outlook anyhow?

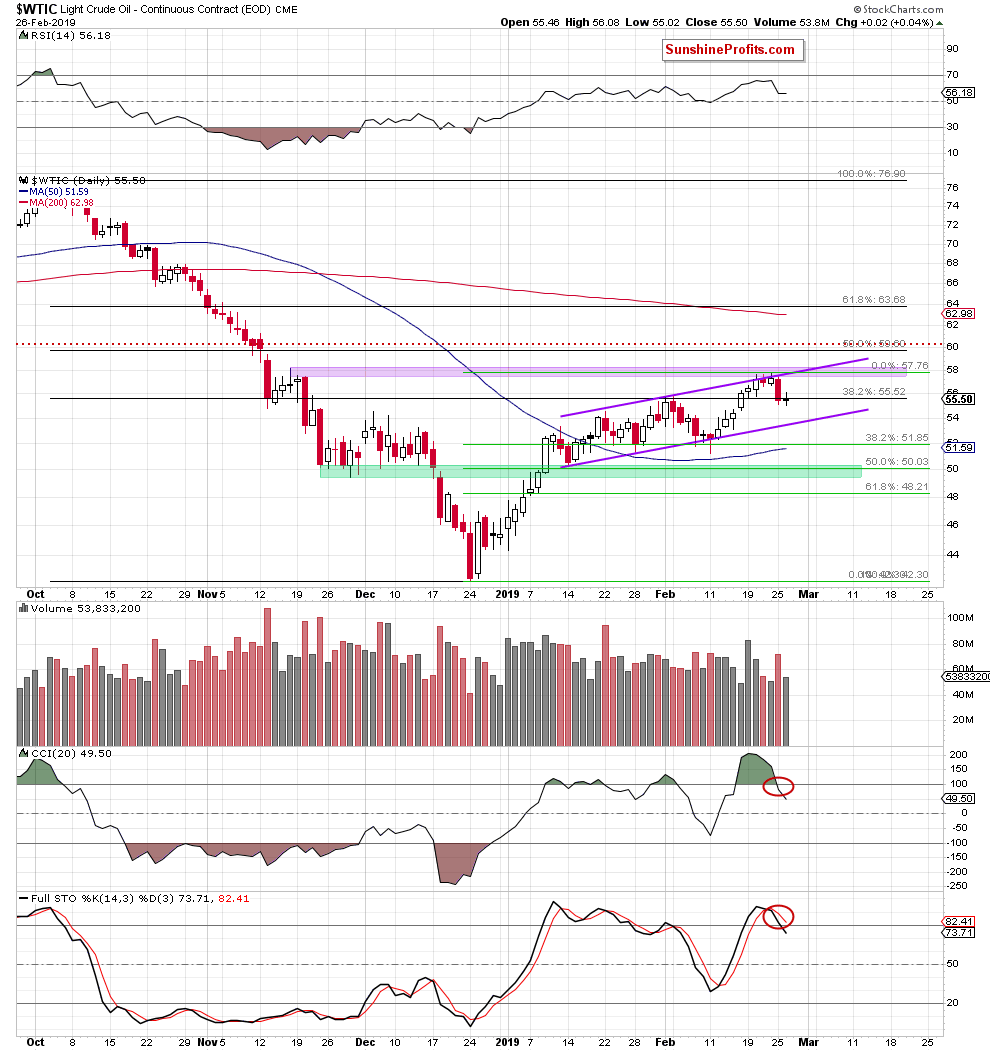

Let’s examine the chart below (chart courtesy of http://stockcharts.com).

Yesterday’s trading was marked by a daily consolidation after sizable Monday’s decline. Crude oil has closed below the 38.2% Fibonacci retracement level. The low volume of yesterday’s session is not an issue – it’s perfectly normal for the market to take such a breather.

Daily indicators’ sell signals remain on the cards. These support another move to the downside, notwithstanding any short-term upswing that might precede it. Actually, we are seeing one right now – the price is attempting to retest the purple resistance zone and is currently at around $56.70. When the downtrend resumes as we expect it to, the first downside target would be the lower border of the purple rising trend channel.

Summing up, short positions continue to be justified from the risk/reward perspective. Invalidations of recent tiny breakout attempts continue to exert their downward influence on the black gold price. Additionally, the volume and the current position of the daily indicators favor the sellers and another move to the downside in the nearest days.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist