In short: In our opinion, small (half) short positions in gold, silver, and mining stocks are still justified (no changes since yesterday).

We summarized yesterday’s second Gold & Silver Trading Alert in the following way:

The USD Index is almost at the short-term support line, which is quite likely to ignite a rally in the currency and this, in turn, is quite likely to ignite a decline in gold and the rest of the precious metals sector. As you know, the initial parts of big declines in gold are quite often very volatile, and being out of the market now would mean giving up on the opportunity to take advantage of it. That's why we keep the positions intact. However, we would like to stress that we will not keep these positions just for the sake of keeping them or for the sake of being correct eventually (we care about your profits way more than about any of the above). We will keep them intact only as long as the risk/reward ratio justifies it and in our opinion that is still the case.

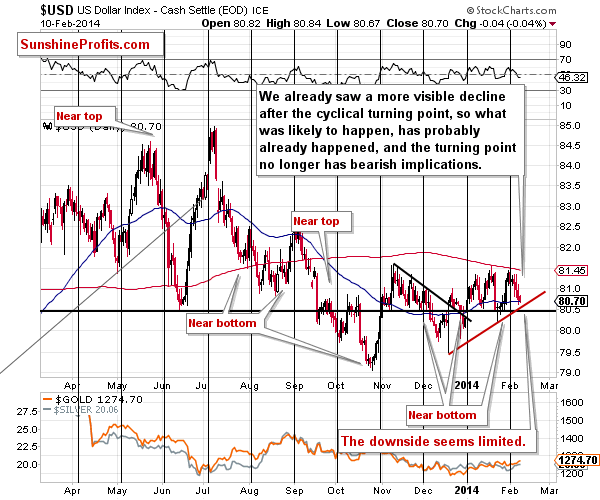

Is it still the case? Let’s take a look, starting with the USD Index (charts courtesy of http://stockcharts.com.)

The USD Index didn’t move below the rising support line, which means that it’s likely to reverse direction and head north any day now. In fact, the index moved to the 80.50 level earlier today, which means that the bottom might already be in. This means that gold and the rest of the precious metals sector will likely soon have a "reason" to decline.

Moving on to gold...

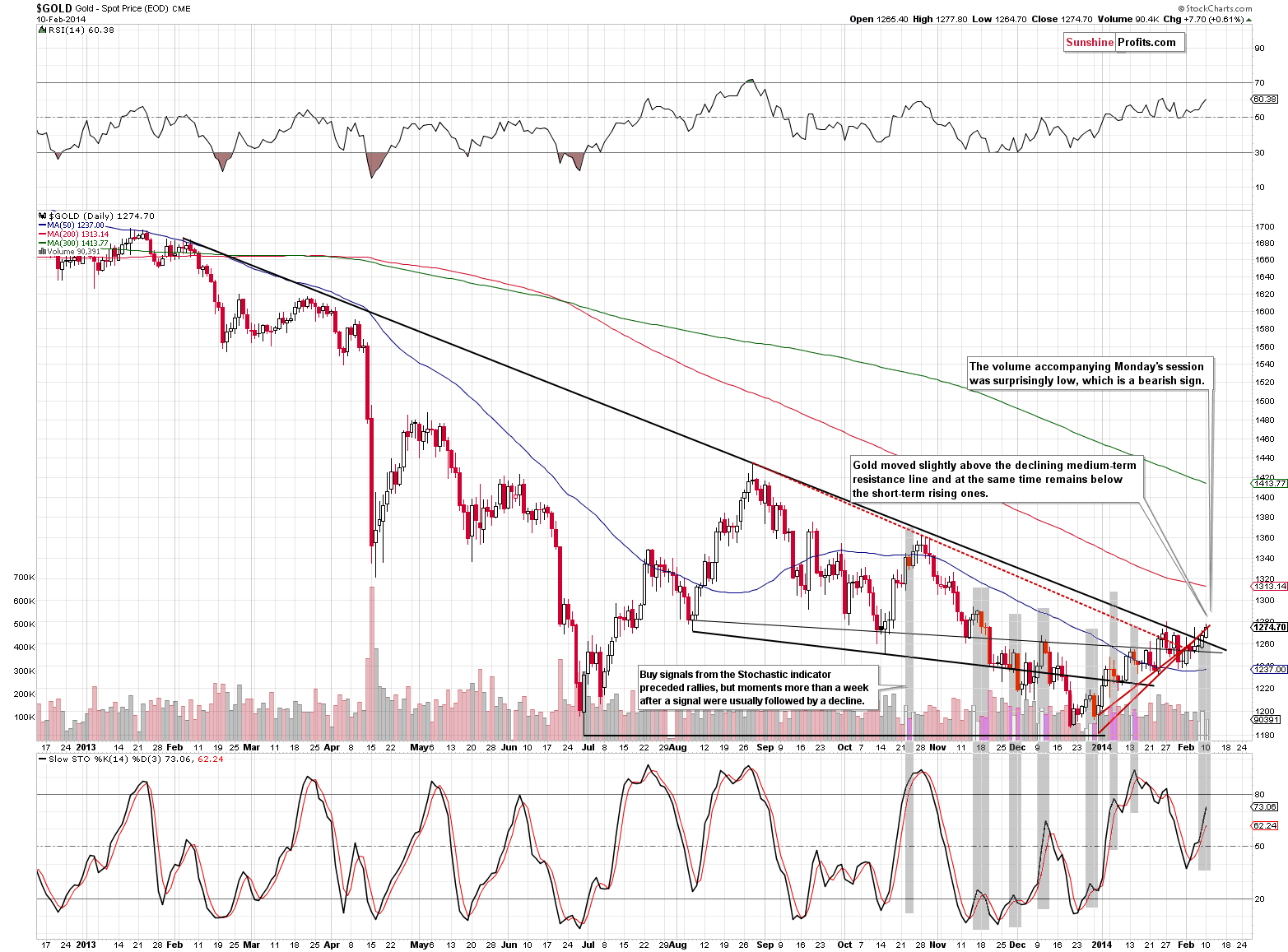

Gold moved higher on Monday and in pre-open trading on Tuesday, but it remains below the 38.2% Fibonacci retracement level based on the entire bull market, so the most important resistance level remains in place. We have previously stated that it would take a significant breakout above this level to change the medium-term outlook – and we have yet to see one.

The move above the rising resistance line was small and almost invisible from the long-term perspective. The breakout is definitely not confirmed and without significant consequences. Interestingly, it materialized on tiny volume, which is more visible on the medium-term chart.

The volume that is supposed to be seen when a given market truly breaks out above a strong resistance level should be strong as well. On Friday, we saw a move above the medium-term resistance line on average volume and Monday’s session was characterized by surprisingly low volume. It does not only make us doubt the reliability of the breakout, but is a bearish sign on its own.

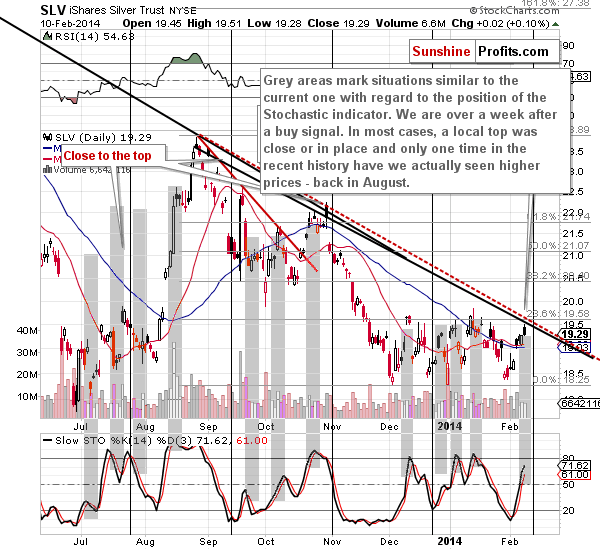

We were asked to comment on the current position of the Stochastic indicator in gold and silver, so we marked the recent situations similar to the one we are currently in (more than a week after a buy signal) with grey rectangles. In most cases, the rally was over by that time and another (small, but still) move lower was about to take place. Consequently, we don’t view the position of this indicator as bullish at this time.

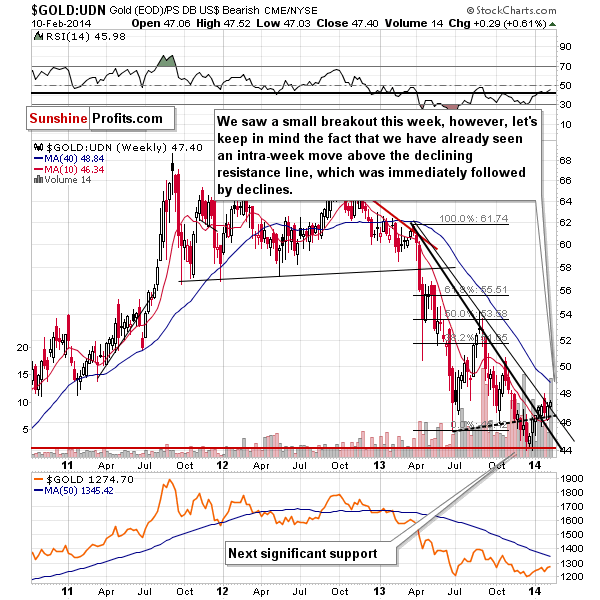

From the non-USD perspective, there was a small, unconfirmed breakout above the declining resistance line. How significant is that? Not really, at least not yet – gold moved above this line 2 weeks ago, which was followed by a quick turnaround. At this time, gold is not even as high as it was back then. There has been no confirmation, so we don’t view the breakout as really bullish.

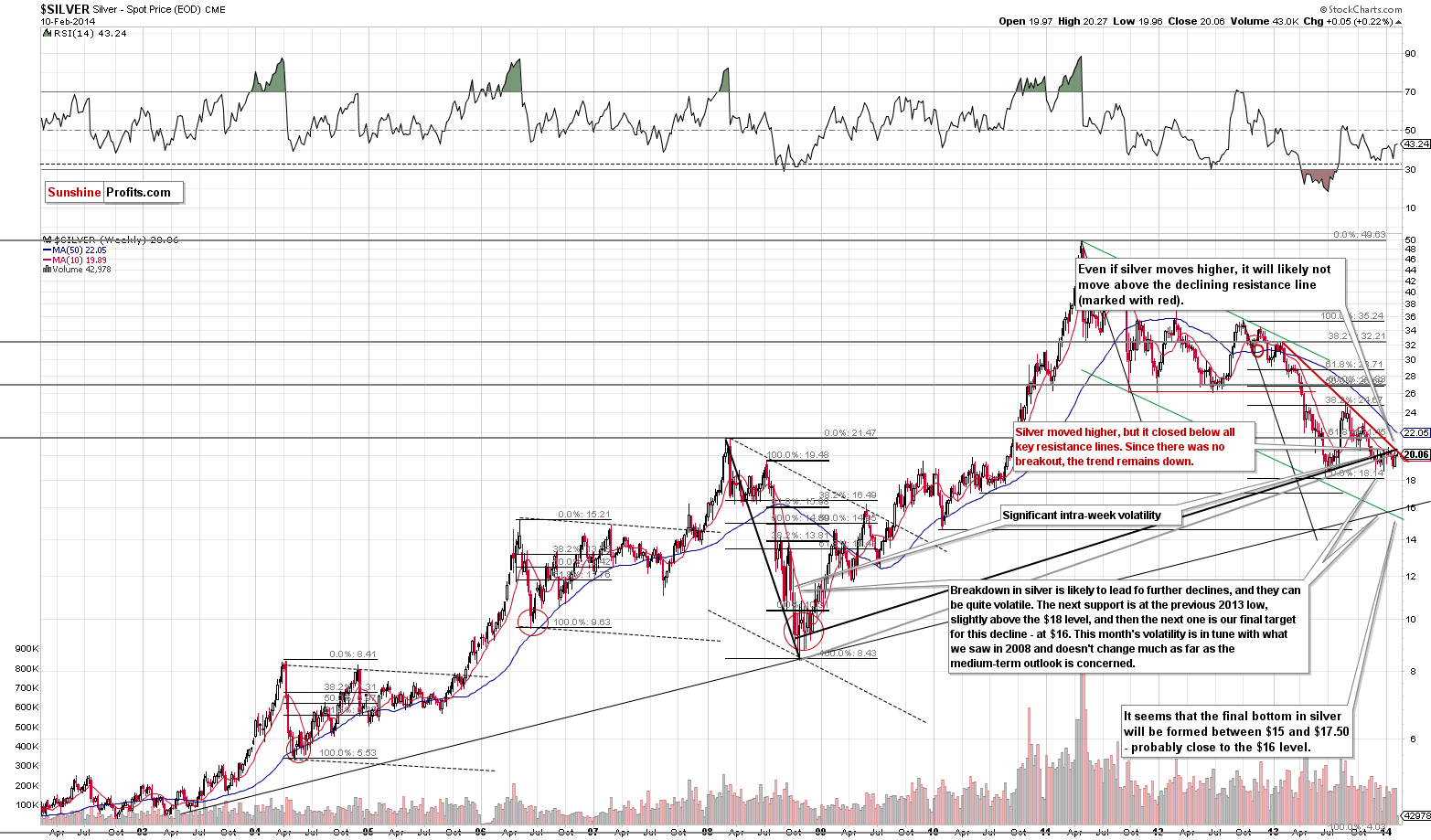

Silver didn’t move much higher yesterday and it hasn’t really moved higher today ($0.10 at the moment of writing these words). Silver remains below key support lines, which means that the downtrend remains in place and that actually nothing changed in this market in the past few days.

The SLV ETF moved only slightly higher in the last few days. It almost reached the declining resistance line – there was no breakout, and the move higher materialized on low volume. The action seen in the silver market is not bullish.

In fact, we have a bearish sign in the form of the upcoming cyclical turning point. The most recent short-term move has been up, so the turning point heralds a decline.

As mentioned earlier, we were asked to comment on the Stochastic indicator for silver. As it was the case with gold, we marked situations similar to the one we have today with grey rectangles. In most cases, similar situations with regard to the Stochastic indicator (meaning being over a week after a buy signal) meant that a local top was about to be formed or had already been in.

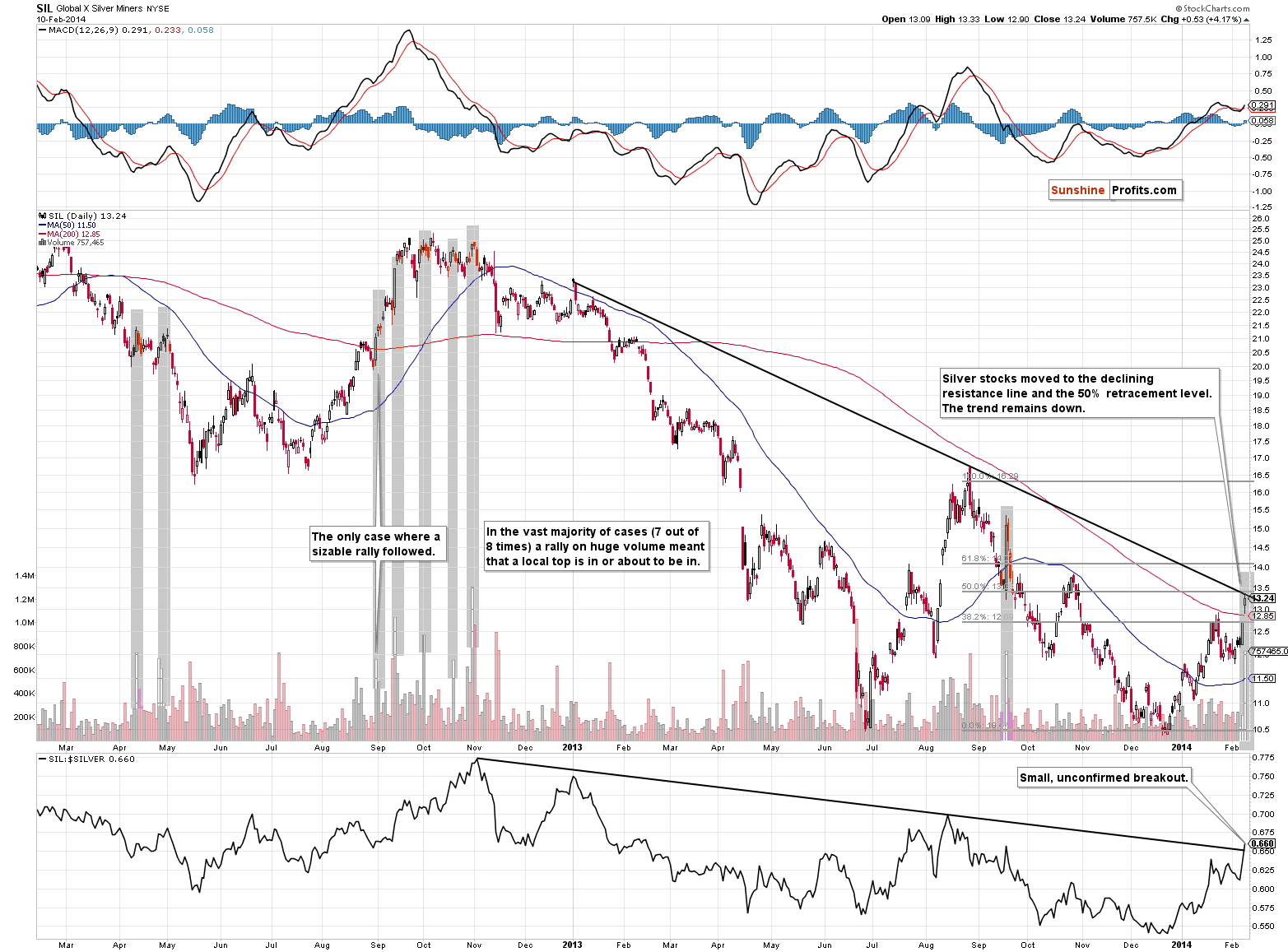

With bearish outlook for silver, let’s take a look at silver stocks:

Silver stocks – just like silver – moved to the resistance line, but didn’t break it. There was a small breakout in the silver stocks to silver ratio, but the lack of breakout in silver and silver stocks themselves seems far more important.

Silver miners have corrected 50% of the August – December decline – as long as they remain below the 61.8% retracement, the recent rally will continue to look like a correction. It’s particularly clear when we factor in the declining resistance line.

On Monday, silver stocks rallied on huge volume, huge enough for us to examine if similar cases had meant something in the past. After all, if a similar thing followed multiple times and something contrary didn’t, we could view the huge volume as some kind of signal.

It turns out that 7 out of 8 times that silver stocks rallied on huge volume marked a local top and there was only one case when a rally followed. In mid-September 2013 we saw a small rally but a bigger decline followed after just several days and as it turned out later, the top that formed right after the huge-volume session, was a major one.

Consequently, the implications are bearish.

Speaking of mining stocks, let’s take a look at mining stocks in general and then let’s examine junior mining stocks.

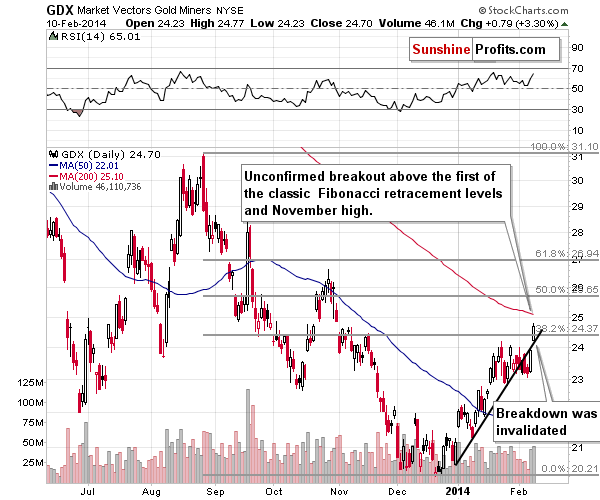

Silver stocks were not the only ones that rallied on significant volume; other miners also did.

In case of the GDX ETF, the rally took miners above the 38.2% Fibonacci retracement level, which may mean that we will see a move to the next resistance at the 50% retracement or even higher. However, that is not likely to happen without a move higher in the underlying metals, and as you have already seen, there are strong resistance levels where both metals are currently trading.

Consequently, the above chart paints a bullish picture and the sentiment was very positive when miners rallied yesterday (many tweets about miners breaking out + many emails from subscribers in our inbox), but can one picture and perspective change the outlook to bullish especially that silver stocks suggest the opposite?

Let’s take a look at the junior miners for more details.

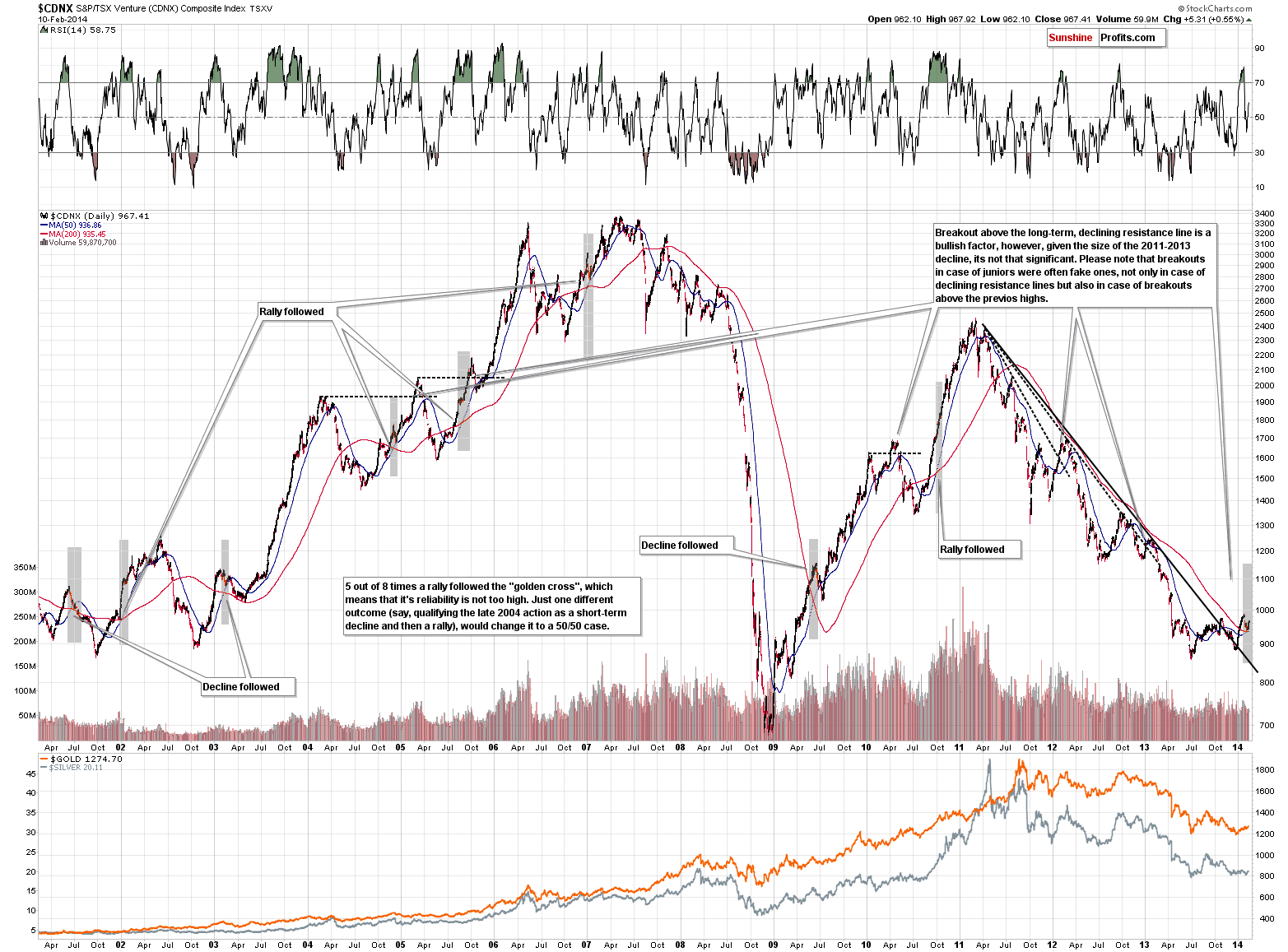

There are 2 bullish (“bullish?”) things in the junior mining stocks sector that we would like to comment on: the breakout, and the "golden cross".

The breakout above the declining resistance line seems very bullish… Until you consider the fact that two previous breakouts above previous resistance lines (declining dashed lines above) failed and were followed by declines. The current move higher is more significant than the previous ones, so it looks more bullish, but still, it’s not necessarily that bullish. Particularly if one considers that junior miners invalidated other “breakouts” as well. Please note that the moves above the previous local highs that we saw in 2005 and 2010 were followed by sharp declines. Consequently, the breakout above declining resistance line is bullish, but much less bullish than it seems at the first sight.

The same goes for the “golden cross” (which is a name for the situation in which the short-term moving average goes above the long-term one; in this case we’re speaking of the 50-day average moving above the 200-day one). We have marked the situations in which we’ve seen the golden cross in the juniors sector in the past with grey rectangles. In most cases – 5 out of 8 – a rally followed. In other words, it looks bullish, but is not that reliable – if there was a different outcome just one time in the past, we would have a 4 out of 8 situation, meaning a 50/50 situation without implications. So, how bullish is the golden cross in juniors? Somewhat. If you compare it to the 7 out of 8 efficiency seen for silver stocks, we overall get a bearish picture based on both signals, as the latter seems more reliable.

Besides, we have another indicator for the junior stock market.

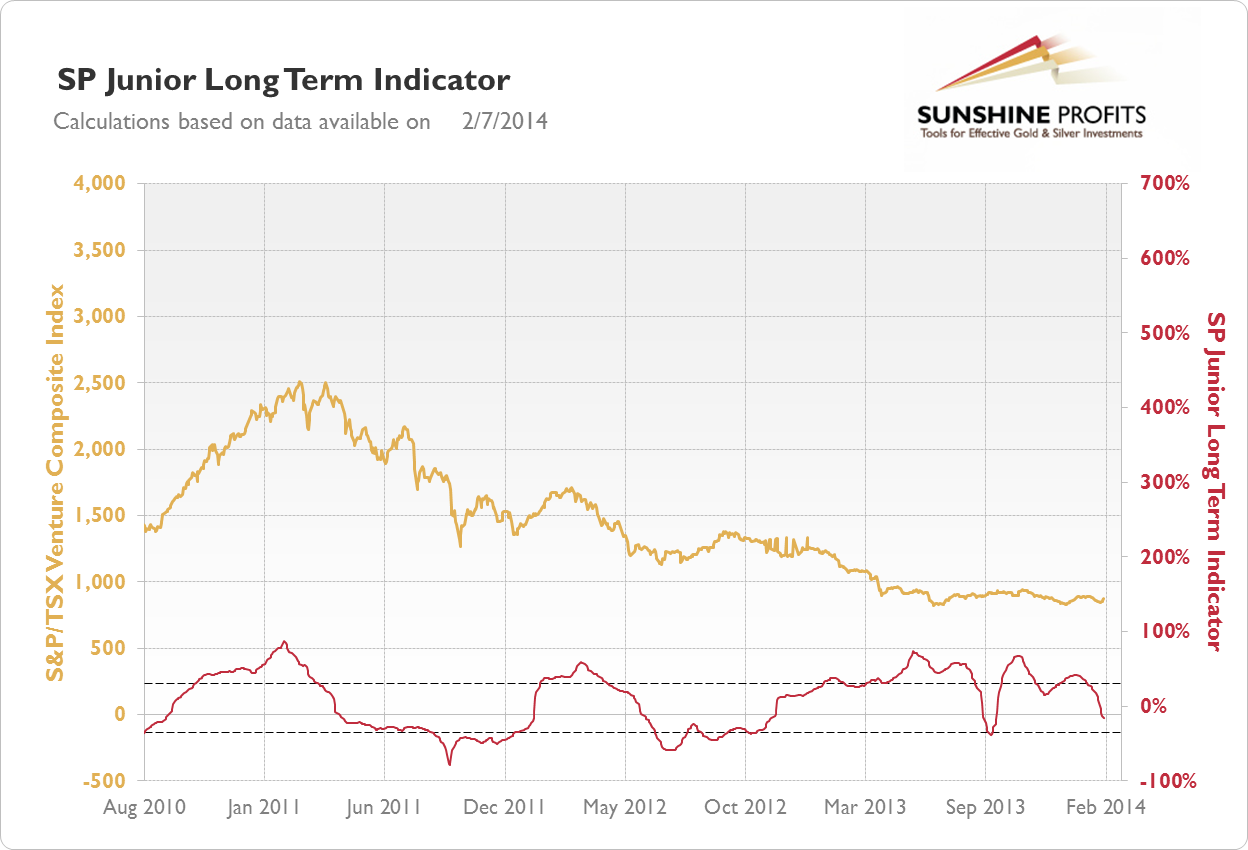

The SP Junior Long Term Indicator flashes buy signals for the junior sector when it’s below the lower dashed line and starts to move up and it flashes sell signals when it’s above the upper dashed line and starts to move down. It’s not a 100% correct crystal ball, but please note how it detected both a local top and local bottom in 2012, and a local bottom in 2011. The current reading is that it’s too early to say that juniors are very likely to move higher – the outlook is still unclear based on this indicator.

Summing up, taking all of the above into account, we arrive at the same conclusion at which we arrived previously – namely, in our opinion it’s a good idea to use a small part of the speculative capital to trade the (likely) coming decline in precious metals.

We have previously described the nature of this position (and the stop-loss orders reflect it) – it’s not about small moves to the upside or downside. It’s about a final, major downswing that is likely to take the entire precious metals sector much lower. We’re not closing the position in order not to be out of the market when it starts, as the initial move can be very volatile. In a way, we’re letting smaller fish go in order to catch a really big one.

The price action in mining stocks looks encouraging, but the situation in the silver market is clearly bearish and the same goes for silver stocks. Gold has not confirmed the breakout above the long-term resistance line and the first major Fibonacci retracement remains unbroken. In our opinion, what happened in mining stocks is much less important than it seems.

If we see a meaningful confirmation of the bearish case (for instance, a decline on strong volume or a breakdown in the HUI Index), we will likely think that increasing the size of the short position might be a good idea. Naturally, in case of an invalidation of the bearish outlook, we will keep you – our subscribers - informed as well.

To summarize:

Trading capital: In our opinion a short position (half) in gold, silver and mining stocks is justified from the risk/reward point of view. We are planning to profit on a significant downswing, so the stop-loss orders that are appropriate in our opinion are not that close (however, if something invalidates the bearish outlook, we will let you know ASAP, even if stop-loss orders are not reached).

Stop-loss orders for the short position:

- Gold: $1,307

- Silver: $21.20

- GDX ETF: $27.20

Long-term capital: No positions.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA