Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Intraday outlook: The broad stock market will likely open virtually flat to slightly higher today. The S&P 500 index may extend its three-week-long consolidation. We could see more short-term volatility.

The U.S. stock market indexes gained 1.1-1.3% on Monday, as they retraced some of their Friday's sell-off. The S&P 500 index retraced almost all of its recent advance and it got back to the short-term local lows on Friday. The broad stock market's gauge is now 4.9% below July the 26th record high of 3,027.98. The Dow Jones Industrial Average gained 1.1% and the Nasdaq Composite gained 1.3% on Monday.

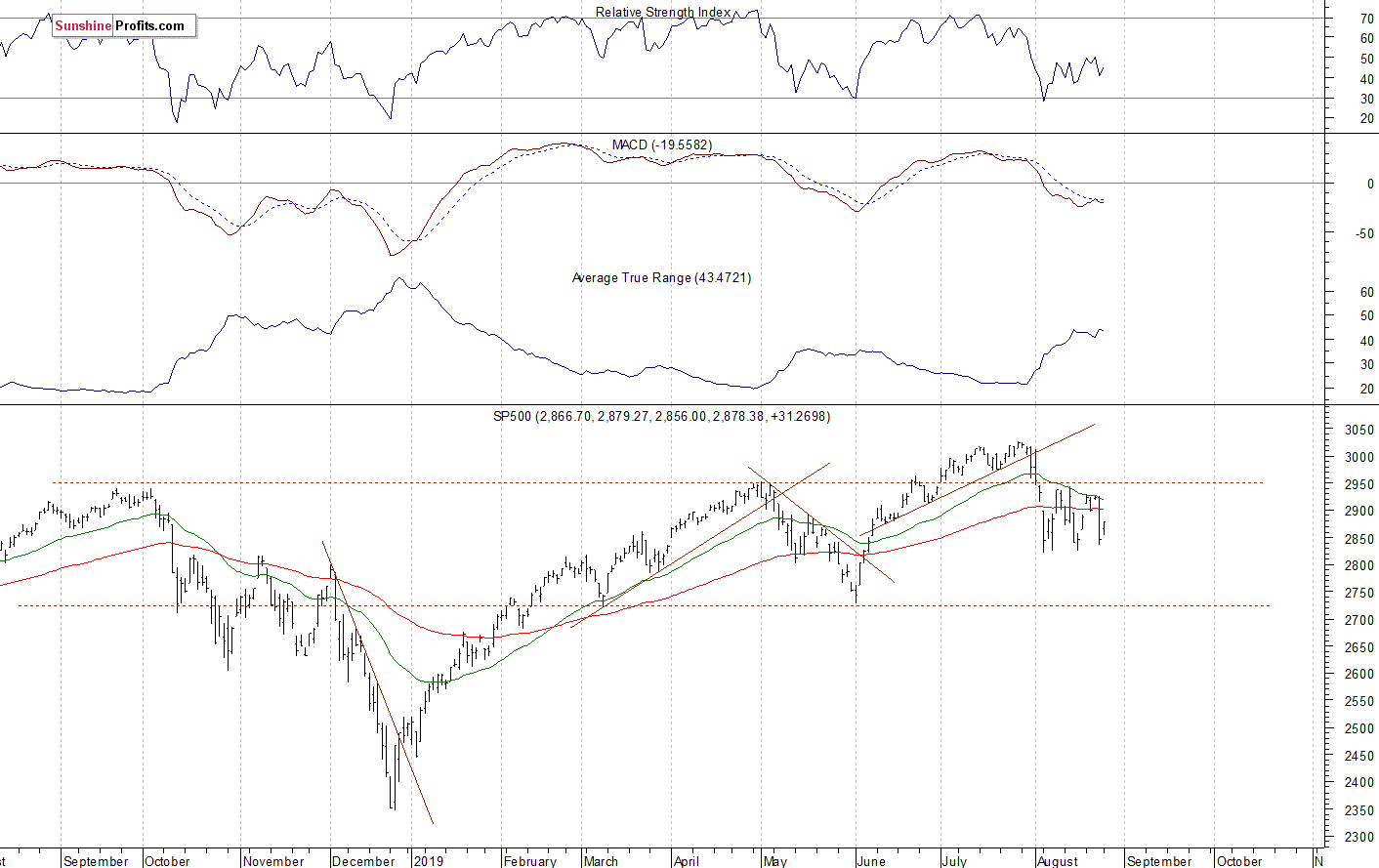

The nearest important resistance level of the S&P 500 index is now at 2,900-2,920, marked by the recent local highs. On the other hand, the support level is at 2,850-2,860. The next support level is at 2,820-2,825, marked by the previous lows.

The broad stock market broke below its two-month-long upward trend line in early August, and then it quickly retraced most of the June-July advance. The S&P 500 index continues to trade within a consolidation following early August decline:

Flat Expectations, More Fluctuations Ahead?

The index futures contracts trade between +0.1% and +0.2% vs. their Monday's closing prices. So expectations before the opening of today's trading session are virtually flat to slightly positive. The European stock market indexes have been mixed so far. Investors will wait for the Consumer Confidence number release at 10:00 a.m.

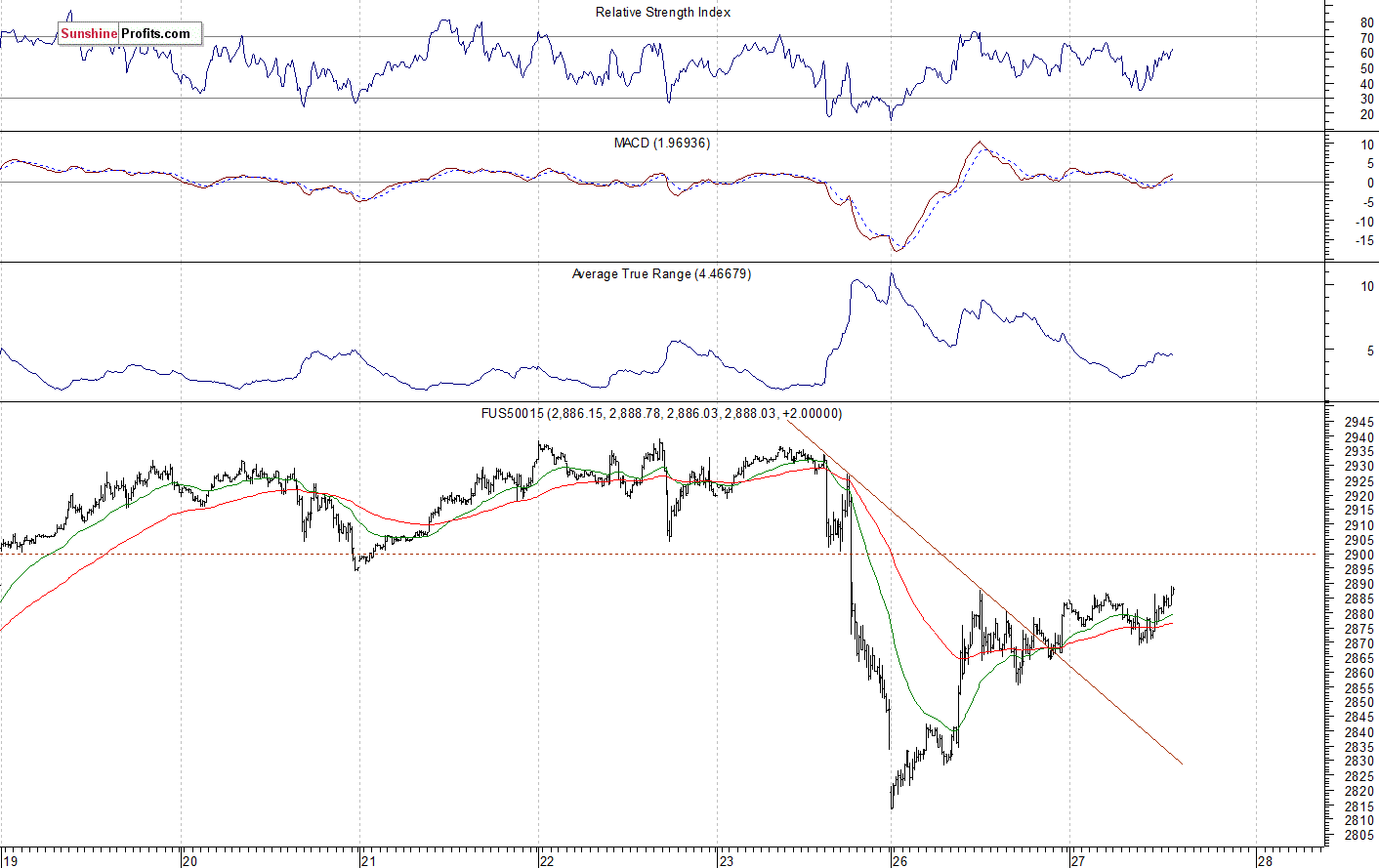

The S&P 500 futures contract trades within an intraday consolidation, as it extends its yesterday's fluctuations. The nearest important resistance level is at 2,890-2,900. On the other hand, the support level is at 2,860-2,865, marked by the short-term local lows. The futures contract remains below its last week's consolidation, as we can see on the 15-minute chart:

Nasdaq 100 Also Going Sideways

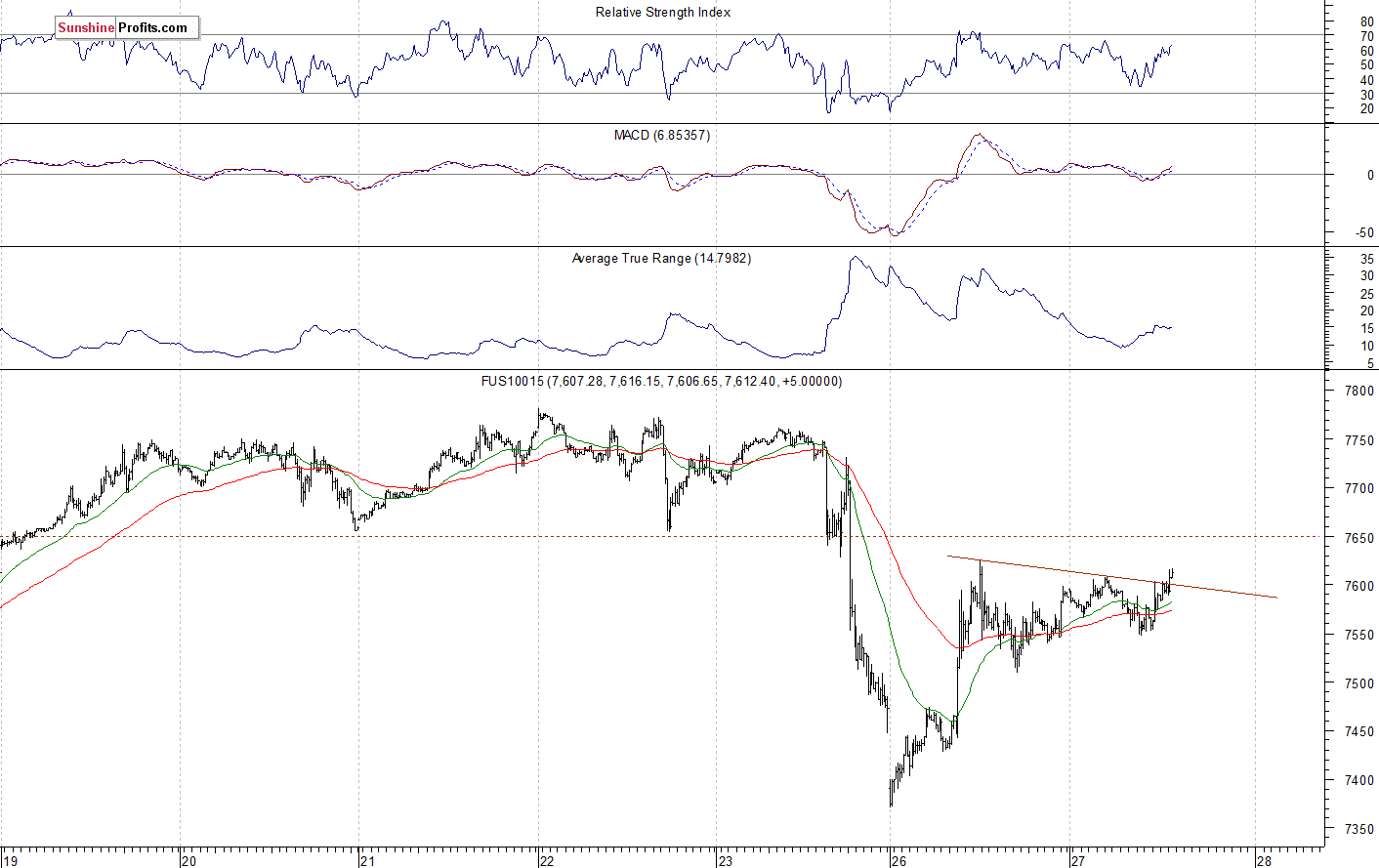

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. It bounced off a support level of 7,350-7,400 again. And the nearest important resistance level remains at around 7,600-7,650. The Nasdaq futures contract extends its short-term fluctuations this morning, as the 15-minute chart shows:

Tech Stocks - Rebounding Off Support Levels Again

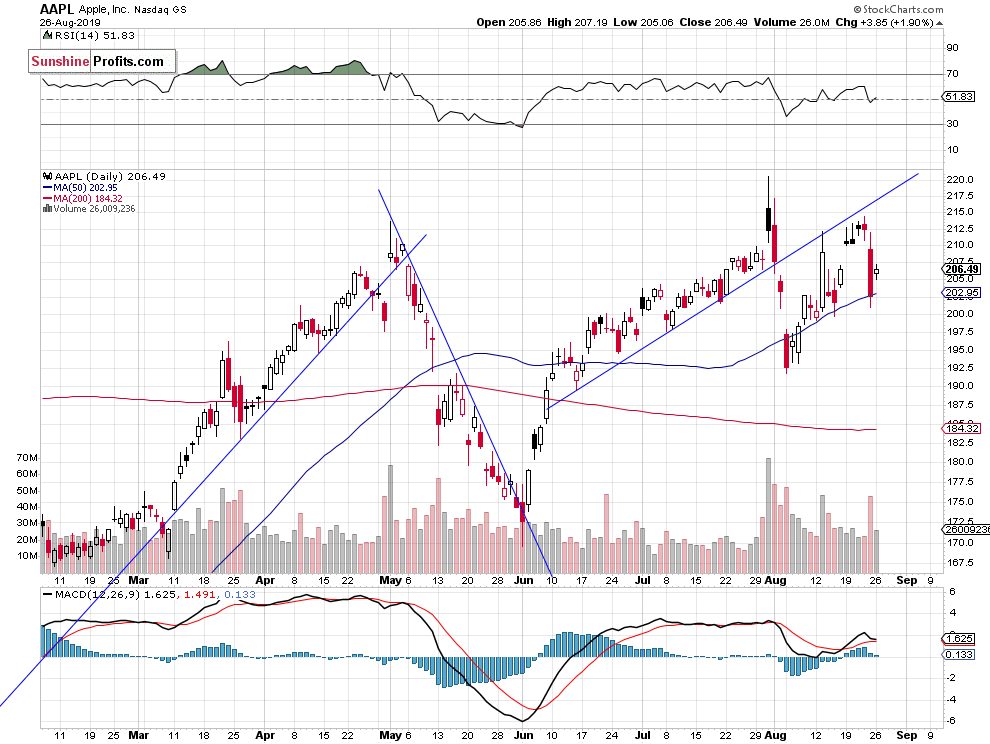

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock sharply reversed its recent upward course on Friday, as it fell closer to the $200 price again. Yesterday it bounced off that support level. The market may extend its volatile fluctuations following the early August breakdown below its two-month-long upward trend line:

Now let's take a look at the daily chart of Microsoft Corp. stock (MSFT). The stock retraced most of its recent advance on Friday, as it fell to a support level of $130-135 again. It still looks like a consolidation within a medium-term uptrend. However, the price remains below its recently broken trend line:

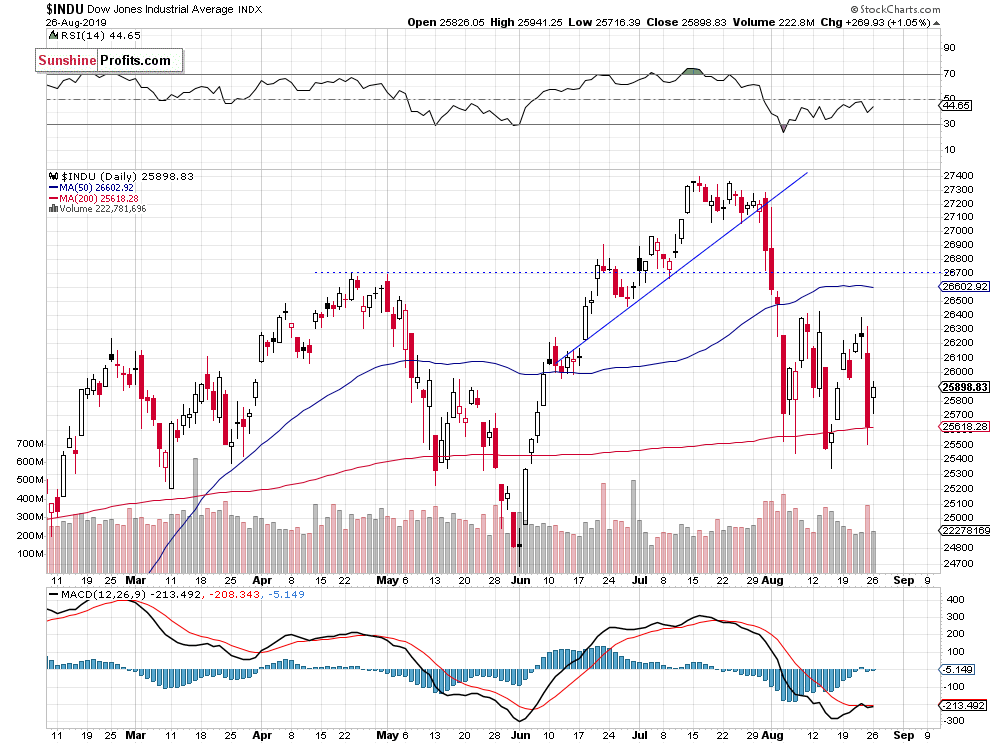

Dow Jones Still Below 26,000 Mark

The Dow Jones Industrial Average broke below its upward trend line in late July. Then it fell to around 25,500, before bouncing off the 200-day moving average. It kept bouncing off that support level recently. On Friday the Dow fell to its average, but yesterday it bounced towards the 26,000 level again:

The S&P 500 index broke below the upward trend line in late July, as investors reacted to the Fed's Rate Decision release, among other factors. We saw technical overbought conditions along with negative technical divergences then. And the market declined following renewed trade war fears. Recently it was rebounding off a support level of around 2,800-2,820. On Friday it reached that support level again. So it was on a brink of either bouncing off a support level again or breaking below it. Will yesterday's short-term reversal last? For now, it looks like an upward correction.

Concluding, the S&P 500 index will likely open virtually flat to slightly higher today. The market may extend its short-term fluctuations. Investors will wait for the Consumer Confidence number release at 10:00 a.m.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care