Trading position (short-term; our opinion): long positions at market (that's 2350 currently) (100% position size) with stop-loss level at 2270 and the initial upside target at 2450. Stay tuned as finetuning the open trade positions' parameters during the day is highly likely.

On the heels of the Fed's unlimited QE promise, the S&P 500 sprang to life finally. All the gains though were given up in less than three hours. As the futures keep climbing overnight, does it herald a turnaround?

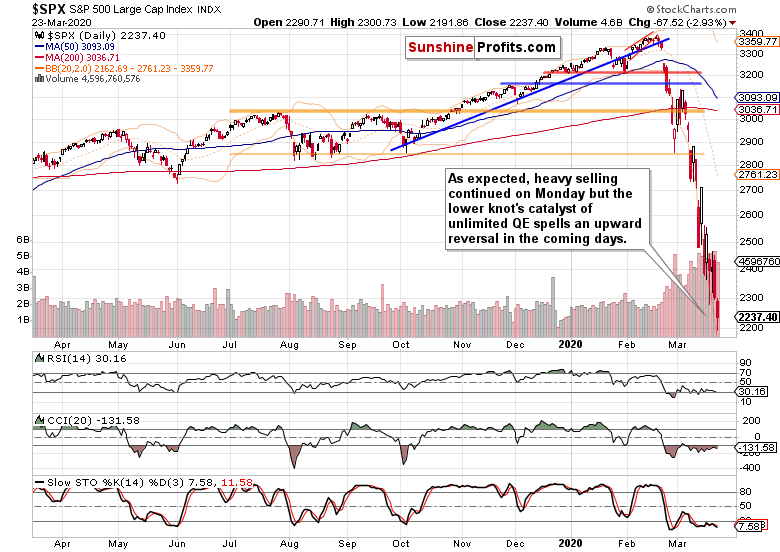

Let's start our analysis with the daily chart examination (chart courtesy of http://stockcharts.com).

Opening with a bearish gap, stocks continued with their slide as can be seen in both the S&P 500 index and the popular SPY ETF. Yet the Fed stepped in again, pledging unlimited QE. Stocks rallied as a result, but gave up all of their gains before too long.

In the overnight session, the futures made it to over 2333. Now, that's an example of some bullish action in the short-term.

Let's remember our yesterday's notes regarding the market breadth indicators:

(...) While they all confirm the bears as being in the driving seat, new highs minus new lows reveals that the sellers aren't as strong as they appear to be when one looks at price action only. The bullish percent index has also curled higher despite new 2020 lows being hit.

As a result, the market breadth indicators indicate a high likelihood of pause in the trend of continuously lower prices. Be it in the form of a sharp rally that runs out of steam relatively fast, or a somewhat more prolonged sideways trading with a bullish bias, it nonetheless justifies our decision earlier today to take the 168-point profit on our short positions off the table.

These observations turned out as expected. The Summary just below captures the short-term outlook accompanied by the trading plan.

Summing up, whilethe bears have the upper hand, the potential for a temporary upswing hasn't decreased despite Friday's slide. And this Fed move might surely stick for longer. The only practical question is whether the rate of new money creation will be faster than the rate of wealth destruction. As the markets like this move, it makes sense to give it the benefit of (short-term and conservative) doubt. Considering the risk-reward perspective, please see our game plan within the Trading position section.

Trading position (short-term; our opinion): long positions at market (that's 2350 currently) (100% position size) with stop-loss level at 2270 and the initial upside target at 2450. Stay tuned as finetuning the open trade positions' parameters during the day is highly likely.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care