Briefly:

Intraday trade: The S&P 500 lost 2.7% on Monday, after opening 0.7% lower. The market will probably open slightly higher today. We may see another attempt at retracing some of the recent declines. But there have been no confirmed positive signals so far.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Today's Stock Trading Alert will be shortened again. We apologize for inconvenience.

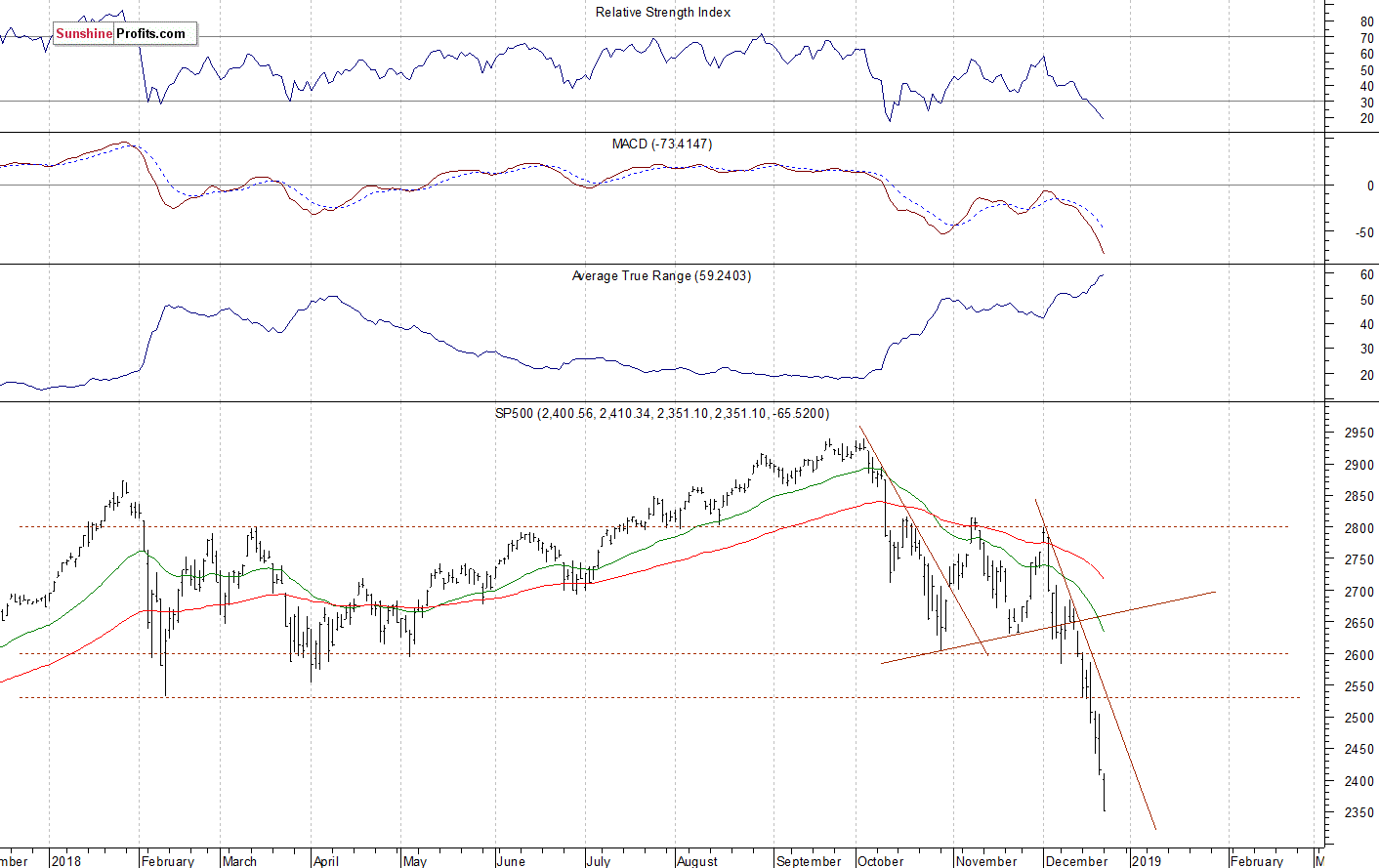

The U.S. stock market indexes lost 2.2-2.9% on Monday, as they accelerated their sell-off following Monday's Treasury Secretary Mnuchin comments, last week's Fed's Rate Decision release and a breakdown below two-month-long consolidation. The S&P 500 index fell the lowest since the late April of 2017 and it traded 20.1% below September the 21st record high of 2,940.91. The daily low was at 2,351.10. The Dow Jones Industrial Average lost 2.9% and the Nasdaq Composite lost 2.2% on Monday.

In today's Gold & Silver Trading Alert we can read that "On Monday, Mnuchin held a conference call with the US regulators to discuss plunging stock market and it was made publicly known. Of course, that was just as effective as a mid-flight announcement that starts with "Don't panic". People panicked. They also ran for the hills, leaving their stock holdings behind."

The broad stock market broke below its two-month-long trading range recently, as the S&P 500 index fell below the level of 2,600. Then the market accelerated lower and it broke below the level of 2,400. The downward correction reached 20% from the September all-time high, surpassing January-February correction of around 12%. Is this a long-term bear market? It still looks like a medium-term downward correction, but the index is now way below the recent consolidation, as we can see on the daily chart:

Concluding, the S&P 500 index will likely open slightly higher today. We may see an attempt at retracing some of the recent sell-off, because there are very clear short-term technical oversold conditions. Monday's sell-off looked like some panic selling ahead of an upward reversal. But for now there have been no confirmed medium-term positive signals so far.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts