Briefly:

Intraday trade: The S&P 500 index gained 0.4% on Monday, after opening virtually flat. The broad stock market will likely open slightly higher today, but it may extend its fluctuations along the resistance level of around 2,850. We prefer to be out of the market, avoiding low risk/reward ratio trades.

Trading position (short-term; our opinion): short positions in the S&P 500 Index with a stop-loss order at 2,875 and the initial downside target at 2,768 are justified from the risk/reward perspective.

Our intraday outlook is neutral. Our short-term outlook is bearish, and our medium-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes gained between 0.2% and 0.6% on Monday, extending their short-term uptrend, as investors' sentiment remained bullish. The S&P 500 index broke slightly above its late July local high and it got the highest since the late January. It currently trades just 0.7% below the January's 26th record high of 2,872.87. The Dow Jones Industrial Average gained 0.2% and the technology Nasdaq Composite gained 0.6% yesterday.

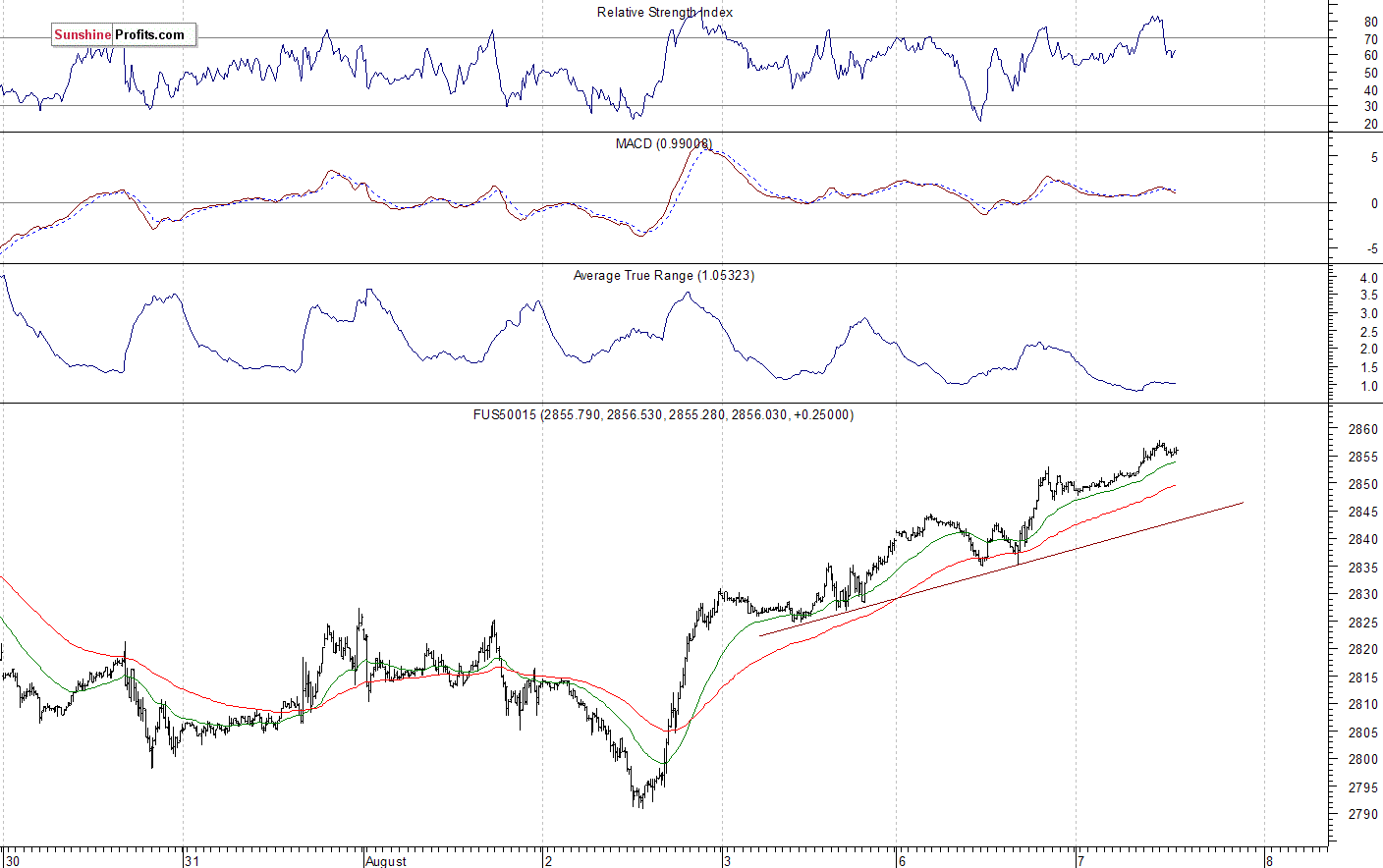

The nearest important level of support of the S&P 500 index is now at 2,825-2,835, marked by the recent local lows. The next support level is at around 2,800, marked by the previous resistance level. On the other hand, the nearest important level of resistance is at 2,850, marked by the late July local highs. The next resistance level is at around 2,870-2,875, marked by the mentioned January's all-time high.

The broad stock market got closer to its January's record high, as investors' sentiment improved following quarterly corporate earnings, economic data releases. The S&P 500 index broke above the level of 2,800, but then it failed to continue above 2,850. It is at 2,850 mark again. But will it continue higher? There are still two possible medium-term scenarios - bearish that will lead us towards the February low again, and the bullish one - breakout higher towards 3,000 mark. The latter one is getting more and more real. The S&P 500 index still seems to be "climbing a wall of worries" here:

Positive Expectations Again

The index futures contracts trade between +0.2% and +0.3% vs. their Monday's closing prices. So the expectations before the opening of today's trading session are positive again. The main European stock market indexes have gained 0.8-0.9% so far. There will be no new important economic data announcements today. The S&P 500 index will probably slightly extend its short-term uptrend today. However, we may see some short-term uncertainty and profit-taking action following breakout above the resistance level of 2,850.

The S&P 500 futures contract trades within an intraday uptrend, as it slightly extends its yesterday's advance. The nearest important level of support is at around 2,850, marked by the recent resistance level. The level of support is also at 2,835-2,840, marked by yesterday's local lows. On the other hand, potential level of resistance is at 2,870-2,880. The futures contract remains above its short-term upward trend line, as the 15-minute chart shows:

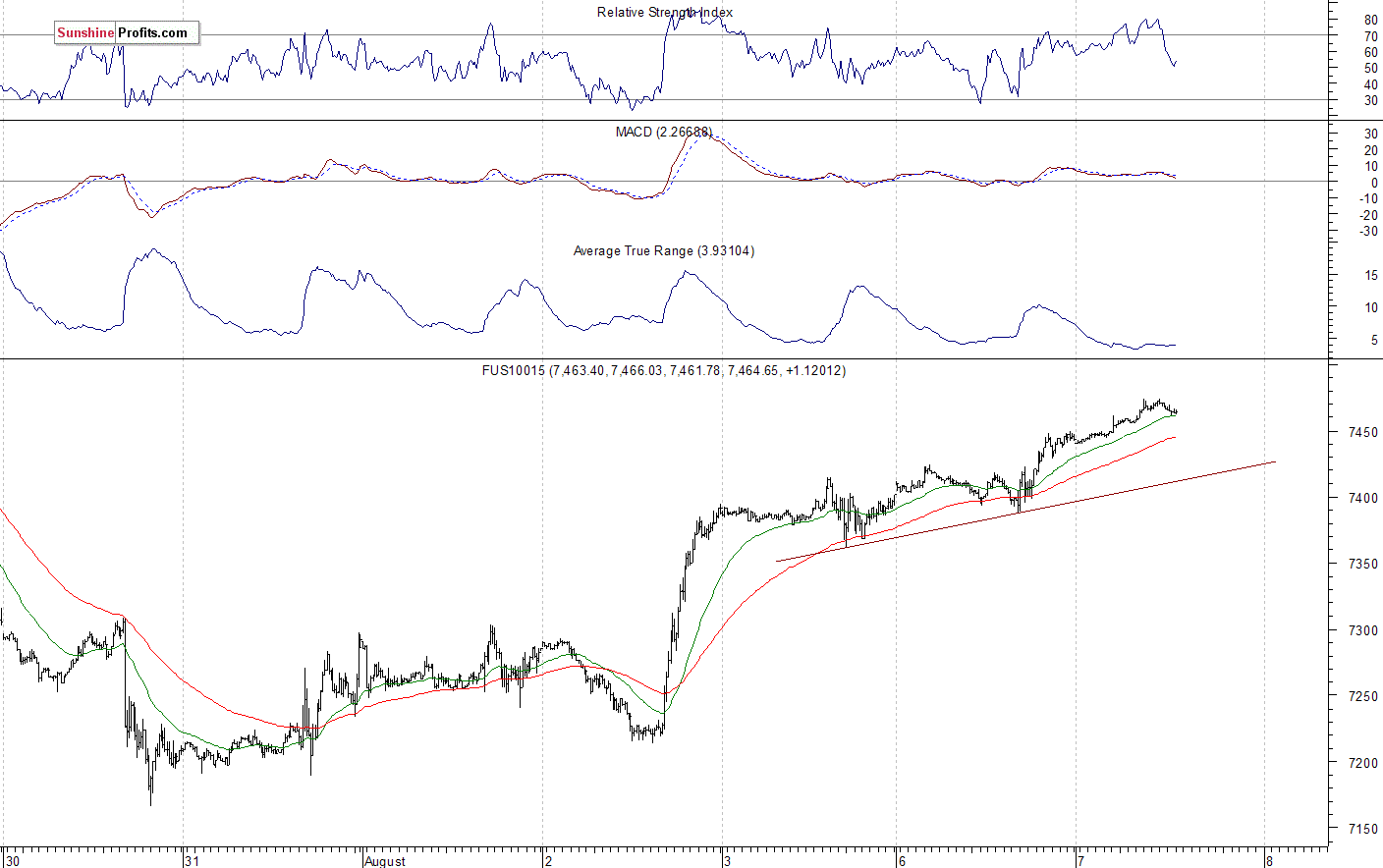

Nasdaq Gets Closer to 7,500

The technology Nasdaq 100 futures contract follows a similar path, as it extends its short-term uptrend. The market gets closer to the late July record high of around 7,530. Will it get back above 7,500 mark? It's hard to say. But there have been no confirmed negative signals so far. The nearest important level of resistance is at around 7,470, marked by the previous local high. On the other hand, support level is at 7,350-7,400, among others. The Nasdaq futures contract is now slightly above the level of 7,450, as we can see on the 15-minute chart:

Big Cap Tech Stocks Still on the Run

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock continued its uptrend yesterday, as it reached yet another new record high closer to the level of $210. Will it continue higher despite some clear short-term technical overbought conditions? There have been no confirmed negative signals so far. The nearest important level of support is now at $190-200, marked by the previous resistance level:

Now let's take a look at Amazon.com, Inc. stock (AMZN) daily chart. It reached the new record high above the level of $1,850 recently, but then it retraced some of the rally. The nearest important level of resistance remains at around $1,850. On the other hand, support level is at $1,750, marked by the medium-term upward trend line:

Dow Jones Still Close to 25,500

The Dow Jones Industrial Average extended its fluctuations along the level of 25,500 last week. Yesterday, the blue-chip stocks index closed almost exactly there. For now, it looks like some relatively flat correction within an uptrend. The nearest important level of support remains at around 25,000, marked by the previous local lows. On the other hand, level of resistance is at 25,600, among others:

The S&P 500 index got the highest since the late January yesterday. The broad stock market continued its short-term uptrend despite some technical overbought conditions. So will the uptrend extend? There have been no confirmed negative signals so far, but the index is getting closer to the resistance level, marked by the late January record high of 2,872.87.

Concluding, the broad stock market will likely open higher again. The S&P 500 index is breaking above 2,850 mark, but we may see some uncertainty as it gets closer to the resistance level of around 2,870-2,875.

Intraday trade:

No intraday position is justified from the risk/reward perspective today.

Trading position (short-term; our opinion): short positions in the S&P 500 Index with a stop-loss order at 2,875 and the initial downside target at 2,768 are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts