Trading position (short-term; our opinion): short positions in the S&P 500 Index with a stop-loss order at 2,875 and the initial downside target at 2,768 are justified from the risk/reward perspective.

As you know, Paul Rejczak is out of the office until August 3rd, but we didn’t want to keep you entirely without information regarding the stock price movement before that time, so we will provide you with occasional brief analyses anyway.

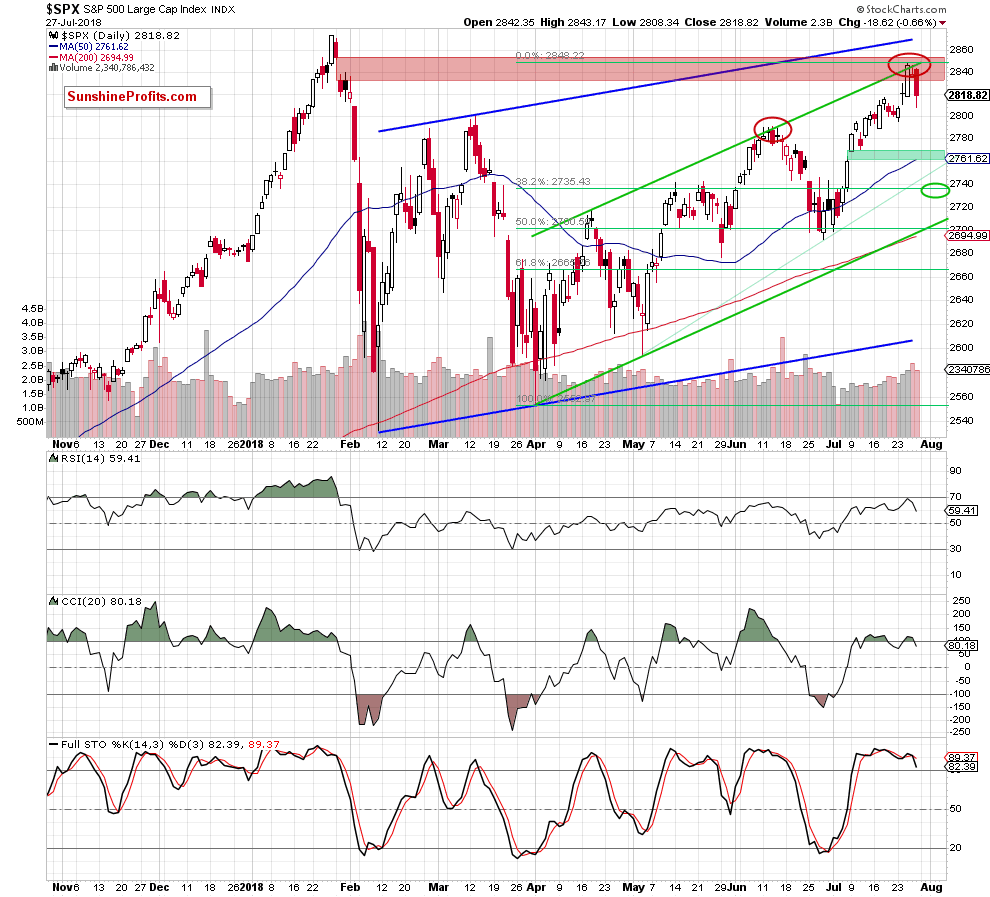

Let’s examine the short-term changes on the chart below (charts courtesy of http://stockcharts.com).

In our Thursday’s Stock Trading Alert, we wrote the following:

(…) breakout above the upper border of the short-term green rising trend channel. Positive sign? Of course, but only at first glance and we have several arguments for it.

(…) although the S&P broke above this resistance, we should keep in mind that the index climbed to the red resistance zone based on the quite big gap created at the end of January.

(…) at the turn of January and February, the bulls tried to return to higher levels, but their dreams of a new speak quickly fell, because the above-mentioned gap proved to be an impassable barrier. As a result, the index moved sharply lower in the following days, erasing over two-month increases.

Such price action suggests very clearly that as long as the gap is open fresh peaks are not likely to be seen and another reversal from current levels should not surprise us.

We also added that (…) a very similar situation has already happened in the past (we marked both of them with the red ellipses). Back then (in mid-June), the buyers also reached the upper line of the green rising trend channel, but despite several attempts to move higher, they failed, which resulted in a quite sizable correction in the following days.

Additionally, we emphasized that (…) the current position of the daily indicators also increases the probability of a reversal in the very near future. Why? Because, the RSI climbed to its highest level since late January, which suggests that the space for its gains may be limited (please keep in mind what happened back then with stocks). The CCI came back to its overbought area, while the Stochastic Oscillator is still wavering above 90, which raises some concerns about the place to its grow. On top of that, there are bearish divergences between them (the last two indicators), which doesn’t bode well for the rally.

What happened since the time we posted that alert?

The situation developed in tune with our assumptions and the S&P declined after Thursday’s unsuccessful attempt to break above the upper border of the green rising trend channel. More specifically, Thursday's price action was a verification of the earlier breakdown, which encouraged the sellers to act.

Thanks to their attack, the index erased almost entire Wednesday’s upswing, while the RSI turned south, the CCI and the Stochastic Oscillator generated the sell signals, giving the bears even more reasons to push the S&P lower in the coming week.

How low could the index go?

In our opinion, if the sellers extend losses from current levels, we’ll see a drop to (at least) around 2,768, where the upper border of the green gap (created on July 9 and reinforced by the 50-day moving average) is. Nevertheless, if it is closed, the S&P will likely test the 38.2% Fibonacci retracement (around 2,735) or even the lower border of the green rising trend channel, which is currently around 2,700, where the lows that we saw at the turn of June and July are.

Taking all the above into account, we believe that opening short positions is justified from the risk/reward perspective now. All the details you need are presented below.

Trading position (short-term; our opinion): short positions with a stop-loss order at 2,875 and the initial downside target at 2,768 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts