Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

That was quite a ride, that yesterday's session in oil. Not that today, things would be any calmer. One day down, the other up. Time to zoom out and look at the bigger chart picture. Yes, a report of attack on two oil tankers in the Gulf of Oman can move the markets short-term but how lasting an effect can such news have? High time to dive into the charts...

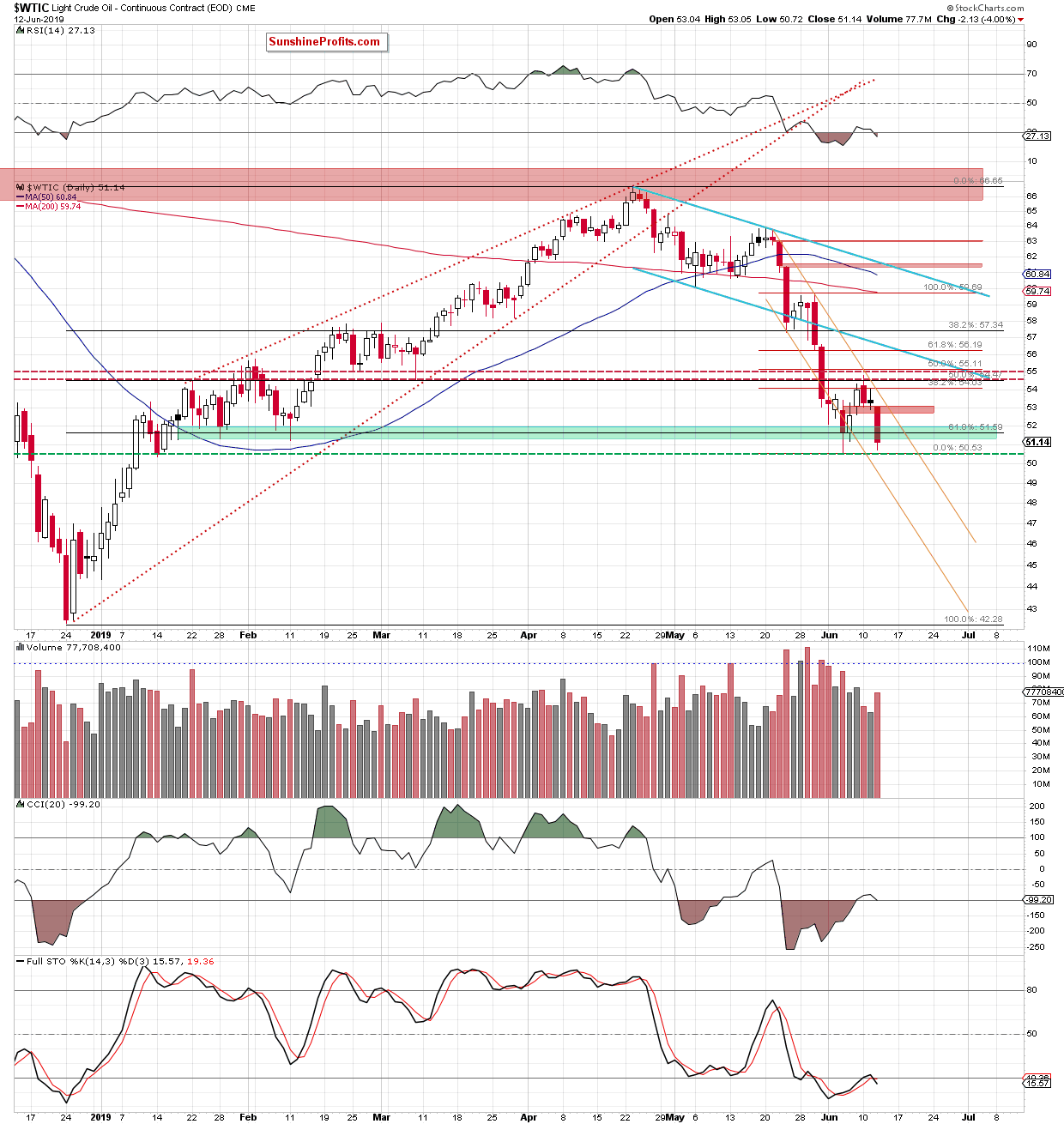

Let's take a closer look at the chart below (first chart courtesy of http://stockcharts.com , the second one courtesy of www.stooq.com).

Crude oil has opened yesterday's trading with a sizable gap down. This is the first step in creating an island reversal pattern - after this gap, an island (a consolidation area with its upper border below the gap) forms and prices remain trapped there for quite a few sessions. This means that the downside momentum created by the gap picks up first.

Indeed, we have seen a sizable down session yesterday, and last week's lows were tested. Has this created the lower border of the island? Is a bullish reversal on the horizon this soon?

Let's remember that the volume of yesterday's downswing has increased. The Stochastic Oscillator has again generated its sell signal. But the bulls have countered and pushed crude oil futures higher earlier today. Let's take a closer look at it.

Today's upswing brought crude oil futures back at yesterday's starting values, however the red gap stopped the bulls. They haven't been able to recapture the ground lost in the pullback and black gold trades at around $52.85 as we speak.

As long as the gap remains open, lower oil prices remain ahead of us. After all, the commodity is still trading inside the declining orange trend channel and remains well below the 38.2% Fibonacci retracement.

The red gap still acts as a resistance. The earlier invalidation of the tiny intraday breakout above the 38.2% Fibonacci retracement also suggests lower prices of black gold ahead. Should we see a continuation of the reversal lower, light crude will likely test the lower border of the orange declining trend channel in the following days.

Summing up, the upswing of previous week has clearly failed and yesterday's session brought sharply lower oil values. Today's upswing notwithstanding, oil is still trading well below the 38.2% Fibonacci retracement and inside the declining orange trend channel. At a minimum, one more downswing remains likely. This is supported by the position of the Stochastic Oscillator. The short position remains justified from the risk/reward point of view.

Trading position (short-term; our opinion): Short position with a stop-loss order at $57.86 and the initial downside target at $51.16 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist