Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, crude oil bounced off this week’s low and climbed to the previously-broken levels. Verification of the earlier breakdowns or something more?

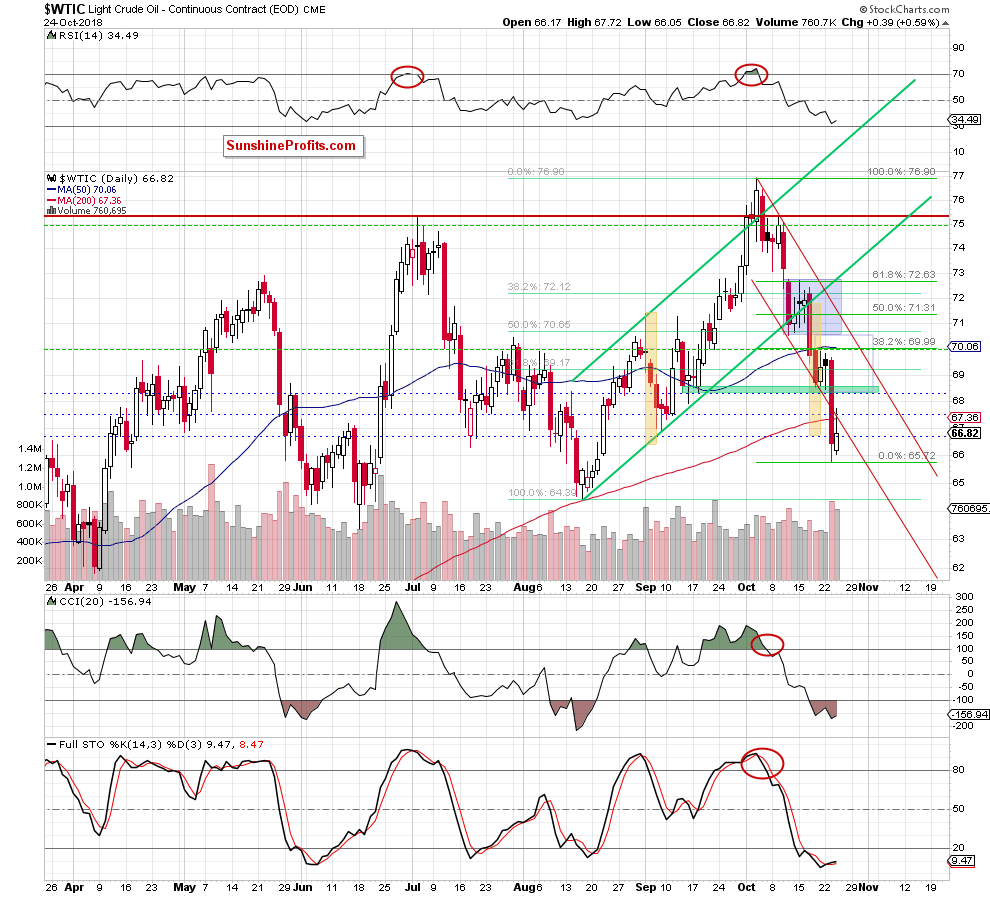

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) the commodity slipped to the area where the size of the downward move corresponded to the height of the green rising trend channel, which triggered a tiny (compared to the size of earlier drop) rebound before the session’s closure. Additionally, the Stochastic Oscillator generated a buy signal, suggesting that reversal may be just around the corner.

(…) a rebound and a verification of yesterday’s breakdowns (under the lower border of the blue rising trend channel marked on the weekly chart, the 200-month moving average, the lower border of the very short-term red declining trend channel seen on the daily chart or even the lower border of the green wedge marked on the monthly chart) should not surprise us.

From today’s point of view, we see that oil bulls pushed the price of black gold higher (as we had expected), which resulted in a comeback to the lower border of the very short-term red declining trend channel, the 200-day moving average and the lower border of the blue rising trend channel.

Although the commodity pulled back before the session closure, the buyers pushed light crude higher after the market’s open once again, which suggests that we’ll see a re-test of yesterday’s resistances or even the previously-broken green zone seen on the daily chart in the very near future.

Therefore, if the situation develops in line with the above assumption and crude oil increases from here, we’ll likely re-open full (150% or even 200% of the regular size of the position) short positions at higher prices in the following days. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts