Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

Friday’s session took crude oil under the barrier of $60. Despite this bearish development, the buyers shook off the rivals' attack and triggered a rebound before the market's closure. Is the worst already behind oil bulls?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

On Thursday, we wrote the following:

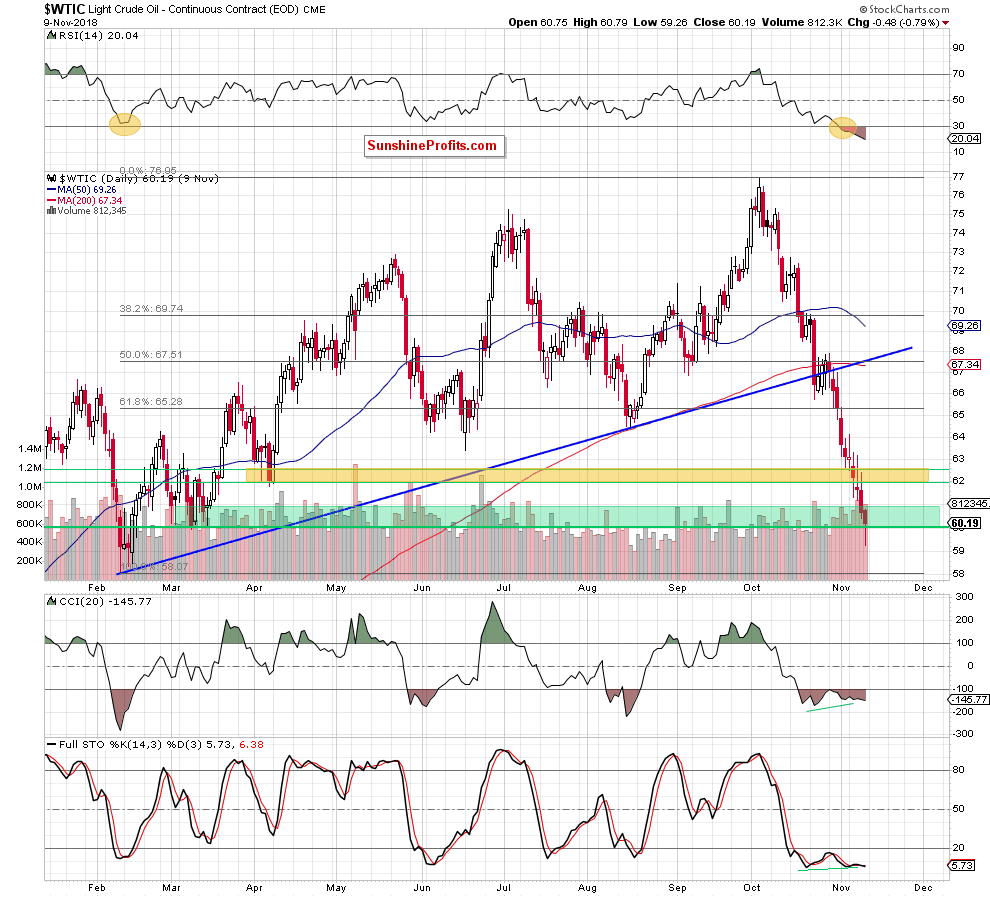

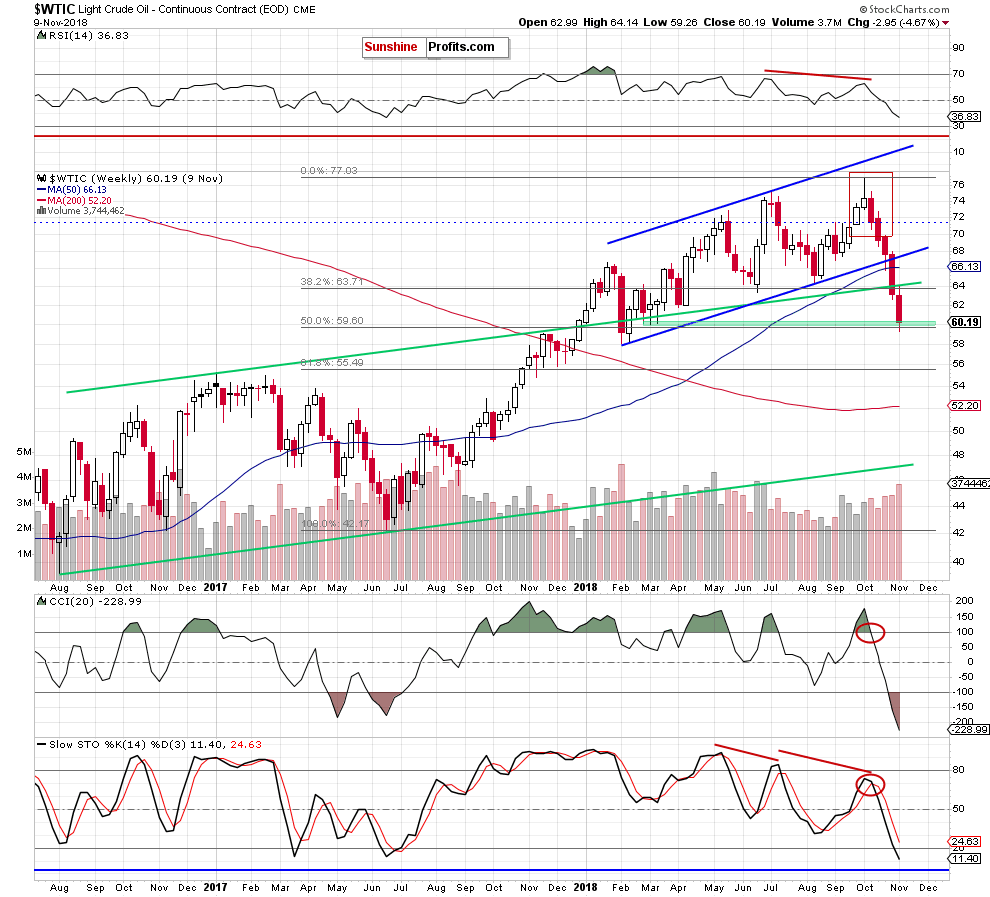

(…) the buyers lost their last technical support, which increases the probability that we’ll see a test of the green support zone or even the barrier of $60 (the lower line of this support area) in the coming days.

On Friday, we added:

(…) if the commodity extends losses, the next downside target will be the green support area created by the March low and the 50% Fibonacci retracement around $59.60-$59.95.

From today’s point of view, we see that the situation developed in line with the above scenario and the price of black gold slipped to our downside targets during Friday’s session.

Nevertheless, despite a small drop below the barrier of $60 oil bulls managed to trigger a rebound before the session’s closure, which resulted in an invalidation of the breakdown below this psychologically important level.

Earlier today, this positive development encouraged the buyers to act, which translated into an upswing to $61. Taking this fact into account and combining it with the current position of the indicators, we think that further improvement is just around the corner.

If this is the case and the commodity extends gains from current levels, we could see an upward move to at least $66 in the coming week. Therefore, if we see oil bulls’ strength, we’ll consider opening long positions in the very near future.

Trading position (short-term; our opinion): none positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts