Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thanks to oil bulls’ determination and yesterday’s price action, crude oil invalidated two important breakdowns. Will this improvement be sustainable in the coming week?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

Quoting our Wednesday’s alert:

(…) a rebound and a verification of yesterday’s breakdowns (under the lower border of the blue rising trend channel marked on the weekly chart, the 200-month moving average, the lower border of the very short-term red declining trend channel seen on the daily chart or even the lower border of the green wedge marked on the monthly chart) should not surprise us.

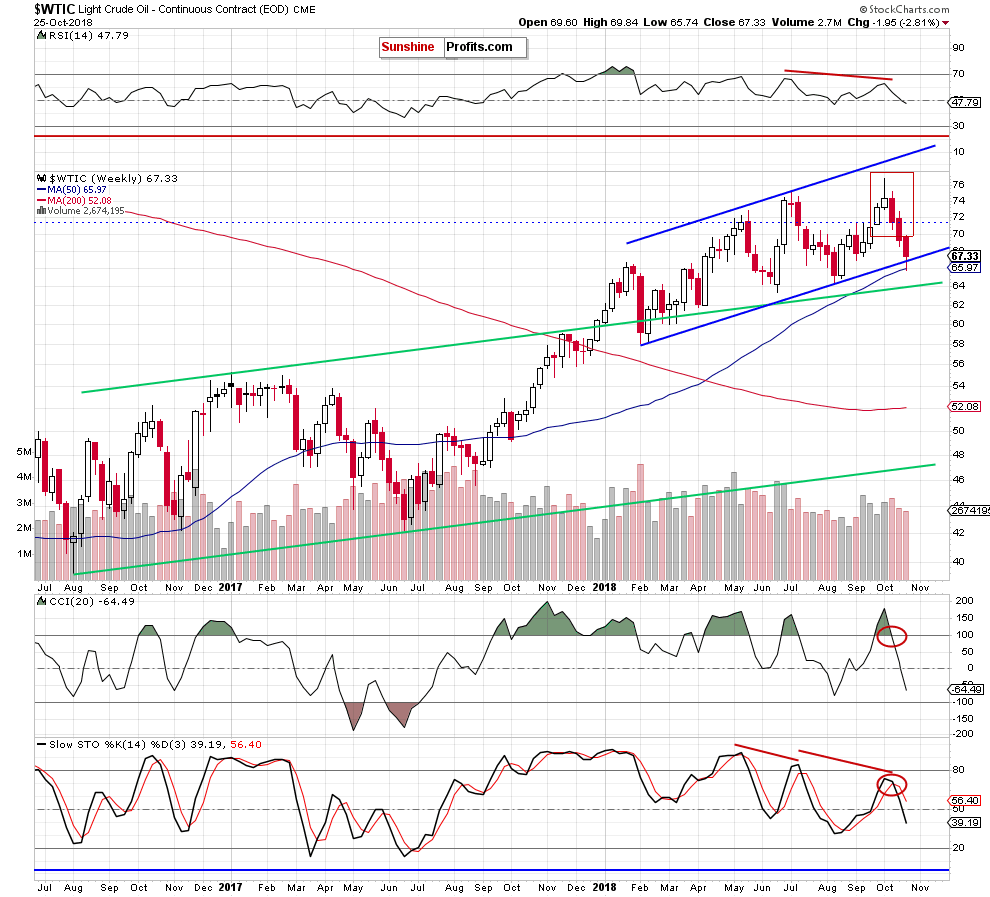

Looking at the weekly chart, we see that oil bulls took the commodity higher (as we had expected), which resulted in an invalidation of the earlier breakdown under the lower border of the blue rising trend channel.

How did this price action affect the very short-term chart?

Before we answer to this question, let’s recall the quote from our yesterday’s alert:

(…) Although the commodity pulled back before the session closure, the buyers pushed light crude higher after the market’s open once again, which suggests that we’ll see a re-test of yesterday’s resistances or even the previously-broken green zone seen on the daily chart in the very near future.

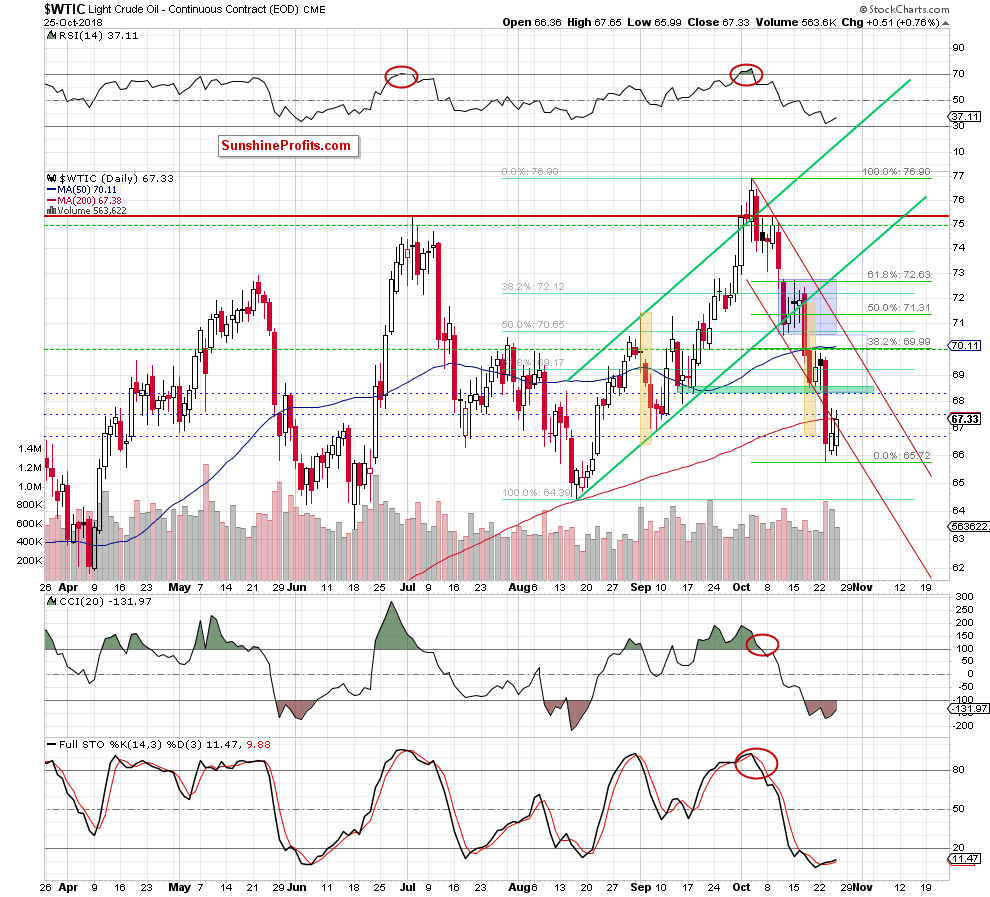

As you see on the daily chart, the situation developed in tune with the above scenario and crude oil increased to its first upside target. Thanks to Thursday’s increase the commodity invalidated the earlier breakdown below the lower line of the very short-term red declining trend channel, which suggests that the bulls may no longer be as weak as it may seem.

Nevertheless, despite the above-mentioned improvements (two invalidations), we think that a bigger move to the upside will be more likely and reliable only if the commodity closes today’s session inside both trend channels (the medium-term blue rising trend channel and the very short-term declining ne).

Until this time, one more downswing below the lower border of the very short-term red trend channel can’t be ruled out. We will keep our subscribers informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts