Briefly:

Intraday trade: The S&P 500 gained 1.1% on Friday, after opening 0.5% higher. The market will probably open lower today. We may see a short-term consolidation following the recent rally.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

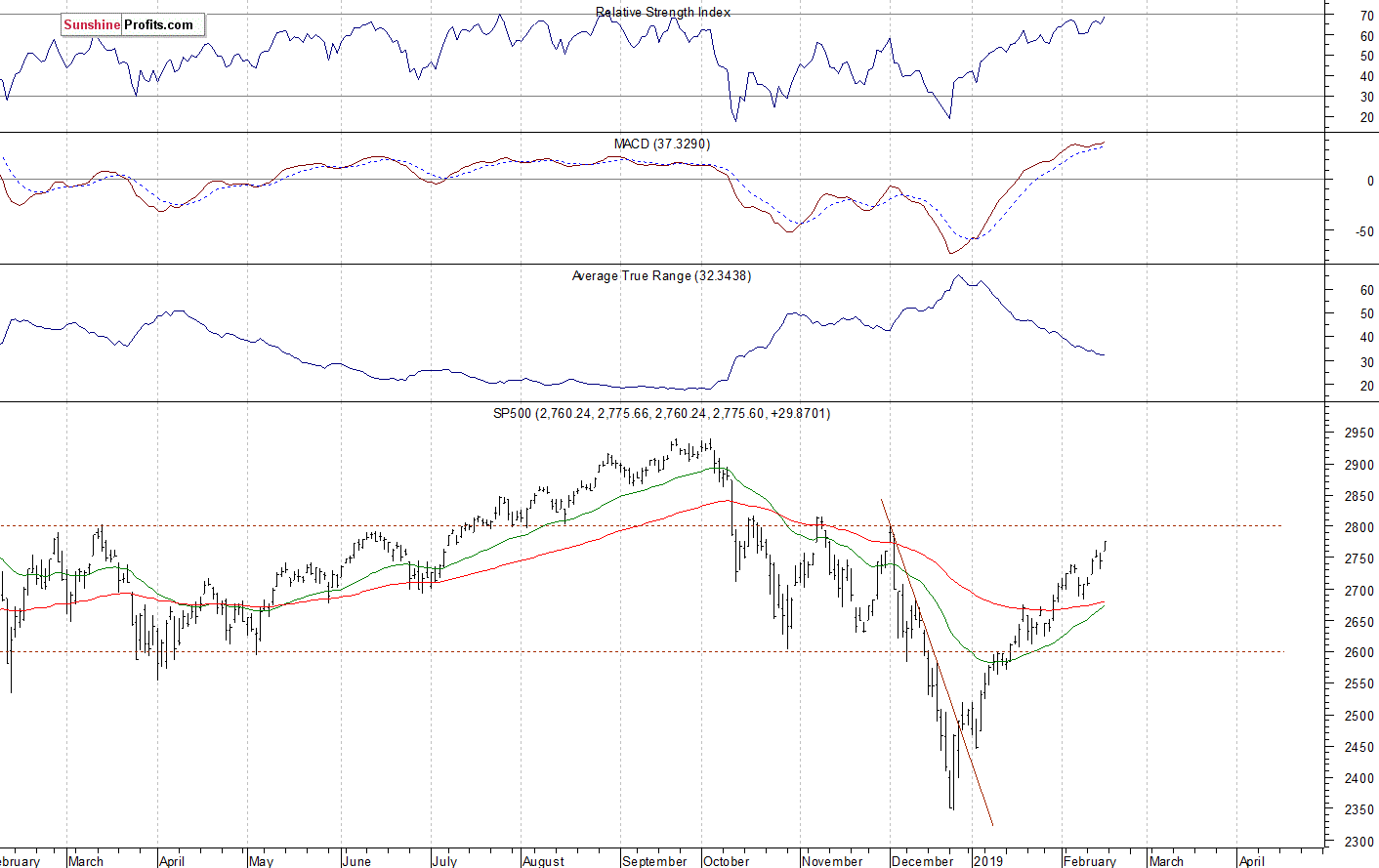

The U.S. stock market indexes gained 0.6-1.8% on Friday, as investors' sentiment further improved despite some clear short-term technical overbought conditions. The S&P 500 index retraced more of its October-December downward correction of 20.2% (2,713.88) recently. It got closer to the previous local highs along the 2,800 level. The Dow Jones Industrial Average gained 1.8% and the Nasdaq Composite gained 0.6% on Friday.

The nearest important resistance level of the S&P 500 index remains at around 2,785-2,800, marked by the previous medium-term local highs. On the other hand, the support level is now at around 2,760, marked by Friday's daily gap up of 2,757.90-2,760.24. The support level is also at 2,720, marked by the last Tuesday's daily gap up of 2,718.05-2,722.61.

The broad stock market retraced almost all of its December sell-off and it got closer to the medium-term resistance level of around 2,800, marked by the October-November local highs. So is it still just a correction or a new medium-term uptrend? The market broke above the 61.8% Fibonacci retracement of the 20% decline. And we may see an attempt at getting back to the record highs. But will the index break above the mentioned previous local highs? There have been no confirmed negative signals so far:

Uncertainty Following the Rally

Expectations before the opening of today's trading session are negative, because the index futures contracts trade between -0.3% and -0.5% vs. their Fridays closing prices. The European stock market indexes have lost 0.3-0.6% so far. Investors will wait for the NAHB Housing Market Index release at 10:00 a.m. The broad stock market will likely fluctuate following its Friday's rally. We may see some uncertainty, as the market remains close to the medium-term resistance level.

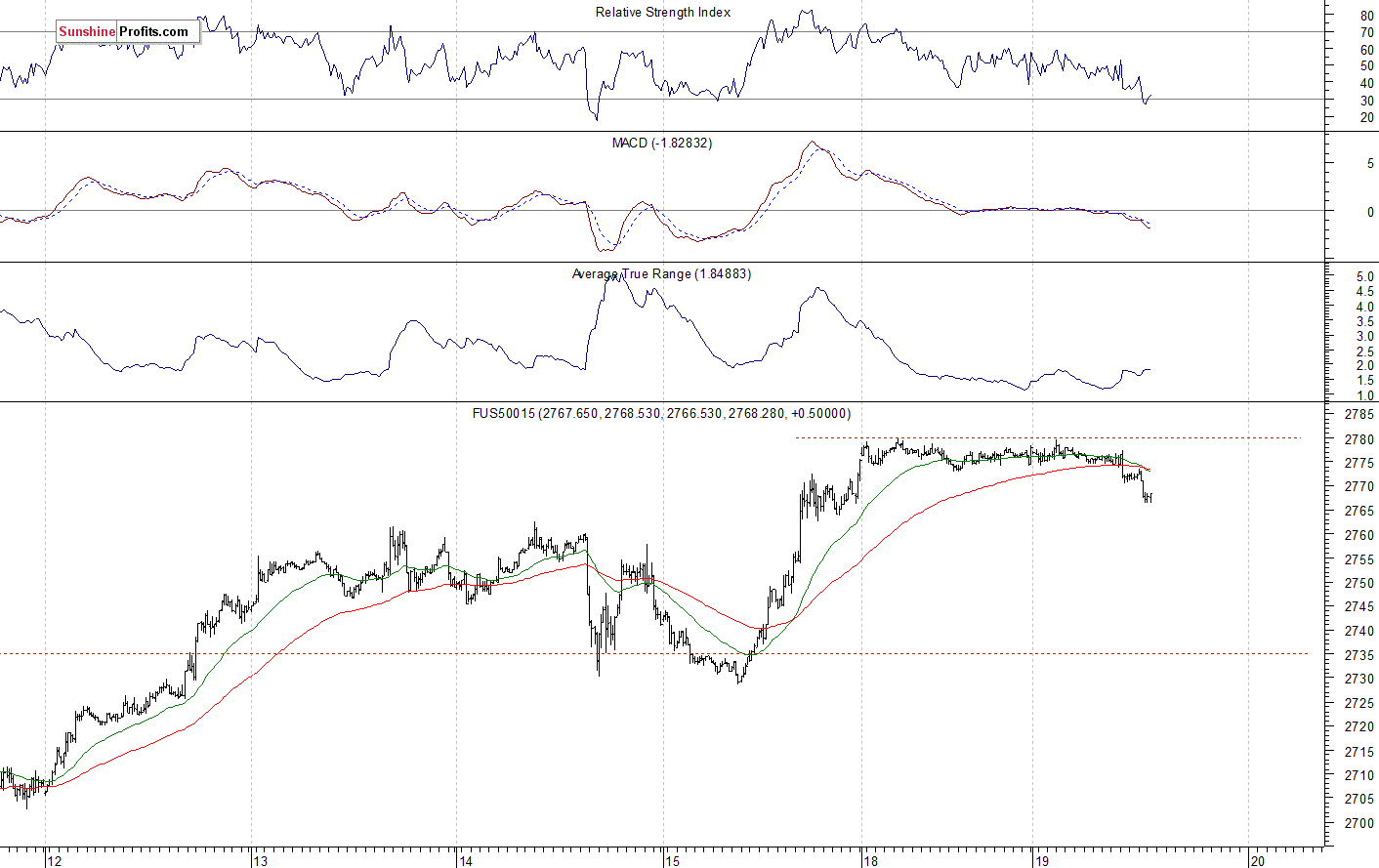

The S&P 500 futures contract trades within an intraday downtrend, as it retraces some of the Friday's advance. The nearest important level of resistance is at around 2,70, marked by the short-term local highs. On the other hand the support level is at 2,760-2,765, marked by the previous resistance level. The futures contract bounced off the short-term resistance level, as we can see on the 15-minute chart:

Nasdaq Remains Above 7,000

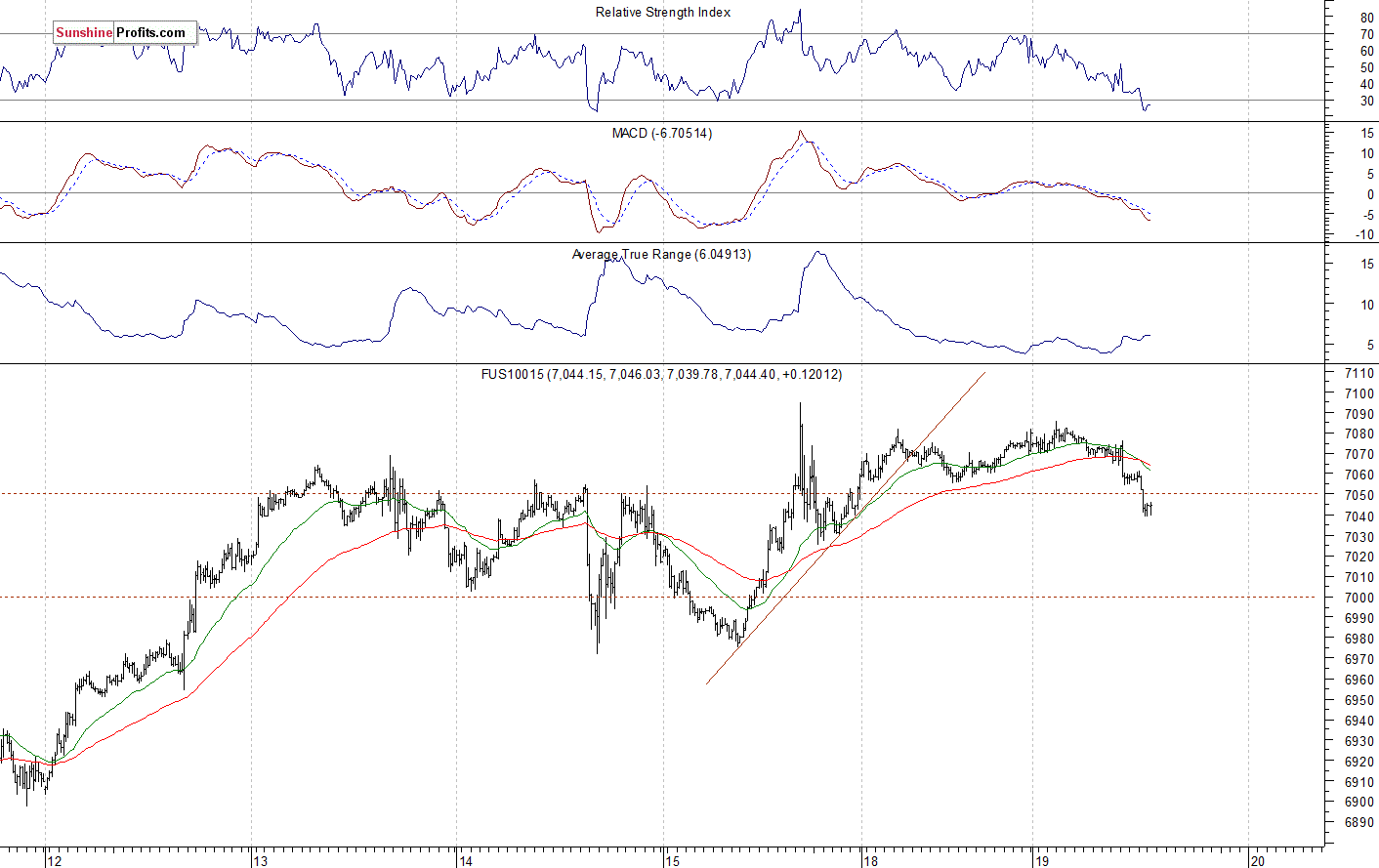

The technology Nasdaq 100 futures contract follows a similar path, as it retraces some of its Friday's advance. The market gained more than 1,250 points from December the 26th local low of around 5,820. The nearest important resistance level is now at 7,050-7,150. The support level is at 6,950-7,000, among others. The Nasdaq futures contract trades at its previous local highs, as the 15-minute chart shows:

Apple, Amazon - Sideways Trading Action

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). Apple released its quarterly earnings recently. Then the stock broke above the recent trading range and the resistance level of $155-160. It retraced some more of its November-December sell-off. But then it bounced off $175, retracing some of the recent advance. It still looks like a short-term downward correction:

Now let's take a look at the daily chart of Amazon.com, Inc. (AMZN). The market broke above one of its three-month-long downward trend lines more than a month ago. Since then it has been going sideways. There is a resistance level at around $1,700-1,750. Recently it bounced off that resistance level following the quarterly earnings release. The stock got closer to the downward trend line again, but then it came back slightly lower again. Overall, it looks like a sideways trend:

Dow Jones Rallied on Friday

The Dow Jones Industrial Average extended its short-term uptrend on Friday. The blue-chip stocks' gauge is at the resistance level of 25,500-26,000. So will it continue higher and reach the record high? Or reverse lower in the near term? There have been no confirmed negative signals so far:

The S&P 500 index extended its short-term uptrend on Friday, as it got closer to the medium term resistance level of around 2,800. Is this a new medium-term uptrend or still just upward correction before another medium-term leg lower? The market trades above the 61.8% Fibonacci retracement of the whole medium-term decline. There have been no confirmed negative signals so far.

Concluding, the S&P 500 index will likely open lower today. We may see a consolidation following the recent rally. There are still some short-term technical overbought conditions.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care