Briefly: In our opinion opening small (half) speculative short positions in gold, silver and mining stocks is now justified from the risk/reward perspective.

The precious metals market once again hasn’t done much yesterday, but the intra-day action was quite interesting and so was the action in the USD Index. Let’s take a closer look (charts courtesy of http://stockcharts.com).

Since there was no change in case of the daily closing price it’s no wonder that the medium-term outlook hasn’t changed and that what we wrote yesterday remains up-to-date:

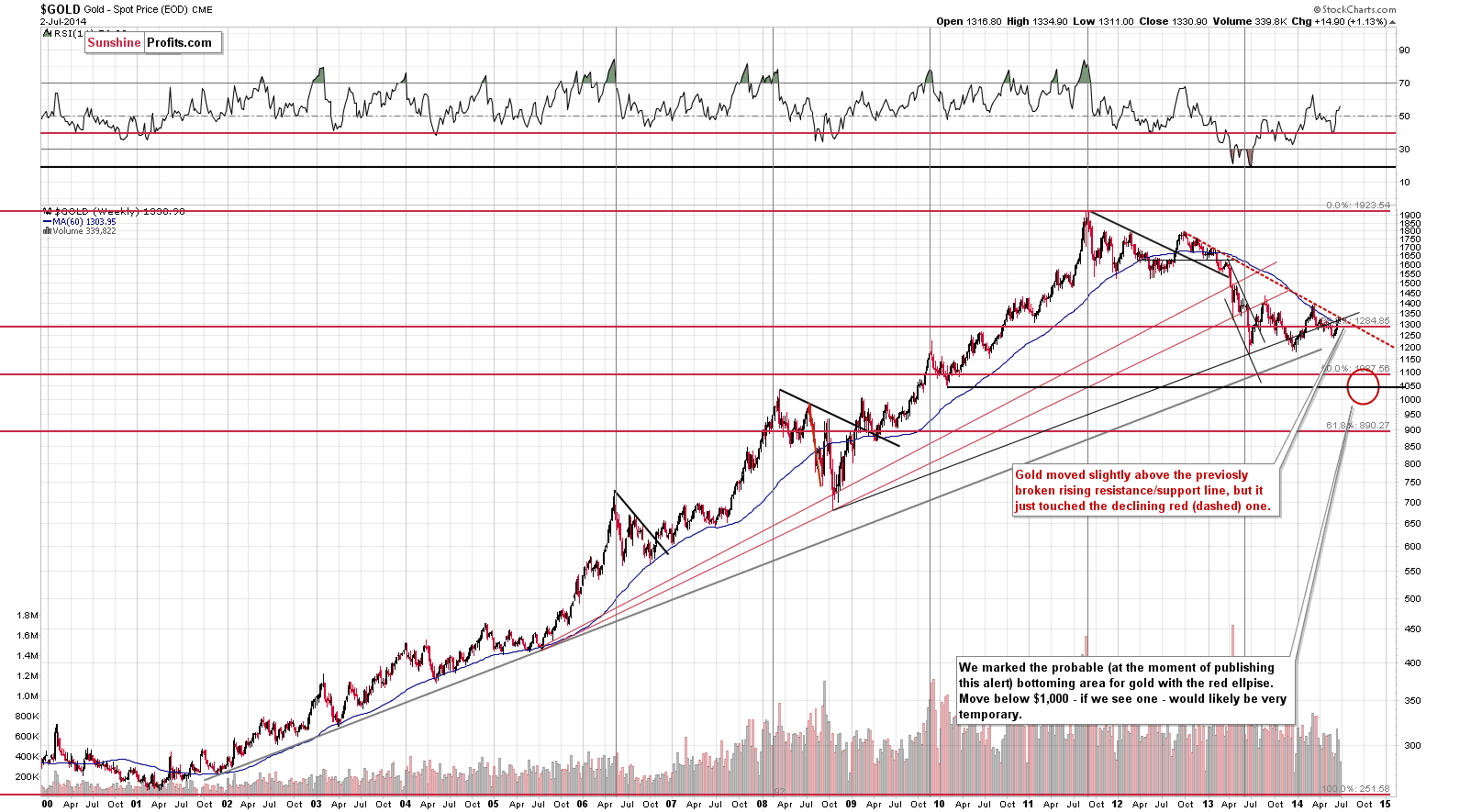

On the long-term chart we see that even though gold moved higher – slightly above the rising resistance line – it remained below the declining red (dashed) resistance line. From this perspective, not much changed yesterday. We still think that the medium-term trend remains down.

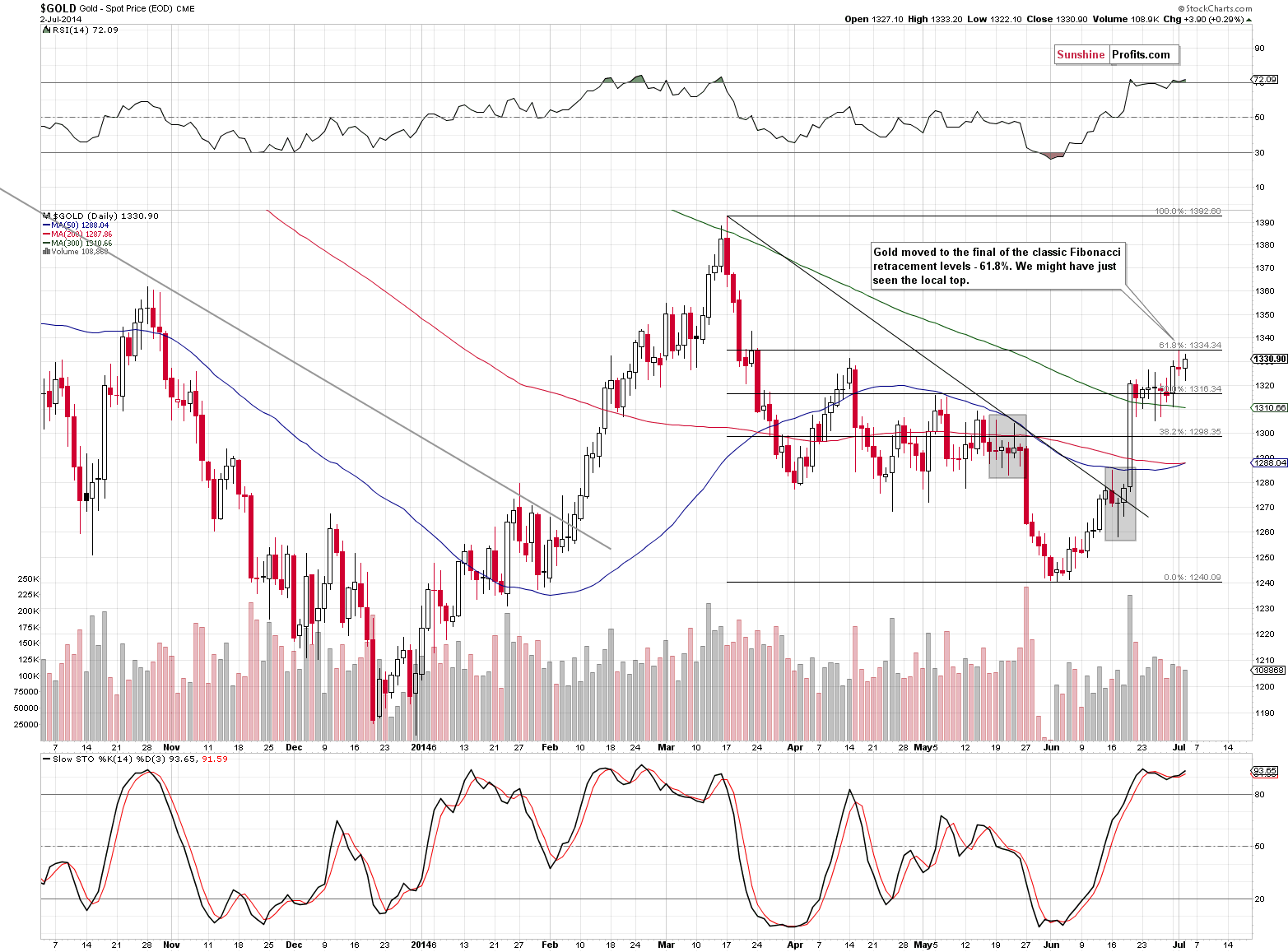

The situation on the short-term chart hasn’t changed either as gold remains below the 61.8% Fibonacci retracement level. Consequently, what we wrote yesterday, remains up-to-date:

On a short-term basis, we can see the significant intra-day action that we mentioned in the opening paragraph of the alert. Gold moved temporarily to the 61.8% Fibonacci retracement level and then moved back down. That’s an important short-term target and it could be the case that we have just seen a local top. The RSI indicator is overbought, supporting the bearish outlook.

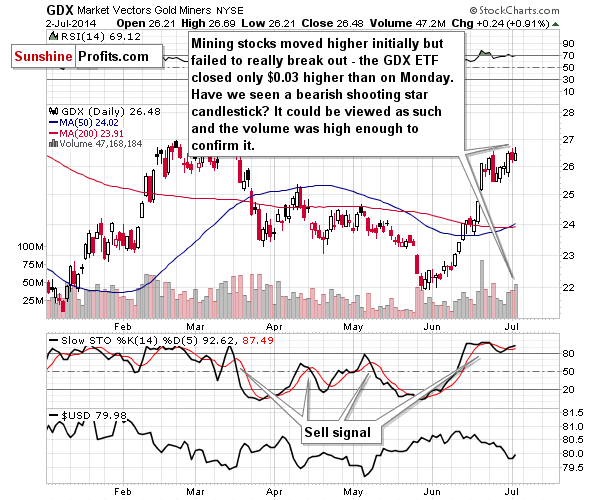

The situation in the mining stocks is different now than it was based on the previous closing prices, but the implications remain in place. Yesterday, we saw an intra-day reversal in the form of a shooting star candlestick, which is a bearish sign. The significant volume confirms the bearish outlook even though the closing price was higher yesterday than on the previous day.

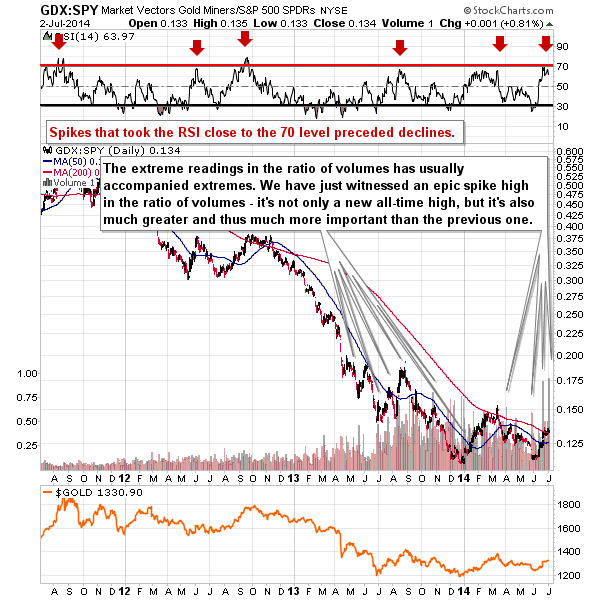

The spike in the ratio of volumes (GDX:SPY) usually signals extremes for the mining stocks and we have just seen a record value. The RSI is close to the 70 level (the sell signal was seen just several days ago) so the odds are that what we saw was a bearish sign.

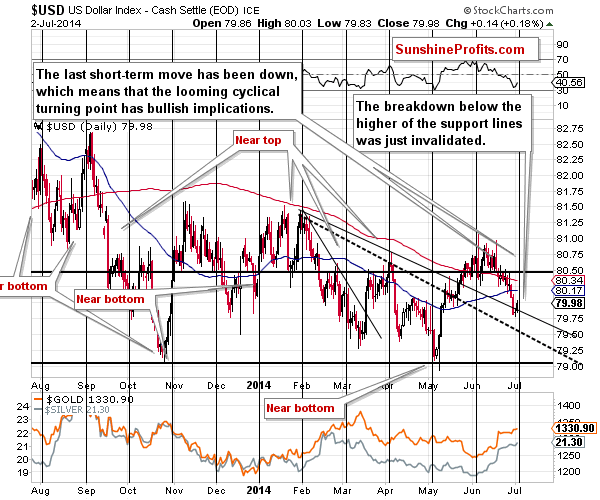

Meanwhile, the thing that changed in case of the USD Index was its turnaround and the invalidation of the breakdown below the upper of the declining resistance lines. It happened almost right at the cyclical turning point so it seems to us that we have already seen the local bottom here and that we will see higher values of the USD index in the coming days and weeks (we could have a bit more weakness in the next few days, though, but that’s not that likely).

The implications of the above are bearish for the precious metals sector. Just as the beginning of June marked a local bottom in gold, silver, and mining stocks, it looks like the beginning of July marks the beginning of a downturn.

Summing up, the situation on the precious metals market has deteriorated based on Tuesday’s and Wednesday’s price action – gold reached 2 important resistance levels (the declining red line and the 61.8% Fibonacci retracement), its intra-day reversal and mining stocks’ underperformance seen on Tuesday (especially given a daily rally on the stock market). The additional bearish confirmation comes from the analysis of the USD Index, its support lines and cyclical turning point that is upon us.

To summarize:

Trading capital (our opinion): Short (half) position in gold, silver and mining stocks with the following stop-loss levels (we are moving the stop-loss for silver a bit higher based on yesterday’s intra-day volatility):

- Gold: $1,343

- Silver: $21.63

- GDX ETF: $27.30

Long-term capital: No positions

Insurance capital: Full position

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts