Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,540 price level, with a stop-loss level of 4,680 (we decided to move it a bit higher to keep our position in the market and to maintain a favorable risk/reward ratio vs. the mentioned entry price level on Monday; that's the only time we adjust the stop-loss level) and 4,400 as an initial price target.

Stocks slightly extended their uptrend on Monday and the S&P 500 index remained above the 4,600 level. Is this still a topping pattern?

For in-depth technical analysis of various stocks and a recap of today's Stock Trading Alert we encourage you to watch today's video.

Video Technical Breakdown is a new addition to the STA, distributed on Tuesday and Thursday along with the premium analysis, to keep you, our subscribers, well-informed with everything happening on the charts.

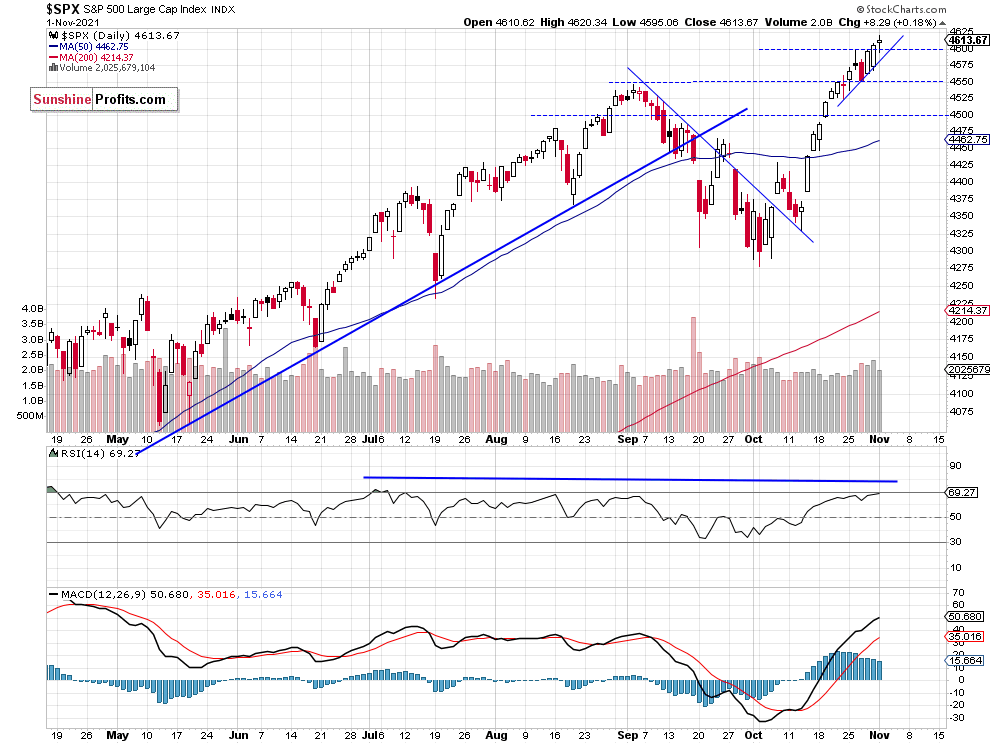

The S&P 500 index gained 0.18% on Monday, Nov. 1, after gaining 0.19% on Friday. The market reached the new record high of 4,620.34 yesterday. The MSFT and TSLA stocks drove the index higher again while the AAPL and AMZN were relatively weak following their last week’s worse-than-expected quarterly corporate earnings releases. The market seems overbought in the short-term most likely it’s still trading within a topping pattern.

The nearest important support level is now at 4,600 and the next support level is at 4,550-4,570. On the other hand, the resistance level is now at around 4,650. The S&P 500 trades above a short-term upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Is a Short Position Still Justified?

Let’s take a look at the hourly chart of the S&P 500 futures contract. In mid-October the market broke above its downward trend line and it broke above its previous local high of around 4,470. On Friday it broke above the resistance level of around 4,600. Since the previous Friday, the price is trading above a short-term upward trend line.

The market seems overbought and poised for a correction. Therefore, we still think that a speculative short position is justified from the risk/reward perspective. To keep our position in the market and to maintain a favorable risk/reward ratio vs. the entry price level we decided to move a stop-loss level a bit higher on Monday. That's the only time we adjust the stop-loss level. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index reached yet another new record high on Monday, however it closed with a gain of just 0.2% again. It still looks like a topping pattern and we may see a consolidation or a downward correction at some point. There may be a profit-taking action following quarterly earnings releases. Today the main indices are expected to open virtually and we will likely see an intraday consolidation.

Here’s the breakdown:

- The S&P 500 reached new record high on Monday, as it remained above the 4,600 level.

- A speculative short position is still justified from the risk/reward perspective.

- We are expecting a 3% or higher correction from the new record highs.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,540 price level, with a stop-loss level of 4,680 (we decided to move it a bit higher to keep our position in the market and to maintain a favorable risk/reward ratio vs. the mentioned entry price level on Monday; that's the only time we adjust the stop-loss level) and 4,400 as an initial price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care