Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Oil bulls are facing ongoing issues in taking the black gold price higher. Actually, it's already the third day of it being so. The Iran tensions remain very much on and the G20 meeting is just starting. Will any of these turn out to be a catalyst of the upcoming move? And by the way, which direction is more likely given the chart situation right now?

Let's take a closer look at the charts below charts courtesy of http://stockcharts.com and www.stooq.com ).

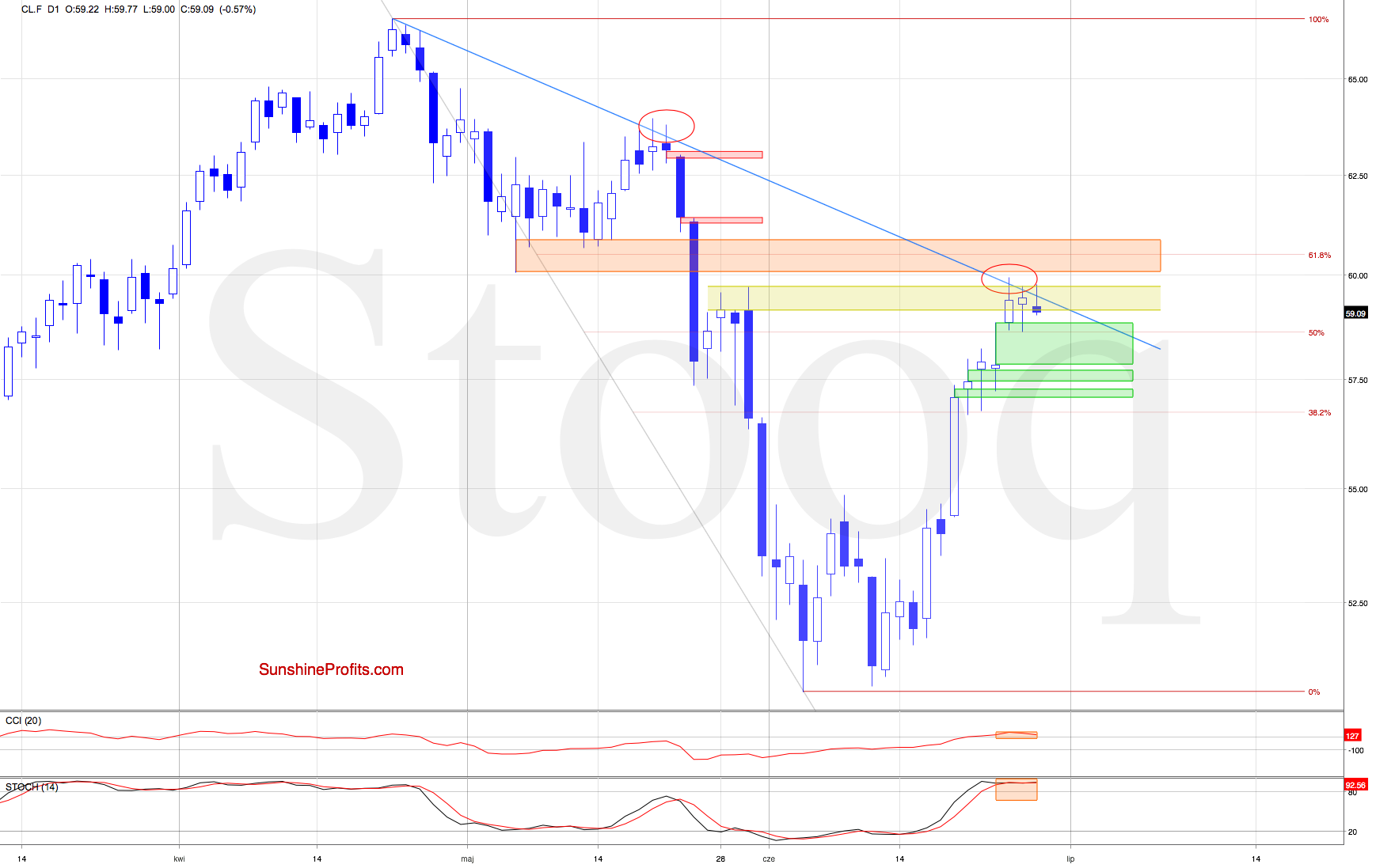

After yesterday's initial failure of the bears to go lower, the oil bulls managed to push prices up one more time today. The fate of today's upswing turned out similar to both the Wednesday and Thursday attempts - it failed.

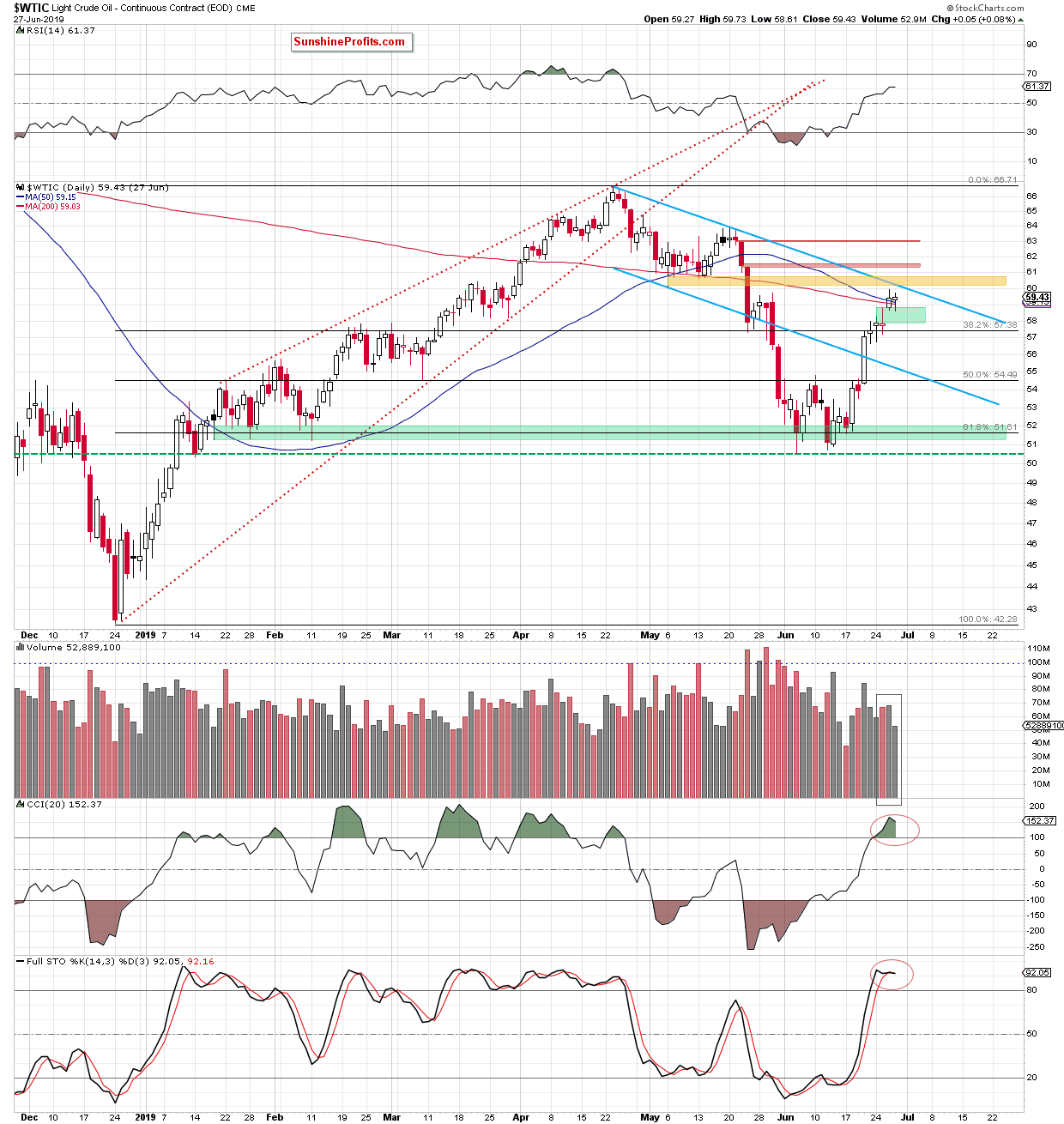

The yellow resistance zone and the declining blue resistance line proved too strong an obstacle for the bulls. A look at the current overbought position of the daily indicators and the declining volume (as shown on the second chart) reveals that black gold is vulnerable to a downswing.

Let's remember our yesterday's observations:

(...) We have already seen a similar price action on May 20 and also the following day. Back then, such moves preceded a sizable downswing, which increases the likelihood of at least a brief reversal from current levels.

The bearish outlook is also reinforced by the current position of the daily indicators and bearish divergence between the crude oil price and the Stochastic Oscillator.

Let's check again the daily chart, this time a bit longer time horizon.

We see the CCI giving an overbought reading, while the Stochastic Oscillator just flashed its sell signal. Session by session, the volume keeps moving down. It hints at the bulls losing commitment and conviction in the fight for higher prices.

Therefore, a reversal targeting the green gap just below remains very likely for the upcoming days. Indeed, black gold is trading at around $59.15 as we speak.

Summing up, the bulls have reached an important resistance and have difficulty overcoming it for the third day in a row. Then, there is the ongoing and increasing bearish divergence in the CCI. The oil market looks set to close today's trading lower as the bears have another test of the green gap in their sights. As for now however, there's no opportunity worth acting upon in the oil arena.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist