Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective.

Thursday's session disappointed many oil bulls’ supporters, because their weakness after the session’s opening contributed to a further deterioration in the price of black gold. Despite yesterday’s downswing, there is still one more oil bull's fortress, which continues to keep declines in check. How important is it for both sides of the market?

Let’s examine the charts below (charts courtesy of http://stockcharts.com/).

Technical Picture of Crude Oil

Today’s alert, we’ll begin with the medium-term picture of the commodity.

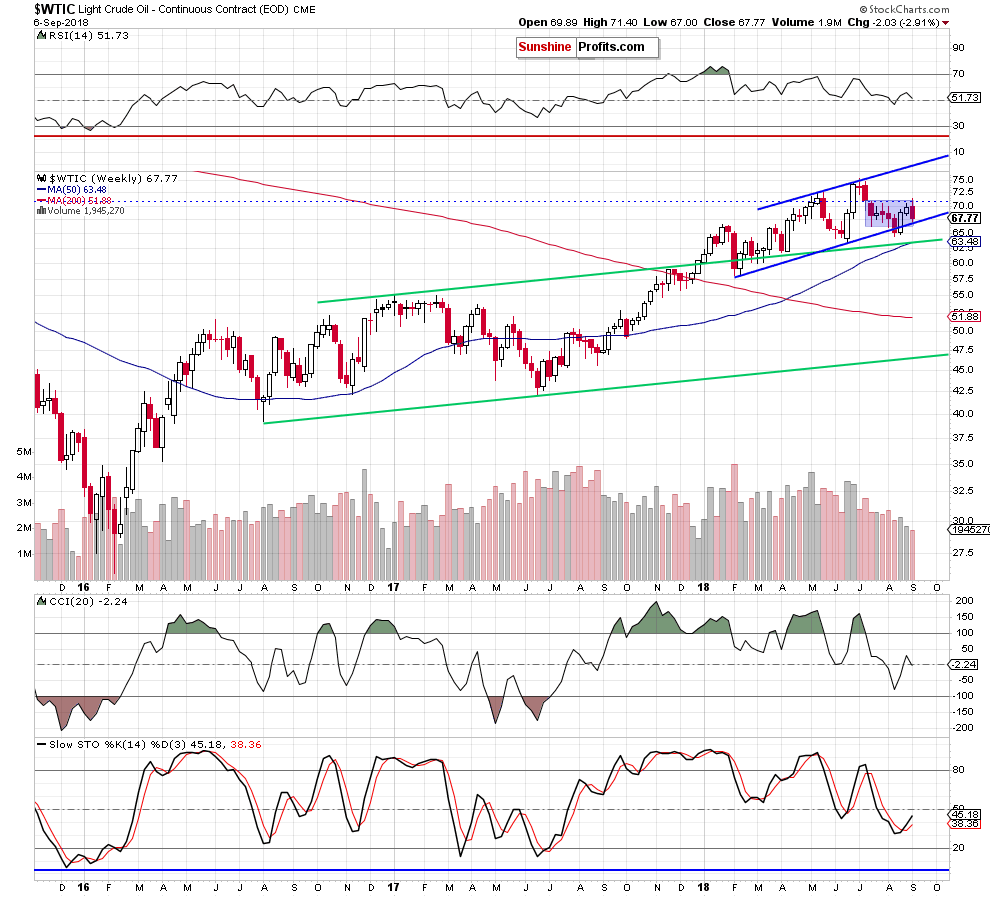

Looking at the weekly chart, we see that the upper border of the blue consolidation triggered a pullback, which took black gold to the lower border of the blue rising trend channel. Such price action suggests that rebound from here is quite likely – especially when we factor in the buy signals generated by the medium-term indicators, which continue to support oil bulls and higher prices of the commodity.

Why this line is so important for black gold?

Because if oil bulls do not manage to withstand the selling pressure and their opponents close today’s session (and what's worse all week) below this line, we could see not only a test of the mid-August lows, but also a decline to the upper border of the long-term green rising trend channel in the following week(s).

How did this drop affect the short-term chart? Let’s examine the daily chart to find out.

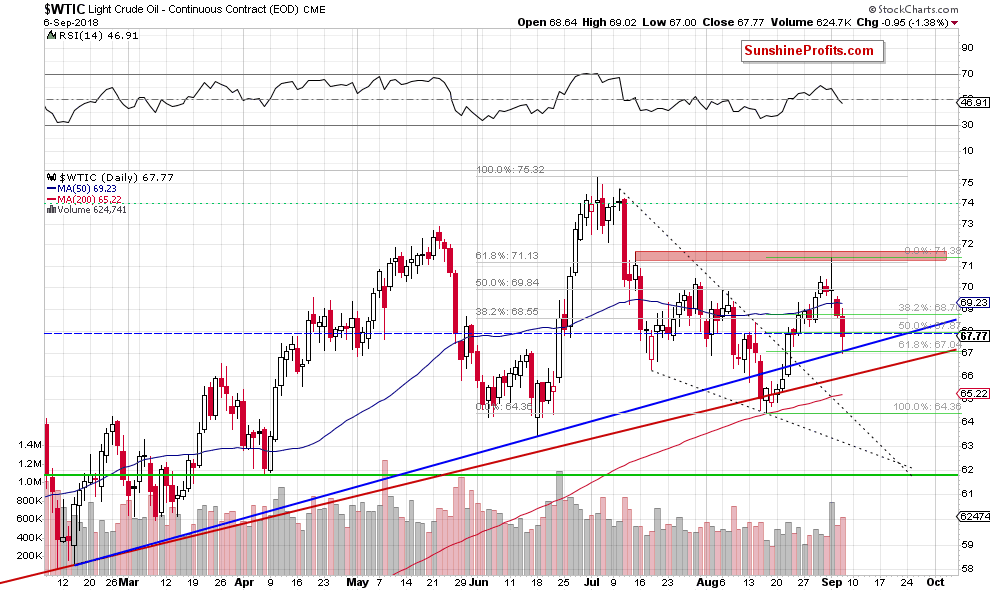

From this perspective, we see that crude oil extended losses, which ruined the growth-friendly scenario based on the similarity to the price action we observed at the end of June.

Nevertheless, despite yesterday’s drop, black gold bounced off the medium-term blue support line (the above-mentioned lower border of the blue rising trend channel) and the 61.8% Fibonacci retracement, which suggests that as long as there is no daily/weekly closure below these supports another attempt to move higher is very likely and long positions continue to be justified from the risk/reward perspective.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts