Trading position (short-term; our opinion): long positions at market (100% position size) with stop-loss level at 3035 and the binding take-profit at 3120.

Stocks opened on a strong note yesterday, and the bulls have been adding to their gains throughout the day. Forcing a close above the nearest resistance, does it mark the end of selling? In other words, have we seen a lasting turnaround?

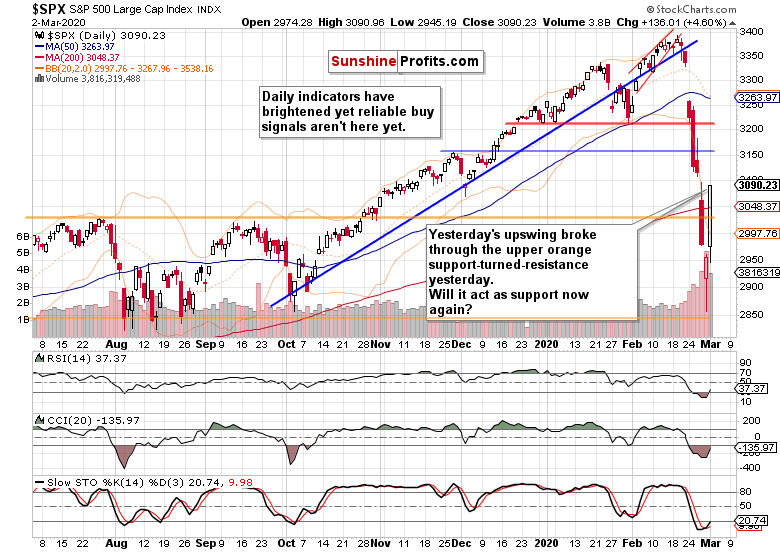

Let's check the weekly chart for whether the current price action fits the bullish interpretation (charts courtesy of http://stockcharts.com).

The price action smacks of invalidation of the breakdown below the lower border of the rising black trend channel. The weekly indicators are starting to turn higher but there're no buy signals to discuss in any kind of depth. And the week is far from over yet. Then, the volume extrapolation doesn't seem to be on track to outshine the volume of last week's bloodbath.

These points raise question marks over the strength of the current rebound.

How has yesterday's session changed the daily chart?

While the bears attempted to close the opening bullish gap yesterday, the bulls countered powerfully, and stocks broke through the upper orange support-turned-resistance. Despite stocks closing at the daily highs, the volume of yesterday's downswwing was lower than that of either two preceding trading days.

That makes it likely that yesterday's gains will be reversed before too long. CCI is still at readings marking strong downtrends, while the RSI disagrees and sends a bullish message instead.

While Stochastics is still in its oversold territory, it has flashed a buy signal already. As the oscillator hadn't yet left the oversold area though, acting on its buy signal can lead to a whipsaw. A pretty mixed bag, these daily indicators.

Let's quote our yesterday's observations as they are still valid today:

(...) looking at the overall picture the indicators are sending, it indeed appears premature to buy with confidence right now.

Look, the market is weighing the expectations of a monetary policy response to cushion the coronavirus blow. With the Fed meeting being two weeks away, and expectations of a hefty rate cut baked into the cake, it appears quite likely that the bears will at some point test the bulls' resolve. As a result, there would be more short-term risk to the downside rather than to the upside.

But is it the case right now?

With the S&P 500 futures changing hands at around 3075 currently, the buyers are set to open with a bullish gap. And we don't expect a ground-breaking announcement that would derail further gains today. Remember, yesterday's upswing hasn't fizzled out during the day, and broke back above an important resistance. While the invalidation is still unconfirmed, it deserves the benefit of the doubt as the bulls are likely to add some more to their prior gains.

As a result, opening long positions with a tight stop-loss appears to be justified at the moment of writing these words. The probable upswing offers us a favorable setup from the risk reward point of view. You can find the position details below.

Summing up, the medium-term S&P 500 outlook has improved with yesterday's price action, and while more downside remains probable before this correction is over both in time in in price, the very short-term balance of forces appears to favor the bulls. The monetary policy response expectations haven't been questioned yet, and there hasn't been any coronavirus-related development that would send stocks into a tailspin. Therefore, opening long positions is justified from the risk-reward perspective.

Trading position (short-term; our opinion): long positions at market (100% position size) with stop-loss level at 3035 and the binding take-profit at 3120.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care